Taiyo Holdings (TSE:4626): Assessing Valuation After Upbeat Q1, Upgraded Guidance, and Leadership Changes

Reviewed by Kshitija Bhandaru

Taiyo Holdings (TSE:4626) just released its first quarter results, showing growth in all business segments, especially Electronics and Medical and Pharmaceuticals. The company also raised its forecasts for the first half and full year, reflecting this positive momentum.

See our latest analysis for Taiyo Holdings.

Taiyo Holdings' upbeat first-quarter results and leadership shake-up have caught investors’ attention, fueling optimism for the year ahead. After a modest but positive 1-year total shareholder return of 1.18%, the latest strategic steps suggest momentum may be building after several quarters of subdued share price moves.

If Taiyo’s recent momentum has you watching for what’s next, now is a smart time to expand your search and discover fast growing stocks with high insider ownership

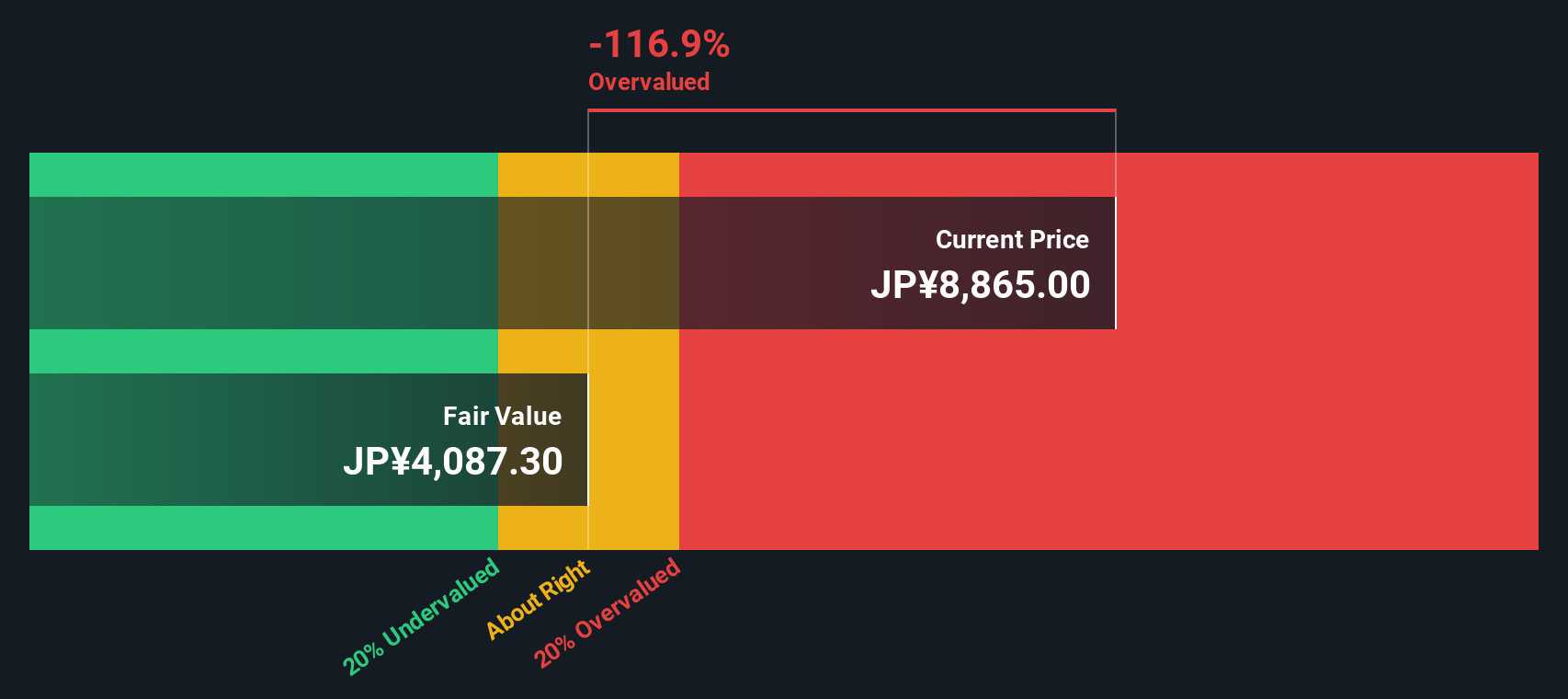

The question now is whether Taiyo Holdings’ upbeat outlook and leadership changes are creating an overlooked buying opportunity, or if the market has already fully priced in all of this future growth.

Price-to-Earnings of 40.5x: Is it justified?

With a price-to-earnings ratio of 40.5x, Taiyo Holdings trades at a considerable premium to both its industry and peer averages. The last close was ¥7,880, far above typical sector valuation benchmarks.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of earnings. For a company like Taiyo Holdings in the chemicals sector, this ratio reflects the market’s expectations for future earnings growth and profitability.

Given Taiyo’s past earnings growth of 7% per year, and future profits forecast to accelerate, the market appears to be pricing in robust earnings expansion. However, the current P/E is more than three times the industry average of 12.6x and over double the peer average of 17.2x. In comparison to the estimated fair P/E ratio of 21.4x, the current multiple looks stretched and could signal expectations that may be difficult to exceed.

Explore the SWS fair ratio for Taiyo Holdings

Result: Price-to-Earnings of 40.5x (OVERVALUED)

However, any slowdown in revenue growth or a pullback toward the analyst price target could quickly challenge the current high valuation expectations.

Find out about the key risks to this Taiyo Holdings narrative.

Another View: What Does Our DCF Model Suggest?

While the current market multiple looks rich, our SWS DCF model tells a slightly different story. It suggests Taiyo Holdings is trading above its estimated fair value of ¥6,417, meaning the shares could be overvalued even by future cash flow expectations. Does this challenge the market’s optimism, or is more growth around the corner?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiyo Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiyo Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, creating your personal analysis takes just a few minutes. Do it your way

A great starting point for your Taiyo Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to uncover exciting investment opportunities across different sectors. There are smart moves to be made beyond Taiyo Holdings. Let your next decision be a confident one.

- Target robust future income by checking out these 19 dividend stocks with yields > 3% offering yields above 3% for steady portfolio growth.

- Take advantage of advances in medicine and data science through these 32 healthcare AI stocks, where healthcare meets AI innovation.

- Spot hidden value before the crowd with these 893 undervalued stocks based on cash flows, highlighting companies whose cash flow potential signals upside ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4626

Taiyo Holdings

Engages in the electronics materials business internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives