Will Mitsubishi Chemical Group’s (TSE:4188) Cut Earnings Forecast Alter Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Mitsubishi Chemical Group recently announced a second-quarter dividend of ¥16.00 per share for the period ended September 30, 2025, steady with its payout a year ago and scheduled for payment starting December 2, 2025.

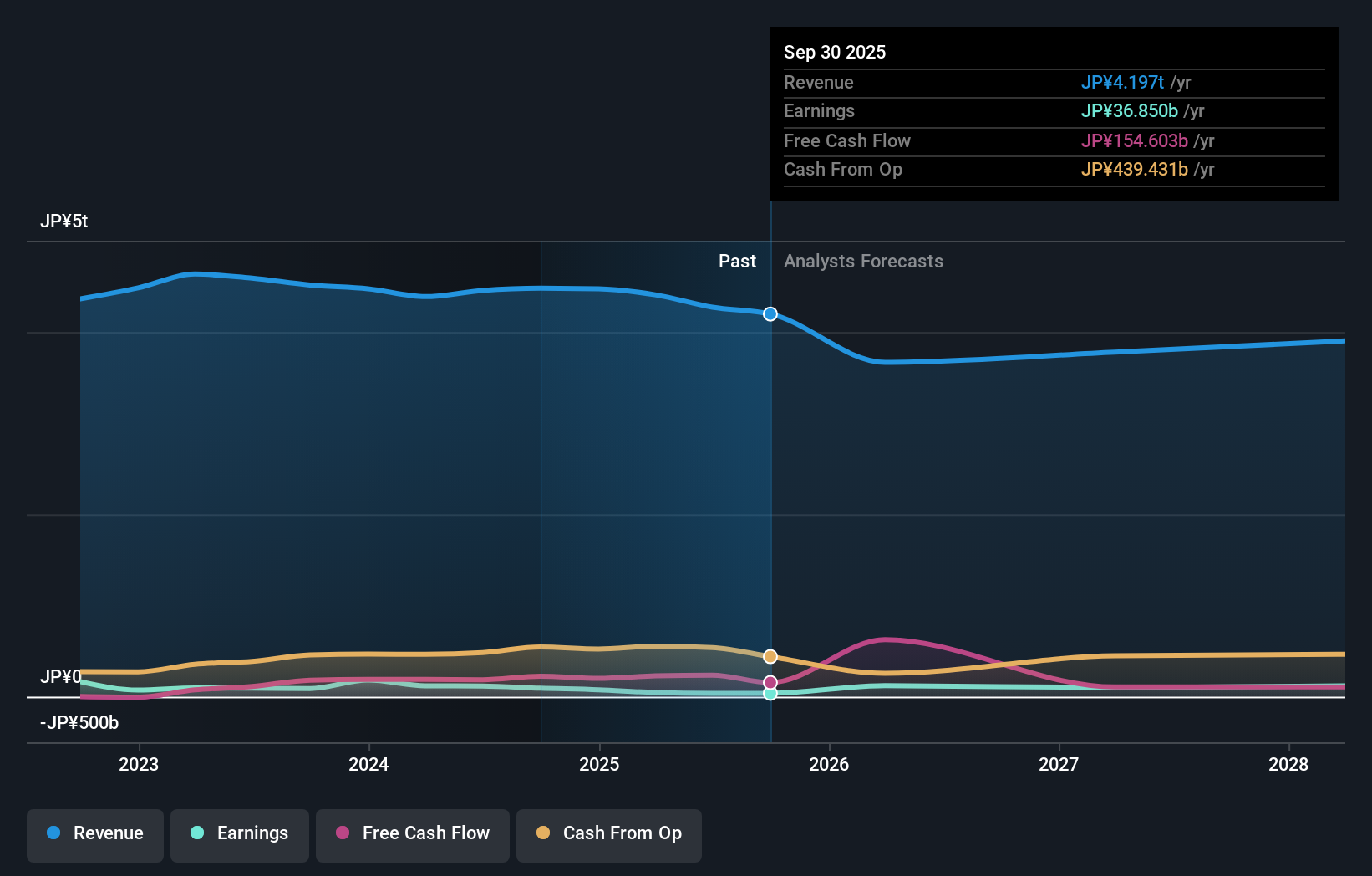

- The company also lowered its full-year earnings guidance, highlighting expected pressures from reduced prices and volumes in key business segments and the impact of special items related to structural reforms.

- We'll explore how the downward revision in full-year earnings guidance affects the company's future earnings outlook and investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Mitsubishi Chemical Group Investment Narrative Recap

To be a shareholder in Mitsubishi Chemical Group today, you need to believe in the potential benefits of its shift toward specialty and high-value materials, along with ongoing structural reforms, despite recent market volatility. The latest downward revision to full-year guidance highlights persistent headwinds in core segments, especially from declining product prices and volumes, and reinforces that earnings pressure remains the most important short-term risk, while a sustained shift in product mix stands out as a key catalyst. The news does not materially change either the risk or the opportunity, executing its specialty transformation is still crucial to the investment story.

Among recent announcements, the October reaffirmation of a ¥16.00 per share dividend for the second quarter stands out. While steady payouts offer income stability, they arrive alongside lowered earnings guidance, underscoring how the company is maintaining shareholder returns in the face of margin and revenue pressure from cyclical market shifts.

But on the other hand, investors should be aware of the unresolved earnings risk as structural reforms and cost cuts may not fully offset...

Read the full narrative on Mitsubishi Chemical Group (it's free!)

Mitsubishi Chemical Group's outlook anticipates revenues of ¥3969.1 billion and earnings of ¥125.7 billion by 2028. This reflects an annual revenue decline of 2.4% and an earnings increase of ¥89.5 billion from the current earnings of ¥36.2 billion.

Uncover how Mitsubishi Chemical Group's forecasts yield a ¥901 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published two fair value estimates for Mitsubishi Chemical Group, ranging from ¥900.91 to ¥1,094.67 per share. With recent guidance cuts reinforcing pressure on revenue and core operating income, explore how your outlook aligns with other investors’ varied takes on the company’s path forward.

Explore 2 other fair value estimates on Mitsubishi Chemical Group - why the stock might be worth as much as 31% more than the current price!

Build Your Own Mitsubishi Chemical Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Chemical Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mitsubishi Chemical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Chemical Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4188

Mitsubishi Chemical Group

Provides performance products, industrial materials, industrial gases, and others in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives