A Look at Mitsui Chemicals (TSE:4183) Valuation Following Stock Split and Updated Dividend Forecast

Reviewed by Simply Wall St

Mitsui Chemicals (TSE:4183) has announced a two-for-one stock split to make its shares more accessible and attract a wider range of investors. The company also updated its dividend forecast to reflect this change.

See our latest analysis for Mitsui Chemicals.

The stock split announcement comes as Mitsui Chemicals works through a period of organizational change, with lower first-half sales and operating income earlier this year. Still, the company’s total shareholder return has been solid, posting 6.3% over the past year and a noteworthy 44.7% over five years. This suggests steady long-term momentum, even as recent share price gains have been more modest.

If you’re interested in discovering what else is catching investor attention, now’s a great time to broaden your search and explore fast growing stocks with high insider ownership

With shares currently trading at a notable discount to analyst targets and recent financials showing mixed signals, investors may wonder if Mitsui Chemicals is offering hidden value or if the market has already priced in future growth.

Most Popular Narrative: 14.8% Undervalued

With Mitsui Chemicals’ narrative fair value set at ¥4,250, the last close price of ¥3,620 paints an intriguing value proposition for investors. The market’s current skepticism contrasts with a narrative projecting operational and strategic transformation in the years ahead.

Mitsui Chemicals' ongoing restructuring to divest and wind-down lower-margin, volatile businesses, such as the Phenols business in China and domestic plans at Ichihara Works, suggests a continued shift to high-value, specialty products. As these efforts mature, both earnings resilience and return on invested capital should improve, positively impacting future net margins.

Want to know what’s fueling this valuation story? The narrative is built around bold shifts in business focus and some surprising improvements ahead. There is a central set of financial forecasts at play. Are you curious what underlying numbers drive that 14.8% upside?

Result: Fair Value of ¥4,250 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in basic materials and unfavorable currency movements could derail the company's recovery and present challenges to the current optimistic outlook.

Find out about the key risks to this Mitsui Chemicals narrative.

Another View: Multiple-Based Valuation Challenges

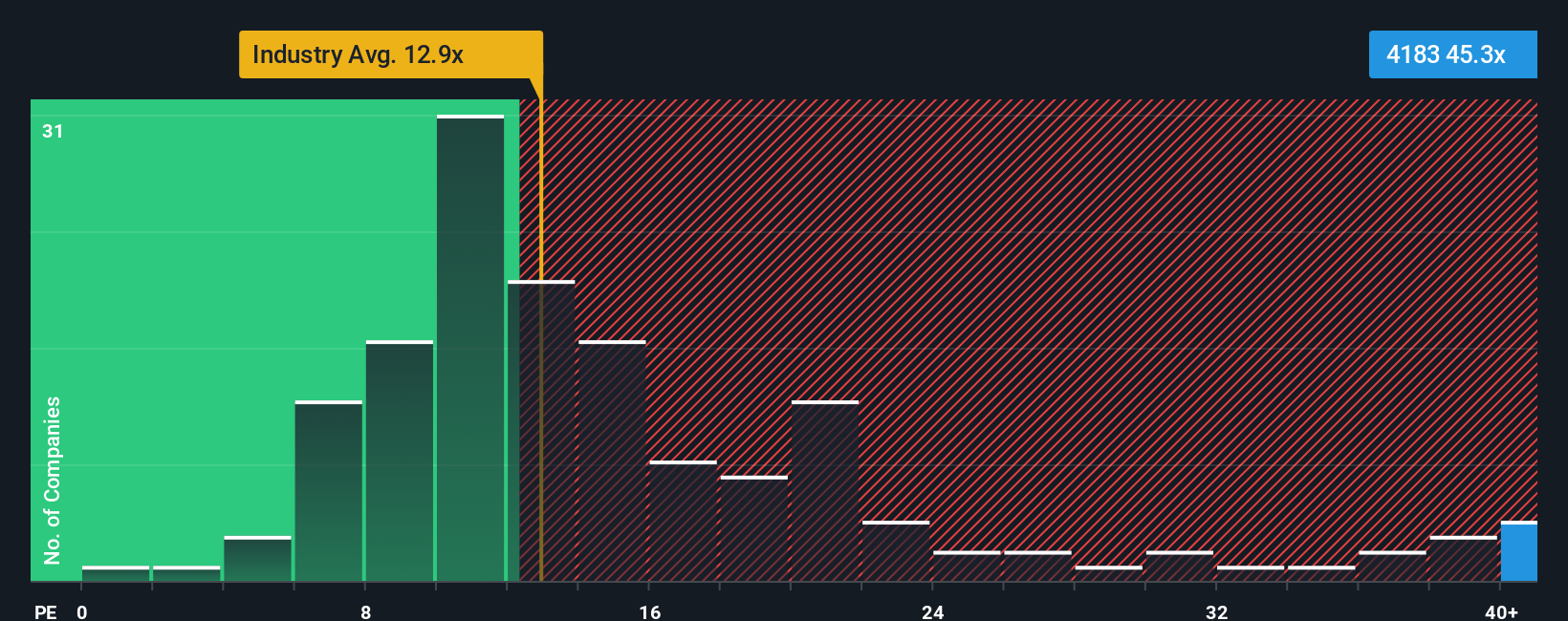

While the narrative and analyst consensus both point to an undervalued opportunity, the price-to-earnings ratio tells a different story. Mitsui Chemicals trades at 45 times earnings, far higher than both the industry average (12.9x) and its own fair ratio of 23.4x, signaling that the market is pricing in considerable risk or high future growth expectations. This premium raises the stakes: will the company’s transformation deliver enough to justify the optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsui Chemicals Narrative

If you see things differently or want to dig deeper into the numbers, you can quickly craft your own perspective in just a few minutes. Do it your way

A great starting point for your Mitsui Chemicals research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop with Mitsui Chemicals. These handpicked opportunities could reshape your portfolio and put you ahead of the crowd. Act now so you never miss what’s next in today’s markets.

- Get ahead of tomorrow’s breakthroughs by checking out these 24 AI penny stocks innovating in artificial intelligence.

- Tap into steady potential with these 16 dividend stocks with yields > 3% offering strong yields for consistent income.

- Ride the wave of financial disruption through these 82 cryptocurrency and blockchain stocks transforming how the world transacts and grows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4183

Mitsui Chemicals

Engages in the mobility, life and health care, basic and green materials, ICT, and other businesses worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives