Dividend Forecast and Earnings Guidance Might Change the Case for Investing in Shin-Etsu Chemical (TSE:4063)

Reviewed by Sasha Jovanovic

- Shin-Etsu Chemical Co., Ltd. recently announced a dividend of ¥53.00 per share for the fiscal year April 2025 to March 2026, along with guidance projecting net sales of ¥2.4 trillion and net income per share of ¥250.00 for the same period.

- These announcements give investors a clearer view of the company’s expected financial performance and upcoming capital returns.

- We'll explore how the visibility around Shin-Etsu Chemical’s dividend forecast may impact its broader investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Shin-Etsu Chemical's Investment Narrative?

For shareholders, the Shin-Etsu Chemical investment story hinges on its ability to sustain competitive leadership in specialty chemicals and capitalize on innovation-driven demand, while navigating margin pressures and global market cycles. The latest announcement, setting a dividend at ¥53.00 per share and forecasting net sales of ¥2.4 trillion, offers reassurance but also points to a modest step down from last year’s financial guidance. Short-term catalysts like share buybacks and new product developments remain relevant, yet the revised earnings outlook and recent price weakness may temper enthusiasm until there’s clearer evidence of a turnaround. This guidance reflects current headwinds and signals that margin compression and revenue growth are key focal points. While the updated dividend outlook supports returns, the company’s guidance update now puts more emphasis on operational risks and slower profit growth as central concerns for investors.

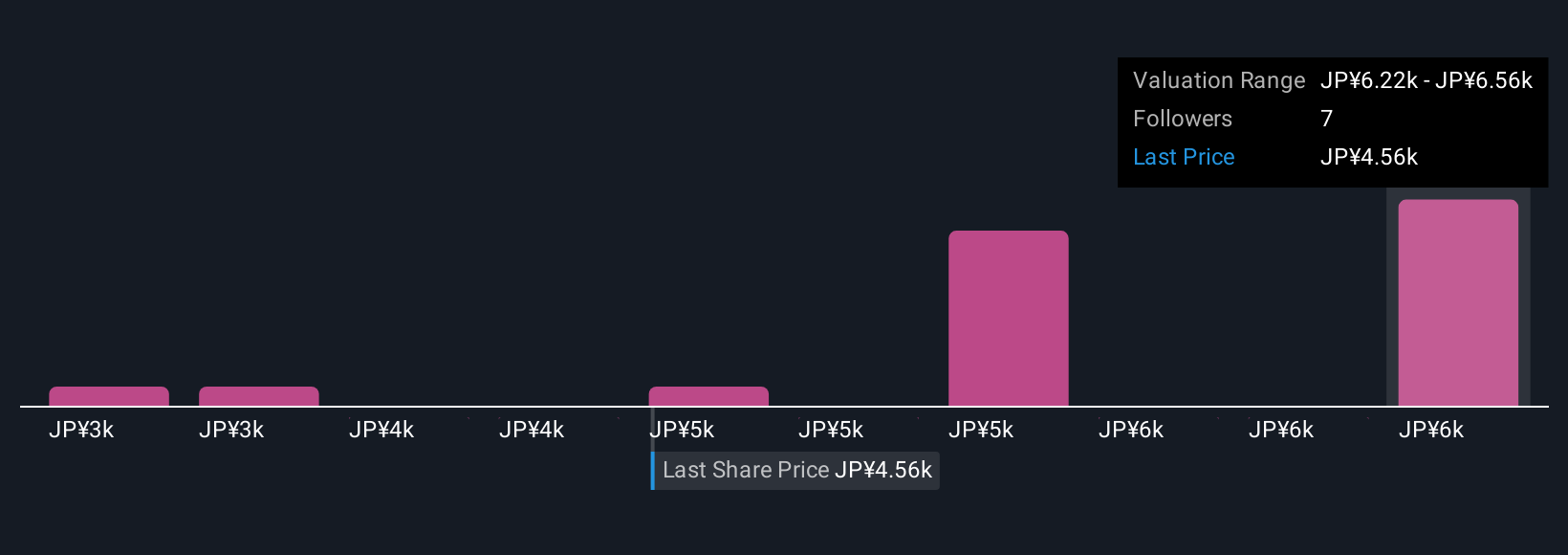

But lurking beneath the headline numbers, sustained margin pressures remain a fact investors should not ignore. Despite retreating, Shin-Etsu Chemical's shares might still be trading 31% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 5 other fair value estimates on Shin-Etsu Chemical - why the stock might be worth 30% less than the current price!

Build Your Own Shin-Etsu Chemical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shin-Etsu Chemical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shin-Etsu Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shin-Etsu Chemical's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4063

Shin-Etsu Chemical

Provides infrastructure, electronics, and functional materials in Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives