Toagosei (TSE:4045): Assessing Valuation Following Shareholder Benefit Program Announcement

Reviewed by Simply Wall St

Toagosei (TSE:4045) attracted attention after its board met on October 27, 2025 to approve a notice about launching a shareholder benefit program. Such moves often encourage closer investor scrutiny of the stock’s overall value.

See our latest analysis for Toagosei.

News of Toagosei’s new shareholder benefit program appears to have breathed fresh life into the share price, adding to steady momentum this year. After a recent uptick, the stock now trades at ¥1,563.5, with a 1-year total shareholder return of 5.9% and an impressive 54.8% over three years. This suggests long-term holders have been well rewarded as investor optimism has grown.

If the latest reward scheme has you thinking about other companies with tailwinds, it could be the perfect moment to discover fast growing stocks with high insider ownership

With consistent returns and revived interest, the real question is whether Toagosei shares are still trading at an attractive price or if the recent good news has already been factored in by the market.

Price-to-Earnings of 17.9x: Is it justified?

Toagosei currently trades at a price-to-earnings (P/E) ratio of 17.9x, putting it well above the Japan Chemicals industry average of 13x and its estimated fair P/E of 13.8x. This makes the stock appear more expensive than its closest competitors based on earnings.

The price-to-earnings ratio tells investors how much they are paying for each yen of current earnings. In the chemicals sector, the P/E ratio is a crucial gauge of market optimism regarding a company's earnings power and growth prospects. Elevated P/E ratios can sometimes signal that future growth is already reflected in the price, but they also mean less margin for error if growth falters.

In this case, Toagosei's P/E is not only higher than the industry average but also exceeds what regression models suggest is fair for the business. This raises questions about whether the market is assigning a premium for expected growth or other qualitative factors, or simply overvaluing the shares compared to sector norms.

With the P/E above both peers and the calculated fair value, the stock may face pressure to justify its valuation through improved growth or operational outperformance.

Explore the SWS fair ratio for Toagosei

Result: Price-to-Earnings of 17.9x (OVERVALUED)

However, if revenue growth is slower than expected or there is a downturn in net income, investors may reassess Toagosei’s premium valuation.

Find out about the key risks to this Toagosei narrative.

Another View: SWS DCF Model Suggests Undervaluation

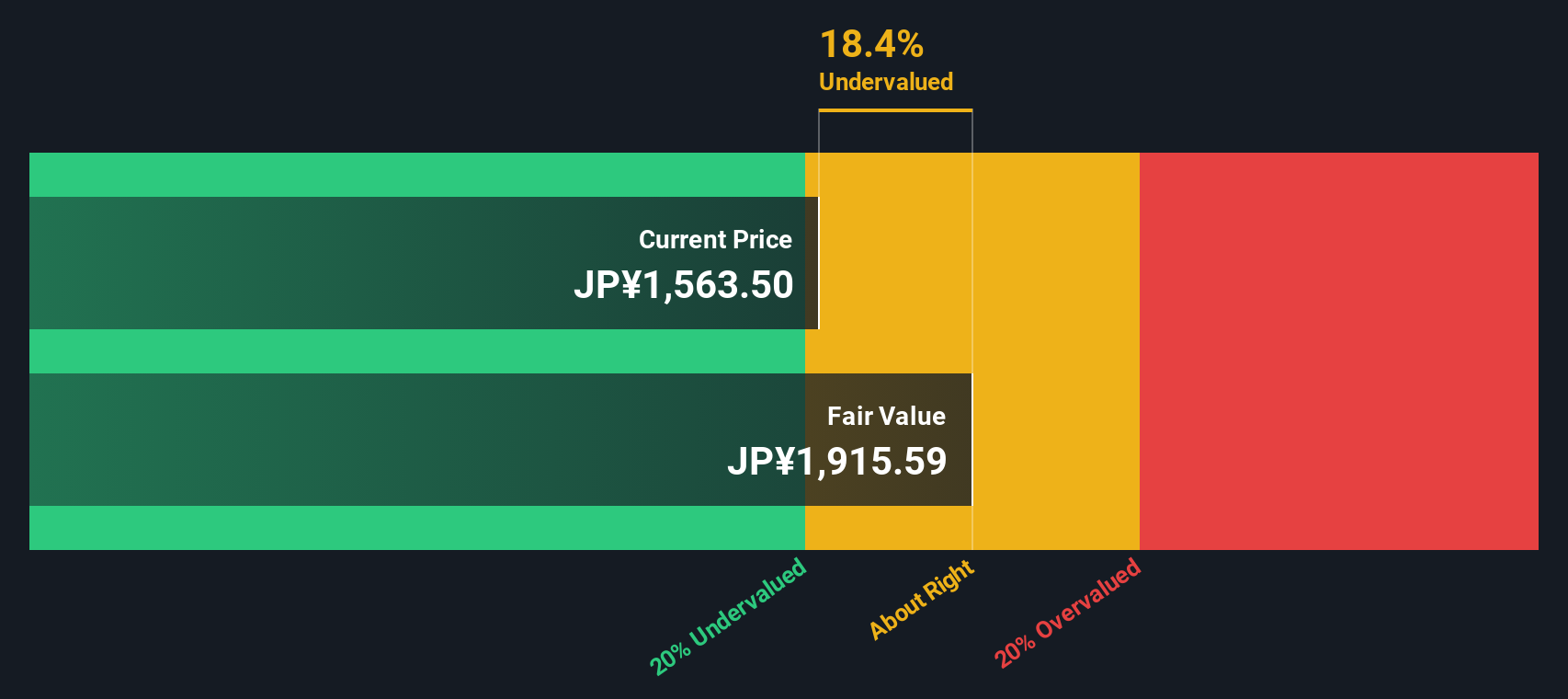

While the price-to-earnings ratio implies Toagosei shares may be expensive, our SWS DCF model tells a different story. It values the stock at ¥1,915.59, about 18% above the current price, signaling possible undervaluation. Which measure best captures reality: earnings multiples or cash flow models?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toagosei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toagosei Narrative

If you want to chart your own course or dive deeper into the numbers, you can easily craft your own analysis in just a few minutes, so why not Do it your way?

A great starting point for your Toagosei research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors don’t limit their horizons. If you want to uncover standout stocks with powerful trends, let Simply Wall Street’s Screener show you what’s possible next.

- Tap into next-generation industry disruptors by checking out these 25 AI penny stocks, which are redefining artificial intelligence solutions.

- Boost your income stream and see which companies pay reliable cash returns through these 16 dividend stocks with yields > 3%, focusing on steady dividends and attractive yields.

- Ride the wave of digital innovation and capitalize on new blockchain opportunities by following these 82 cryptocurrency and blockchain stocks before these trends hit the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toagosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4045

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives