A Look at Tokuyama’s (TSE:4043) Valuation Following Its Latest Dividend Increase

Reviewed by Simply Wall St

Tokuyama (TSE:4043) just announced a boost to its dividend, raising the payout to JPY 60.00 per share for the second quarter. This is an increase from JPY 50.00 a year earlier. The company also raised its dividend guidance for the full fiscal year.

See our latest analysis for Tokuyama.

Tokuyama’s recent dividend boost comes as momentum has surged this year, with its share price climbing 44.7% year-to-date and delivering a strong 40.99% total shareholder return over the past year. These gains suggest growing market confidence following the company’s accelerated earnings growth and the latest dividend announcement, both of which signal management’s upbeat outlook.

If you’re searching for more companies demonstrating rapid growth and insider conviction, now is a smart time to broaden your horizons and discover fast growing stocks with high insider ownership

With Tokuyama’s stock already soaring on the back of robust earnings and an upbeat dividend outlook, investors now face a key question: is there still value to be uncovered here, or has the market already factored in the company’s promising future?

Price-to-Earnings of 11.4x: Is it justified?

Tokuyama currently trades at a price-to-earnings (P/E) ratio of 11.4x, which signals that the market values each yen of earnings at a modest premium compared to its direct peers and sector benchmarks.

The P/E ratio measures how much investors are willing to pay for each unit of a company’s earnings. In the chemicals sector, a lower-than-average P/E may imply the stock is seen as undervalued, particularly for companies with improving profit outlooks.

At 11.4x, Tokuyama’s P/E is below the JP Chemicals industry average of 13x. It also sits well beneath the peer average of 14.8x and our estimated fair P/E of 17x. This strong discount suggests the market may be overlooking momentum in earnings growth and potential profitability improvements that could push the multiple higher.

Explore the SWS fair ratio for Tokuyama

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, persistent volatility in the chemicals sector and unexpected shifts in global demand could still pose challenges to Tokuyama’s outlook in the coming quarters.

Find out about the key risks to this Tokuyama narrative.

Another View: Discounted Cash Flow Analysis

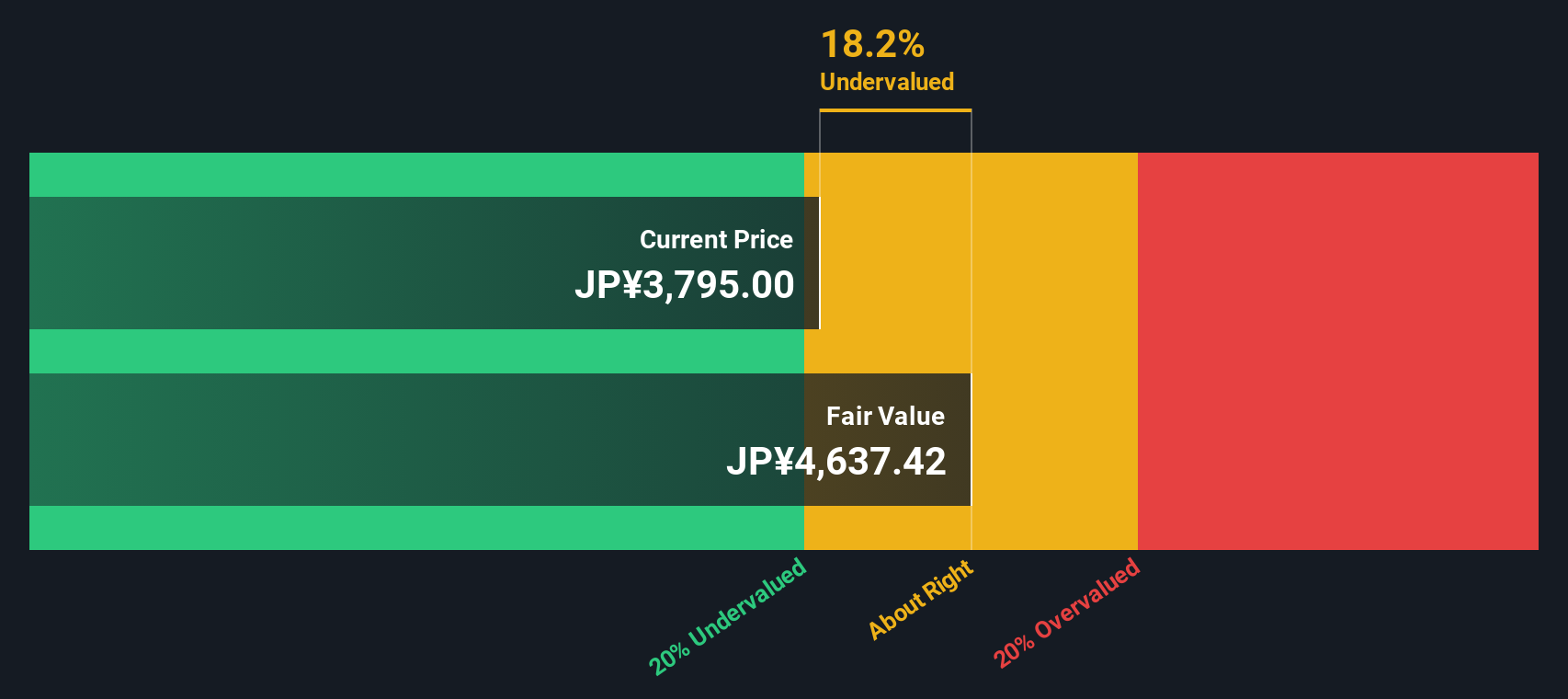

While the market currently prices Tokuyama attractively on earnings, our SWS DCF model uses a different approach. According to this valuation, the stock trades about 18% below its estimated fair value, suggesting a deeper level of undervaluation than multiples alone reveal. Could the DCF signal a hidden opportunity, or is the multiple-based pricing telling the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokuyama for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokuyama Narrative

If you want to dig deeper or build a perspective that fits your own analysis, it's easy to craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tokuyama.

Looking for More Smart Investment Moves?

Great investors always keep an eye out for what’s next, so don’t let unique opportunities pass you by. Simply Wall Street’s powerful screeners make it easy to spot tomorrow’s potential winners today.

- Tap into market-beating potential by browsing these 849 undervalued stocks based on cash flows that are trading well below their intrinsic value and primed for growth.

- Catch cutting-edge breakthroughs by scanning these 28 quantum computing stocks on the cusp of reshaping entire industries with quantum computing advances.

- Boost your passive income strategy with these 17 dividend stocks with yields > 3%, highlighting winners with reliable, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokuyama might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4043

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives