Be Sure To Check Out Nankai Chemical Company,Limited (TSE:4040) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Nankai Chemical Company,Limited (TSE:4040) is about to go ex-dividend in just 3 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase Nankai Chemical CompanyLimited's shares on or after the 27th of September will not receive the dividend, which will be paid on the 9th of December.

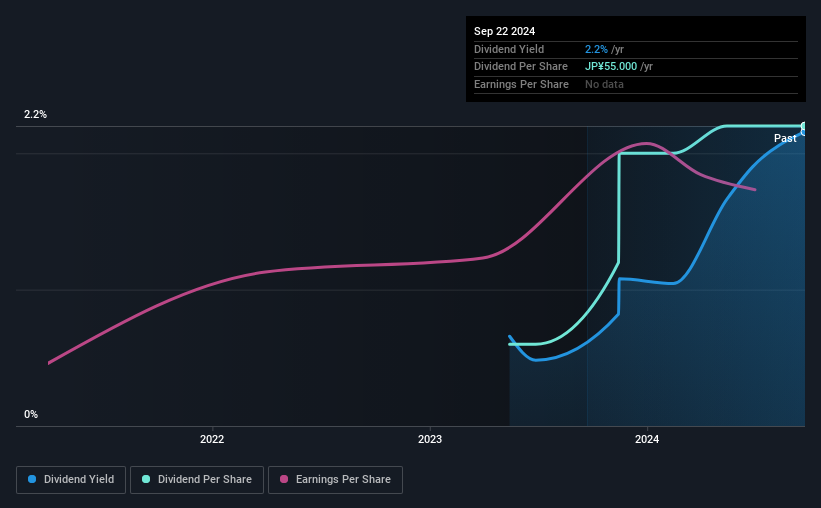

The company's next dividend payment will be JP¥20.00 per share. Last year, in total, the company distributed JP¥55.00 to shareholders. Calculating the last year's worth of payments shows that Nankai Chemical CompanyLimited has a trailing yield of 2.2% on the current share price of JP¥2548.00. If you buy this business for its dividend, you should have an idea of whether Nankai Chemical CompanyLimited's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Nankai Chemical CompanyLimited

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Nankai Chemical CompanyLimited has a low and conservative payout ratio of just 9.1% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 8.4% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Nankai Chemical CompanyLimited paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Nankai Chemical CompanyLimited's earnings have been skyrocketing, up 30% per annum for the past five years. Nankai Chemical CompanyLimited earnings per share have been sprinting ahead like the Road Runner at a track and field day; scarcely stopping even for a cheeky "beep-beep". We also like that it is reinvesting most of its profits in its business.'

Nankai Chemical CompanyLimited also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. It's hard to grow dividends per share when a company keeps creating new shares.

Given that Nankai Chemical CompanyLimited has only been paying a dividend for a year, there's not much of a past history to draw insight from.

To Sum It Up

Is Nankai Chemical CompanyLimited worth buying for its dividend? We love that Nankai Chemical CompanyLimited is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. There's a lot to like about Nankai Chemical CompanyLimited, and we would prioritise taking a closer look at it.

While it's tempting to invest in Nankai Chemical CompanyLimited for the dividends alone, you should always be mindful of the risks involved. Our analysis shows 4 warning signs for Nankai Chemical CompanyLimited and you should be aware of them before buying any shares.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Nankai Chemical CompanyLimited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4040

Nankai Chemical CompanyLimited

Nankai Chemical Company,Limited manufacturers and sells chemical in Japan and internationally.

Solid track record and good value.