Toray Industries (TSE:3402): Assessing Current Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

Toray Industries (TSE:3402) has shown resilience in its recent stock performance, closing at ¥930.2. Over the past month, shares slipped about 5%, but its three-year return stands at an impressive 37%.

See our latest analysis for Toray Industries.

The past year has seen Toray Industries' share price drift lower, but its strong three-year total shareholder return of 37% tells a different story about long-term momentum. While short-term price dips can reflect shifting market sentiment around risk and future growth, the company’s track record suggests underlying resilience.

If you’re interested in finding more standouts beyond materials, it might be the perfect time to discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and solid earnings growth, investors may be wondering if Toray Industries is undervalued right now, or if markets have already priced in all the future upside potential.

Most Popular Narrative: 15.1% Undervalued

Toray Industries’ most widely followed narrative suggests the fair value is significantly higher than the last close price, highlighting ambitious profit margin and revenue growth targets that could drive the next leg higher.

The implementation of business structure reforms, including Project AP-G 2025 and the D Pro profitability improvement projects, is anticipated to streamline operations and boost net margins by focusing on high-growth and high-profitability segments. The global and Japanese economic recovery, along with strategic investments in R&D and capital expenditure, position the company for sustained revenue growth and improved operating income.

Want to decode the projections behind this bullish narrative? The full analysis reveals aggressive upgrades to future profits and margins, relying on industry shifts and internal reforms. Curious which forecasts might surprise the market? Hit the link to uncover the financial assumptions analysts are betting on.

Result: Fair Value of ¥1,095 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent foreign exchange fluctuations or further delays in high-margin product launches could quickly undermine these optimistic forecasts.

Find out about the key risks to this Toray Industries narrative.

Another View: How Do Valuation Multiples Stack Up?

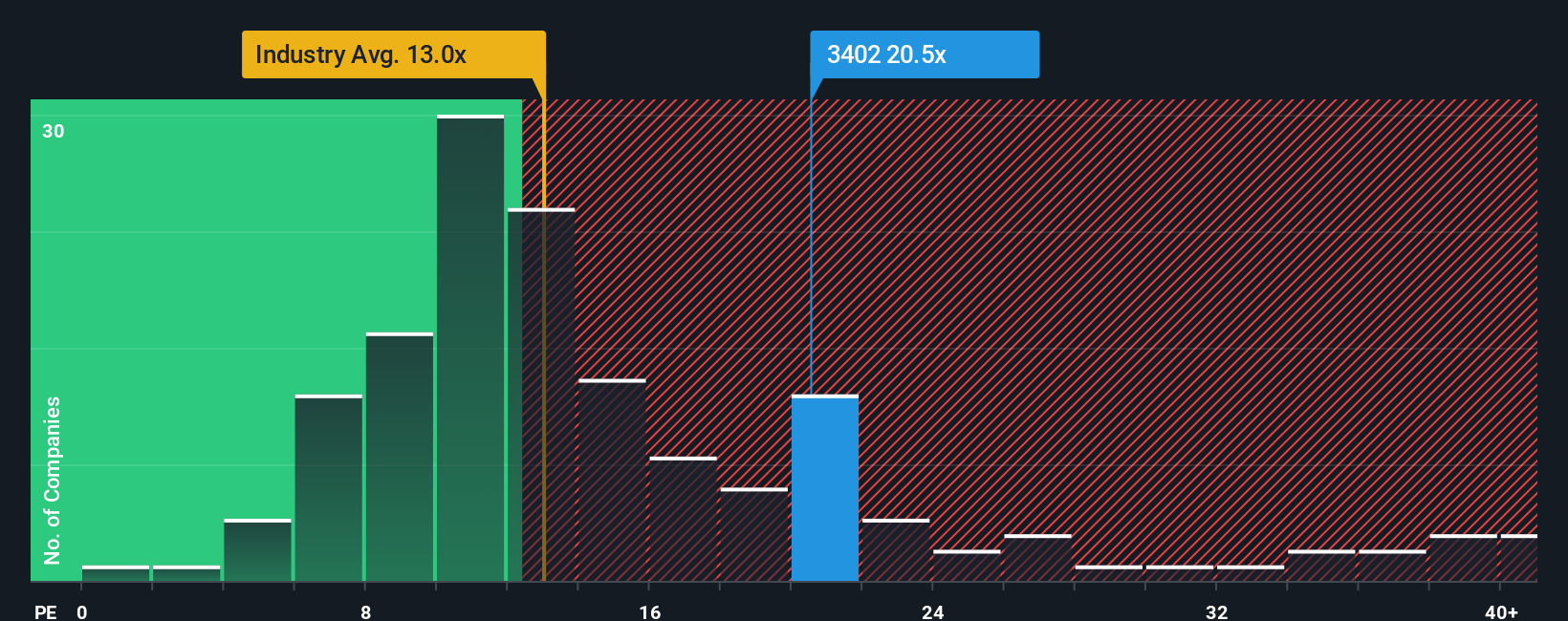

Looking from another angle, Toray Industries trades at a price-to-earnings ratio of 20.5x, which is higher than both the JP Chemicals industry average of 13x and the market’s fair ratio of 20.4x. This premium suggests investors see greater growth ahead. However, it adds valuation risk if expectations disappoint. Could the market be overestimating future gains, or is there still upside that multiples alone might miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toray Industries Narrative

If the current narrative doesn't fully capture your perspective or you want to do your own digging, you can craft your own in just a few minutes. Do it your way

A great starting point for your Toray Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors move quickly when opportunity knocks. Expand your horizons now and don't miss out on timely stocks that could shape your financial future.

- Boost your search for reliable income by checking out these 17 dividend stocks with yields > 3%, which consistently deliver strong yields above 3%.

- Capture potential high-growth winners with these 25 AI penny stocks, poised to transform industries using advanced AI technology.

- Stay ahead of the curve with these 82 cryptocurrency and blockchain stocks, driving innovation across cryptocurrency and blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toray Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3402

Toray Industries

Manufactures, processes, and sells fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products in Japan, China, North America, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives