- Japan

- /

- Healthcare Services

- /

- TSE:8129

Toho Holdings (TSE:8129) Valuation in Focus Following Share Buyback Program Update

Reviewed by Simply Wall St

Toho Holdings (TSE:8129) recently disclosed the acquisition of 508,000 shares under its ongoing buyback program. This initiative is aimed at enhancing shareholder value and optimizing the company’s capital structure. This announcement has drawn some investor attention.

See our latest analysis for Toho Holdings.

The buyback update comes as Toho Holdings builds on a year of steady progress, including initiatives to strengthen governance and refine operations. While the 1-month share price return is down nearly 10%, the strong 12.75% total return over the past year, as well as impressive gains across three and five years, suggest that long-term momentum is still very much intact. Recent volatility likely reflects a recalibration in market expectations rather than any fundamental shift in the business outlook.

If you’re interested in discovering what else stands out in the healthcare space, take the next step and check out See the full list for free.

Given this context, is Toho Holdings currently trading below its true value and offering investors an entry point, or has the market already priced in the company’s future growth prospects?

Price-to-Earnings of 14x: Is it justified?

Toho Holdings trades at a price-to-earnings (P/E) ratio of 14x, slightly below the peer average of 15.8x and below its estimated fair P/E of 18.1x. At the last close of ¥4,866, the stock appears moderately undervalued when benchmarked against both its sector and fair value benchmarks.

The price-to-earnings ratio helps investors assess how much they are paying for each yen of the company's earnings. A lower P/E relative to peers or the fair benchmark can suggest undervaluation, particularly for established firms in steady industries such as healthcare distribution.

In Toho Holdings' case, the market may be underpricing the company’s recent profit growth and margin improvement. Its strong earnings expansion over the last five years and stable profit margins indicate that there could be more room for the valuation multiple to rise if business performance remains robust.

Compared to the Japanese Healthcare industry average P/E of 13.5x, Toho Holdings is trading at a modest premium. However, the fair ratio analysis indicates a P/E of 18.1x as reasonable. This implies the market could still move closer to this level given the company’s underlying fundamentals.

Explore the SWS fair ratio for Toho Holdings

Result: Price-to-Earnings of 14x (UNDERVALUED)

However, if slower annual revenue and net income growth continues, it could challenge the current valuation and investor optimism moving forward.

Find out about the key risks to this Toho Holdings narrative.

Another View: What Does the SWS DCF Model Suggest?

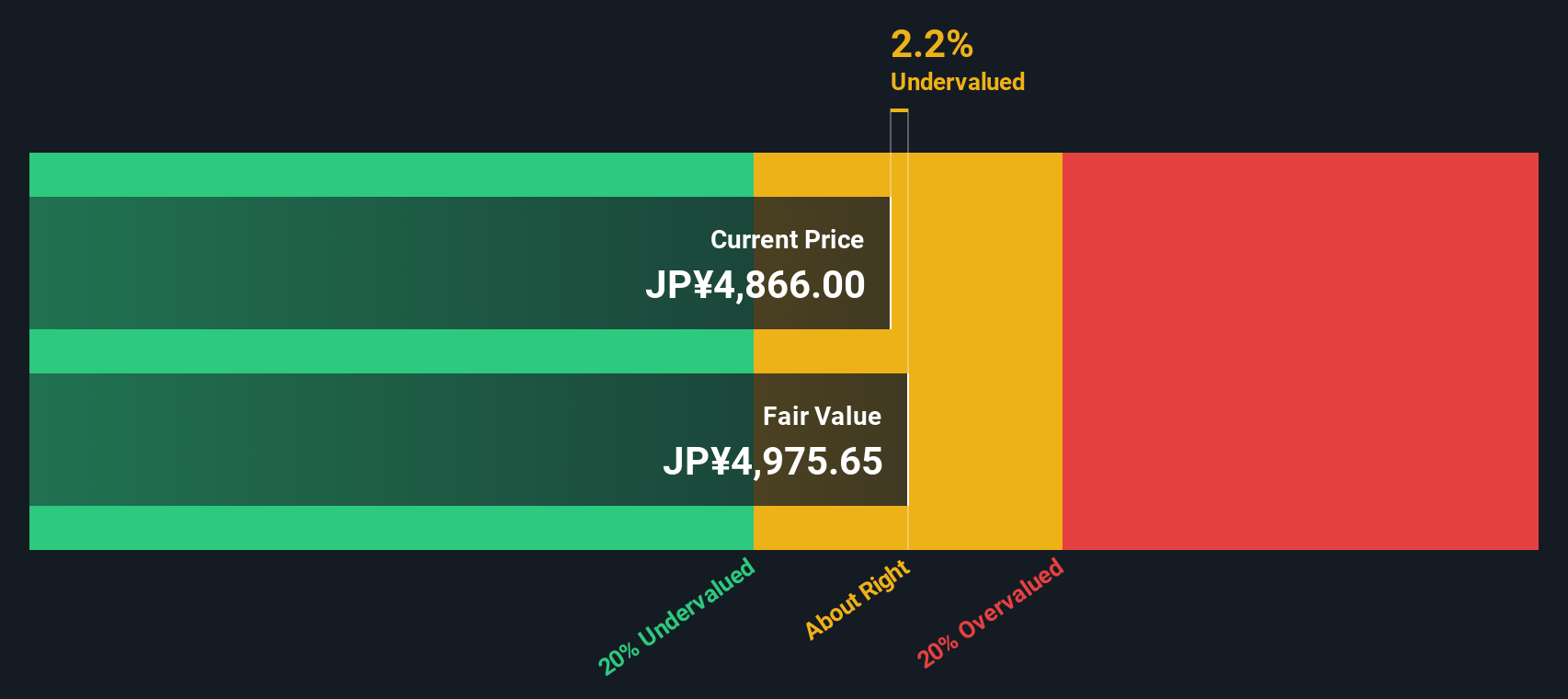

Switching gears to our DCF model, the numbers suggest Toho Holdings is currently trading just under 2% below its estimated fair value. This supports the earlier view from the earnings ratio, but the margin is not large. Is this thin discount enough to create a real buying opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toho Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toho Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers, you can craft your own take on Toho Holdings in just a few minutes. Do it your way

A great starting point for your Toho Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let the best investments pass you by. Put your capital to work in promising trends by checking out these high-potential opportunities. Your next idea could be one click away.

- Snapshot strong income potential as you review these 16 dividend stocks with yields > 3% offering yields above 3%, designed for investors seeking reliable payouts and financial resilience.

- Catch early growth stories in the tech space by scanning these 24 AI penny stocks making waves with cutting-edge advancements in artificial intelligence.

- Ride the fintech revolution by examining these 82 cryptocurrency and blockchain stocks poised to benefit as cryptocurrencies and blockchain reshape financial markets and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8129

Toho Holdings

Engages in the wholesale distribution of pharmaceutical products in Japan.

Excellent balance sheet and fair value.

Market Insights

Community Narratives