- Japan

- /

- Medical Equipment

- /

- TSE:8086

A Fresh Look at Nipro (TSE:8086) Valuation After Profit Surge and Dividend Upgrade

Reviewed by Simply Wall St

Nipro (TSE:8086) grabbed attention after it released its midyear results for September 2025, delivering a substantial jump in operational profits and revising its dividend forecast upward for the current fiscal year. This combination could influence the stock’s appeal among income-focused investors.

See our latest analysis for Nipro.

Nipro’s rally in operational profits and upgraded dividend outlook appear to have caught investors’ attention. Its share price has climbed steadily in recent months, with a 1-year total shareholder return of 11.05%. Momentum is gradually building, supported by recent financial outperformance and improved shareholder returns.

If the combination of earnings surprises and dividend growth has you wondering what else is driving strong performance in this sector, now is the perfect time to discover See the full list for free.

But with shares up over 11% this year and operational metrics strengthening, the question remains: is Nipro now undervalued compared to its fundamentals, or has the market already priced in the improved profitability and future growth prospects?

Price-to-Earnings of 42.8x: Is it justified?

Nipro trades at a price-to-earnings (P/E) ratio of 42.8x, which stands out compared to both peer companies and the broader market. The current share price of ¥1,509.5 reflects a premium that investors appear willing to pay for future prospects.

The P/E ratio is a measure of how much investors are paying for every yen of the company’s earnings. In the medical equipment sector, this multiple often signals expectations around growth, profitability, and business model resilience. Here, Nipro’s elevated P/E ratio puts it in a higher bracket than the industry average and may indicate that the market sees sizable earnings growth ahead, or that speculative optimism is at play.

Compared to its direct peers, Nipro’s multiple is far higher. The JP Medical Equipment industry averages a P/E of just 15x, and the fair price-to-earnings ratio is estimated at 24.4x. Both comparisons highlight that the stock is expensive relative to sector norms and the theoretical “fair” level. This premium might or might not be maintained depending on future growth realization.

Explore the SWS fair ratio for Nipro

Result: Price-to-Earnings of 42.8x (OVERVALUED)

However, slower revenue growth or a discount to analyst price targets could challenge the current optimism and put pressure on Nipro’s valuation in the future.

Find out about the key risks to this Nipro narrative.

Another View: Discounted Cash Flow Perspective

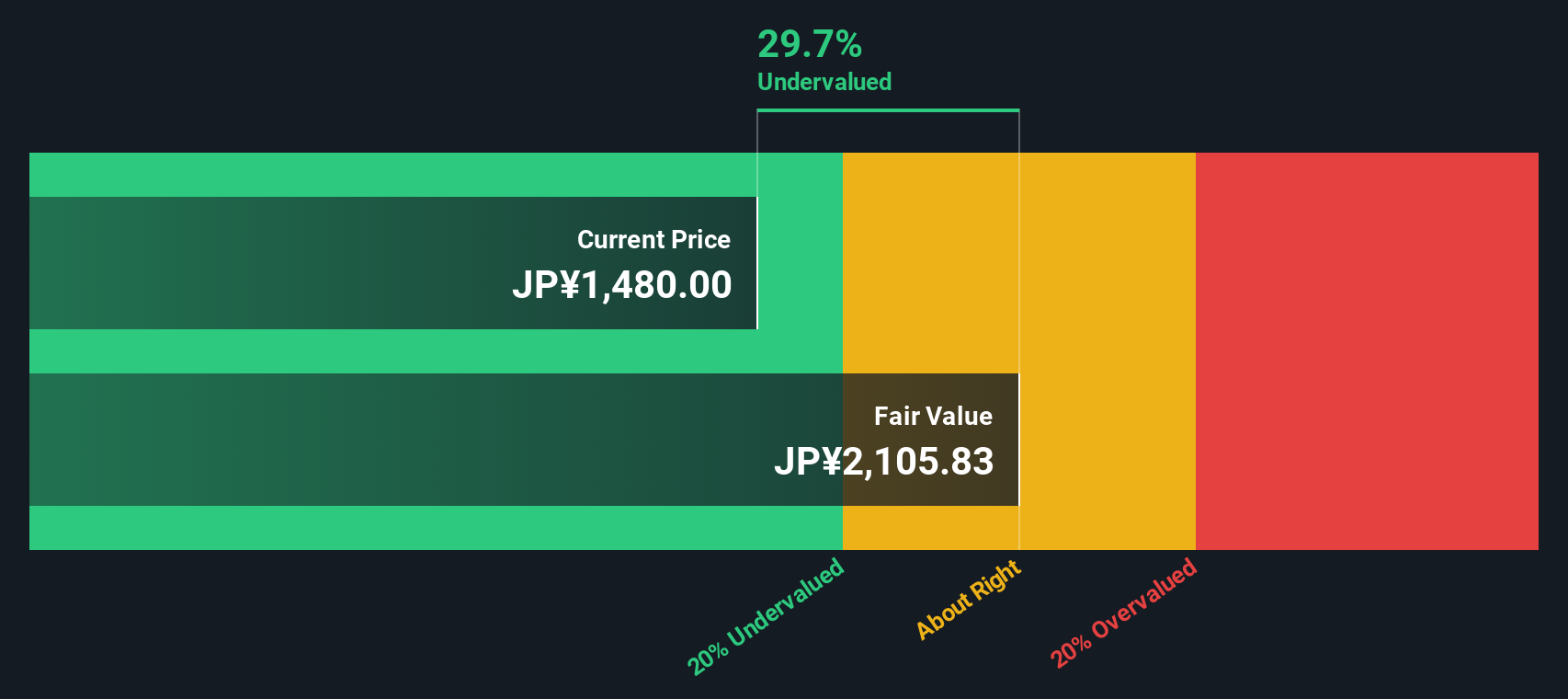

While the price-to-earnings ratio paints Nipro as expensive, the SWS DCF model reveals a different possibility. Based on our fair value estimate of ¥2,105.83 compared to a current price of ¥1,509.5, Nipro may actually be undervalued by nearly 28%. Could the market be underestimating future cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nipro for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nipro Narrative

If you see the results differently or prefer to dive into your own analysis, you can easily create your personal assessment in just a few minutes, then Do it your way.

A great starting point for your Nipro research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let ripe opportunities slip through your fingers. Expand your watchlist now with stocks that might offer growth, value, or sector breakthroughs that suit your strategy.

- Capitalize on the rising stars shaking up markets by checking out these 3572 penny stocks with strong financials, making headlines for their rapid moves and surprising resilience.

- Position yourself at the forefront of cutting-edge tech with these 25 AI penny stocks, shaping innovation and defining the next era of artificial intelligence.

- Strengthen your portfolio with smart income opportunities via these 15 dividend stocks with yields > 3%, consistently delivering above-average yields and dependable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nipro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8086

Nipro

Engages in the medical devices, pharmaceuticals, and pharma packaging businesses.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives