Stock Analysis

- Japan

- /

- Medical Equipment

- /

- TSE:7779

Analyzing 3 Japanese Exchange Growth Companies With High Insider Ownership And At Least 14% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate through varied economic signals, Japan's market faces its own unique challenges, particularly with a recent retreat from record highs amid currency intervention speculations. This backdrop sets a compelling stage for examining growth-oriented companies in Japan, especially those with high insider ownership which suggests confidence among those closest to the company.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.5% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Here we highlight a subset of our preferred stocks from the screener.

UT GroupLtd (TSE:2146)

Simply Wall St Growth Rating: ★★★★★☆

Overview: UT Group Co., Ltd. operates in Japan, focusing on the dispatch and outsourcing of permanent employees across various sectors including manufacturing, design and development, and construction, with a market capitalization of approximately ¥131.21 billion.

Operations: The company generates its revenue by providing staffing solutions across sectors such as manufacturing, design and development, and construction in Japan.

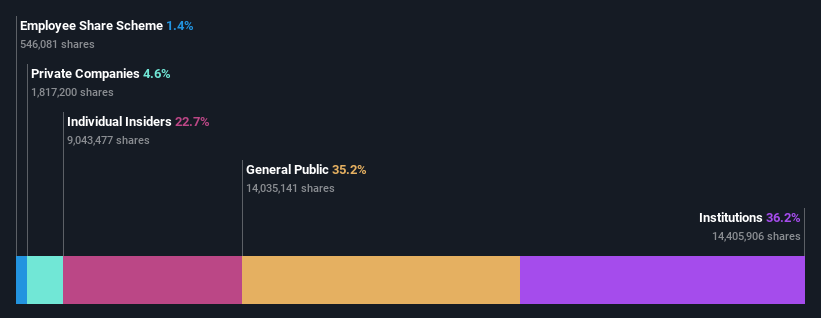

Insider Ownership: 22.7%

Revenue Growth Forecast: 14.9% p.a.

UT Group Ltd., a key player in Japan's labor market, recently launched a new career support service through JOBPAL, enhancing job opportunities and skill development for dispatch workers. Despite an unstable dividend track record, the company's earnings are expected to grow by 24.05% annually, outpacing the Japanese market average. With high insider ownership, UT Group is poised for robust revenue growth of 14.9% per year and projects a strong return on equity of 32.9% in three years, indicating potential for significant value creation despite some operational challenges.

- Take a closer look at UT GroupLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that UT GroupLtd is trading behind its estimated value.

WealthNavi (TSE:7342)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WealthNavi Inc. operates an online asset management and risk management platform, with a market capitalization of approximately ¥88.18 billion.

Operations: The company generates its revenue through an online platform focused on asset and risk management.

Insider Ownership: 18%

Revenue Growth Forecast: 21.5% p.a.

WealthNavi Inc., despite a highly volatile share price and shareholder dilution over the past year, is expanding its offerings with a new online insurance advisory service launched in May 2024. This service complements its robo-advisor platform, aiming to integrate insurance with investment strategies for working families. While one-off items have impacted financial results, the company's revenue is expected to grow by 21.5% annually, outpacing the Japanese market significantly. However, its Return on Equity is forecasted to remain low at 12.7% in three years.

- Click here and access our complete growth analysis report to understand the dynamics of WealthNavi.

- Our comprehensive valuation report raises the possibility that WealthNavi is priced higher than what may be justified by its financials.

CYBERDYNE (TSE:7779)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CYBERDYNE Inc. is a company focused on researching, developing, producing, selling, leasing, and maintaining robotic equipment and systems for medical and welfare use across regions including Japan, the United States, Europe, the Middle East, Africa, and Asia Pacific countries with a market capitalization of ¥47.72 billion.

Operations: The company generates its revenue by researching, developing, producing, selling, leasing, and maintaining robotic equipment and systems for medical and welfare applications across various global regions.

Insider Ownership: 38.9%

Revenue Growth Forecast: 20.5% p.a.

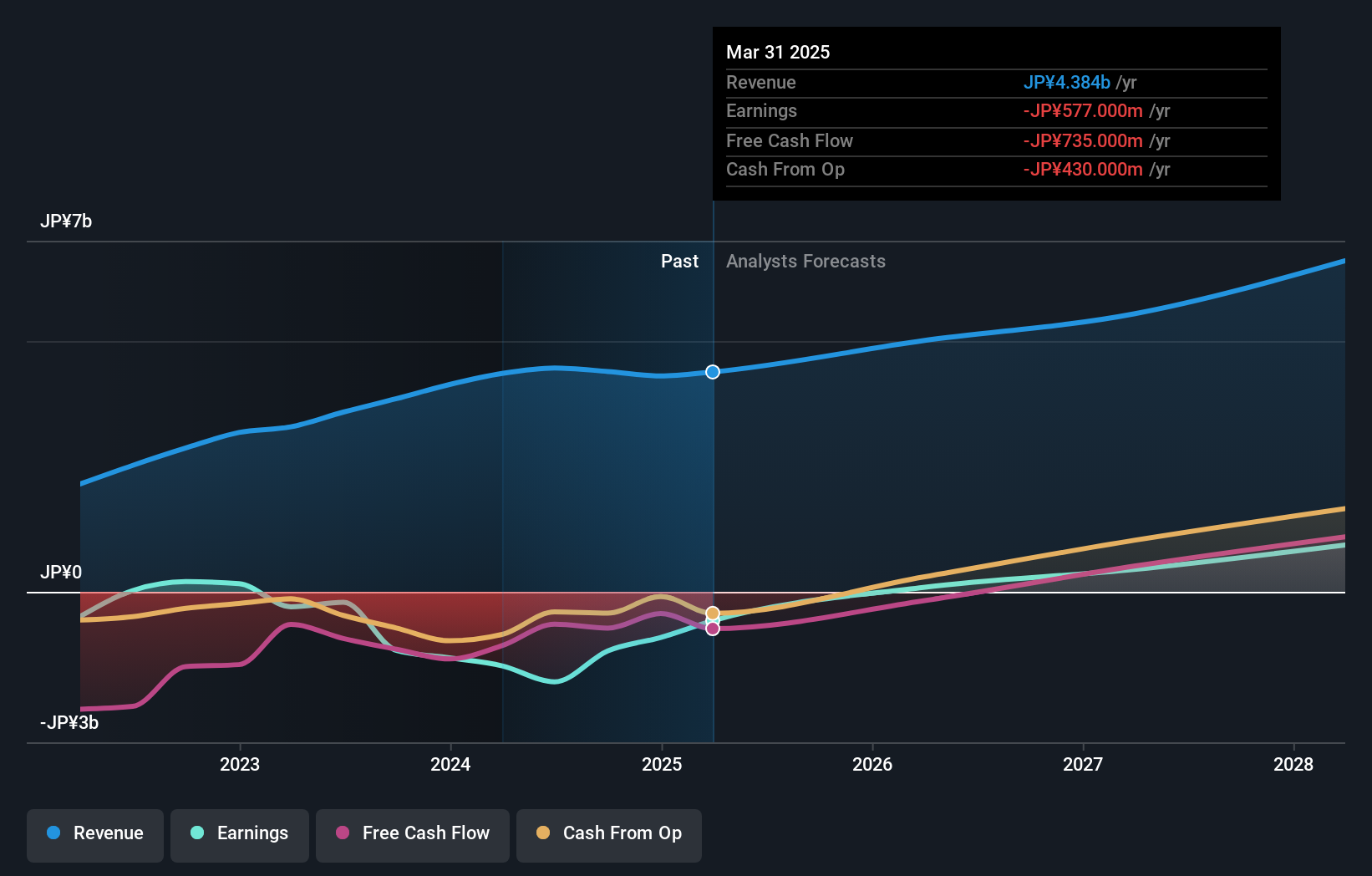

CYBERDYNE is set to become profitable within the next three years, with its revenue growth forecast at 20.5% annually, significantly outpacing the Japanese market average of 4.3%. Despite this promising growth and recent U.S. FDA approvals expanding indications for its Medical HAL device, concerns linger due to a highly volatile share price and low forecasted Return on Equity at just 1.2%. Insider trading activity has been negligible in the past three months, indicating stable insider confidence amidst expansion efforts.

- Click to explore a detailed breakdown of our findings in CYBERDYNE's earnings growth report.

- Our valuation report here indicates CYBERDYNE may be overvalued.

Seize The Opportunity

- Dive into all 96 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether CYBERDYNE is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7779

CYBERDYNE

Researches, develops, produces, sell, leases, and maintains robotic equipment and systems for medical and welfare in Japan, the United States, Europe, the Middle East, Africa, and the Asia Pacific countries.

High growth potential with adequate balance sheet.