- Japan

- /

- Medical Equipment

- /

- TSE:7741

How HOYA’s (TSE:7741) Record Interim Dividend Signals a Shift in Its Investment Narrative

Reviewed by Sasha Jovanovic

- On October 31, 2025, HOYA Corporation's board approved an interim dividend of ¥125.00 per share for shareholders of record as of September 30, 2025, a very large increase compared to the ¥45.00 per share paid the previous year, with payment scheduled for November 28, 2025.

- This substantial dividend increase highlights HOYA's capacity to return more capital to shareholders and signals management's confidence in its financial position.

- We now explore how this unusually large interim dividend, a central factor, may reshape HOYA's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is HOYA's Investment Narrative?

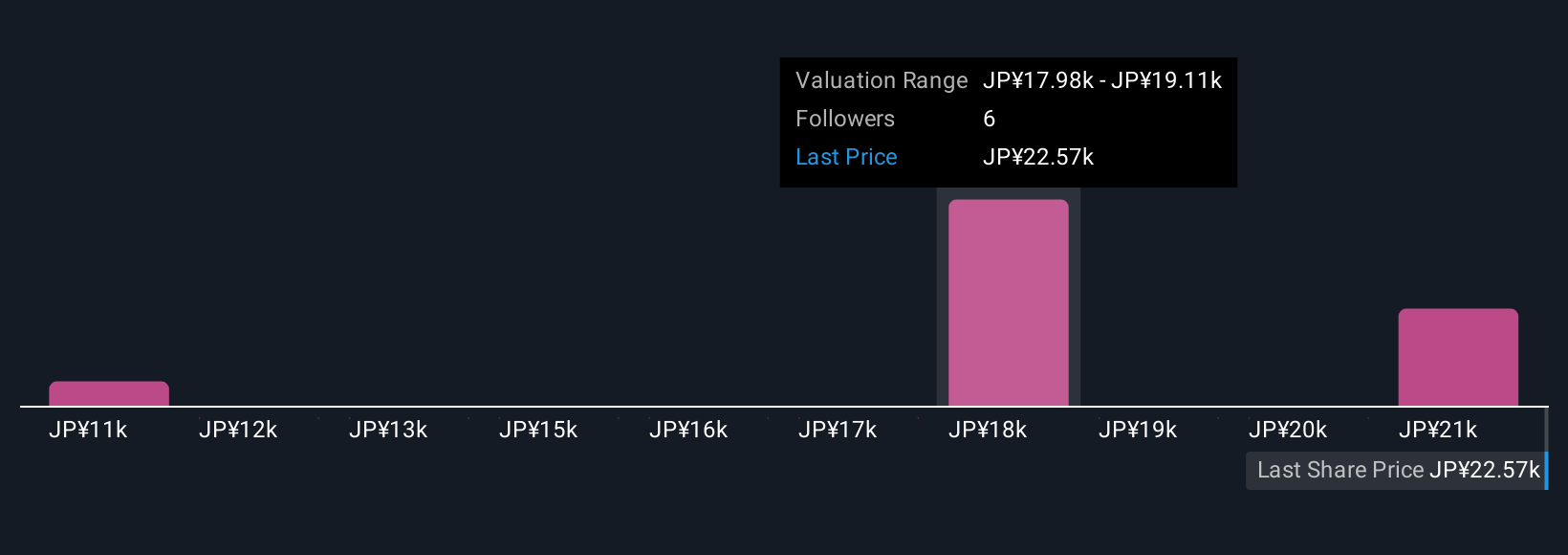

Owning HOYA stock means buying into the belief that the company can continue to deliver solid earnings growth and capital returns over time, powered by its technology portfolio and expanding medical and vision care products. The recent extraordinary interim dividend announcement on October 31, 2025, could shift near-term expectations: such a significant payout highlights growing shareholder focus on cash returns and introduces a fresh catalyst that may draw increased market attention to HOYA’s capital allocation. Previously, conversations centered on steady, progressive dividends and robust buybacks; now, questions turn to whether this step signals a new chapter for payouts or a one-time spike. That said, key risks around valuations remain, analysts have flagged HOYA as expensive compared to sector and peer averages, and the stock trades above consensus fair value estimates. How much this new dividend attitude affects these risks is something to watch.

Yet concerns about HOYA’s valuation multiples compared to peers may limit any immediate upside.

Exploring Other Perspectives

Explore 3 other fair value estimates on HOYA - why the stock might be worth as much as ¥23944!

Build Your Own HOYA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HOYA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free HOYA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HOYA's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7741

HOYA

A med-tech company, provides high-tech and medical products worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives