- Japan

- /

- Medical Equipment

- /

- TSE:7716

A Look at Nakanishi (TSE:7716) Valuation Following Share Buyback Program Update

Reviewed by Simply Wall St

Nakanishi (TSE:7716) revealed it has already repurchased over a million shares through its ongoing buyback program, with plans to raise that amount to two million shares by the end of December. This signals a focused approach to boosting shareholder value while fine-tuning the capital structure.

See our latest analysis for Nakanishi.

While Nakanishi’s share buyback plan grabbed headlines, the company’s recent share price momentum tells a more nuanced story. Despite a single-day share price gain of 1.58%, this year’s total shareholder return is down 20.2%. Momentum has been fading over the longer term as recent events have not yet sparked a sustained turnaround.

If you’re tracking moves in medical technology and device makers, now is the perfect moment to discover See the full list for free.

The question now is whether Nakanishi’s recent weakness offers an attractive entry point for new investors, or if the current share price already reflects the company’s potential for future growth.

Price-to-Earnings of 33.8x: Is it justified?

Nakanishi trades at a lofty price-to-earnings (P/E) ratio of 33.8x, well above both its industry peers and the broader market, despite recent share price weakness. At the last close of ¥2,056, investors are paying a steep premium per yen of earnings, reflecting optimism about future growth or confidence in company fundamentals.

The price-to-earnings ratio measures what investors are willing to pay today for a company’s earnings power. A higher P/E can signal expectations for fast earnings growth or a distinct advantage in the business model, but it can also mean the market is inflating the company's prospects compared to reality.

For Nakanishi, the multiple looks expensive when set against medical equipment peers, whose average P/E is just 15.3x. It is also richer than our estimated fair P/E of 24.3x, a level the market could potentially revert to if sentiment cools. This suggests the current price might be factoring in ambitious expectations that have yet to materialize.

Explore the SWS fair ratio for Nakanishi

Result: Price-to-Earnings of 33.8x (OVERVALUED)

However, slowing share price momentum and ambitious valuation multiples could challenge investor confidence if earnings growth does not accelerate as expected.

Find out about the key risks to this Nakanishi narrative.

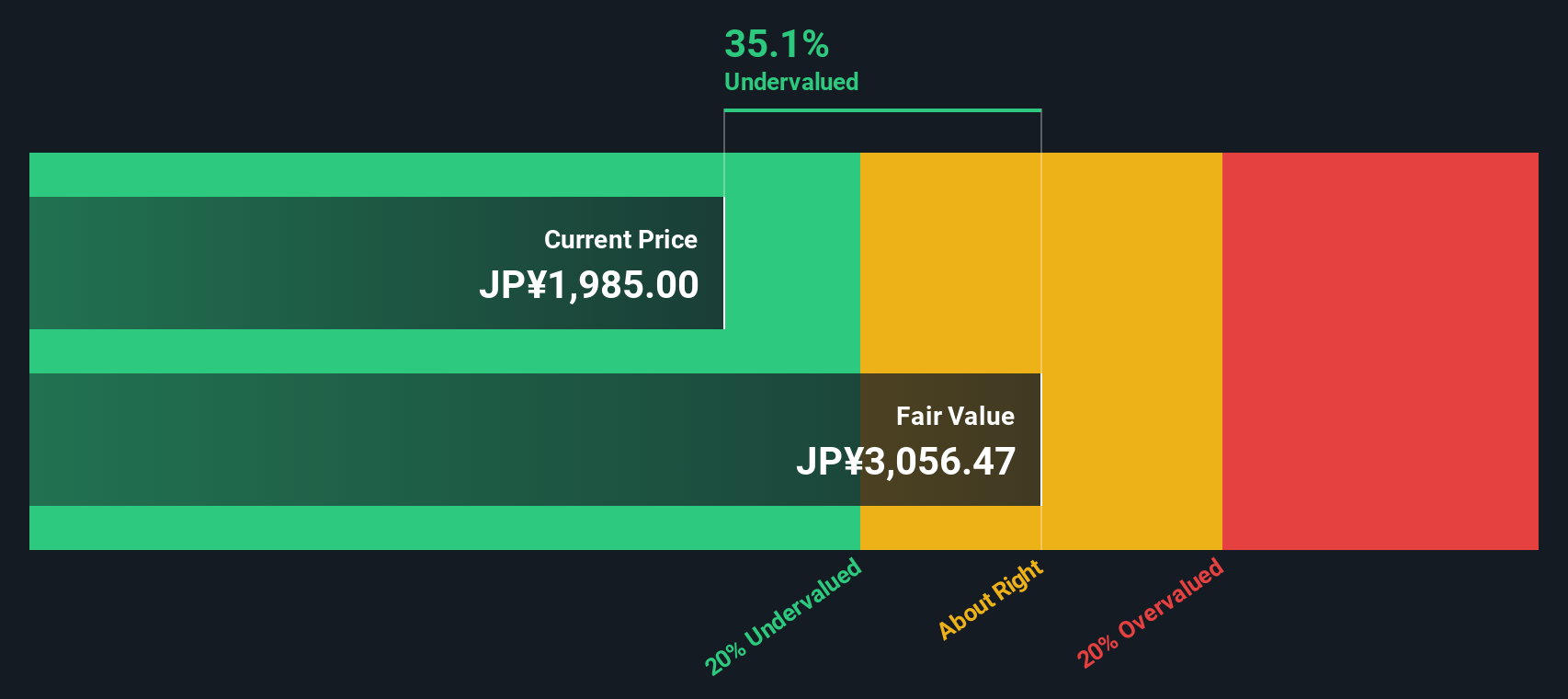

Another View: Discounted Cash Flow Signals Undervaluation

While the price-to-earnings ratio paints Nakanishi as expensive compared to industry peers, our DCF model suggests a very different interpretation. According to this approach, shares are trading at a 33.9% discount to their estimated fair value of ¥3,110.21.

Look into how the SWS DCF model arrives at its fair value.

So, is the market underestimating Nakanishi’s future cash flows, or does the elevated earnings multiple reflect hidden risks not captured by the DCF model?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nakanishi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nakanishi Narrative

If you would rather form your own conclusions or prefer digging into the numbers yourself, you can construct your own perspective in just a few minutes, starting with Do it your way

A great starting point for your Nakanishi research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You owe it to yourself to seize the best potential moves. Don’t leave hidden winners on the table when there’s a world of ideas at your fingertips.

- Capitalize on market volatility by chasing under-the-radar value with these 848 undervalued stocks based on cash flows that could offer compelling upside based on solid cash flows.

- Maximize your portfolio’s income stream with these 17 dividend stocks with yields > 3% delivering robust yields above 3% and proven financial strength.

- Ride the wave of financial innovation and position yourself ahead by targeting rapid growth in digital finance through these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nakanishi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7716

Nakanishi

Engages in the manufacture and sale of dental, surgical, and general industrial products in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives