- Japan

- /

- Medical Equipment

- /

- TSE:6869

Sysmex (TSE:6869) Is Down 5.2% After Guidance Cut Despite Dividend Increase and Commemorative Payout

Reviewed by Sasha Jovanovic

- On November 5, 2025, Sysmex Corporation announced a dividend increase to ¥18.00 per share for the second quarter ended September 30, 2025, introduced a ¥1.00 commemorative dividend, and revised its full-year guidance downward, citing lower-than-expected sales in China and Japan.

- Despite the reduction in sales and profit forecasts, Sysmex is marking its 30th listing anniversary with a commemorative dividend, highlighting its commitment to shareholder returns even during challenging periods.

- We’ll examine how Sysmex’s revised earnings outlook due to continued sales weakness in China and Japan affects its investment story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sysmex's Investment Narrative?

To believe in Sysmex as a long-term holding, an investor needs confidence in the company's ability to navigate shifting demand in core markets like Japan and China while maintaining innovation in diagnostics and laboratory equipment. The recent guidance cut highlights how dependent the business remains on recovery in these regions, which has clearly hurt near-term catalysts around earnings momentum and potential margin improvement. That said, the simultaneous dividend increase and special commemorative payout send a clear signal that management remains committed to returning value to shareholders, even in tougher periods. Prior expectations for mid-single-digit revenue and double-digit profit growth now face greater risk from prolonged regional weakness and could prompt investors to re-examine assumptions around near-term recovery. Share price declines ahead of this news suggest the market had started to price in some caution, but the revised forecasts make those concerns more concrete. In contrast, expectations for renewed growth hinge on how quickly demand stabilizes in China and Japan.

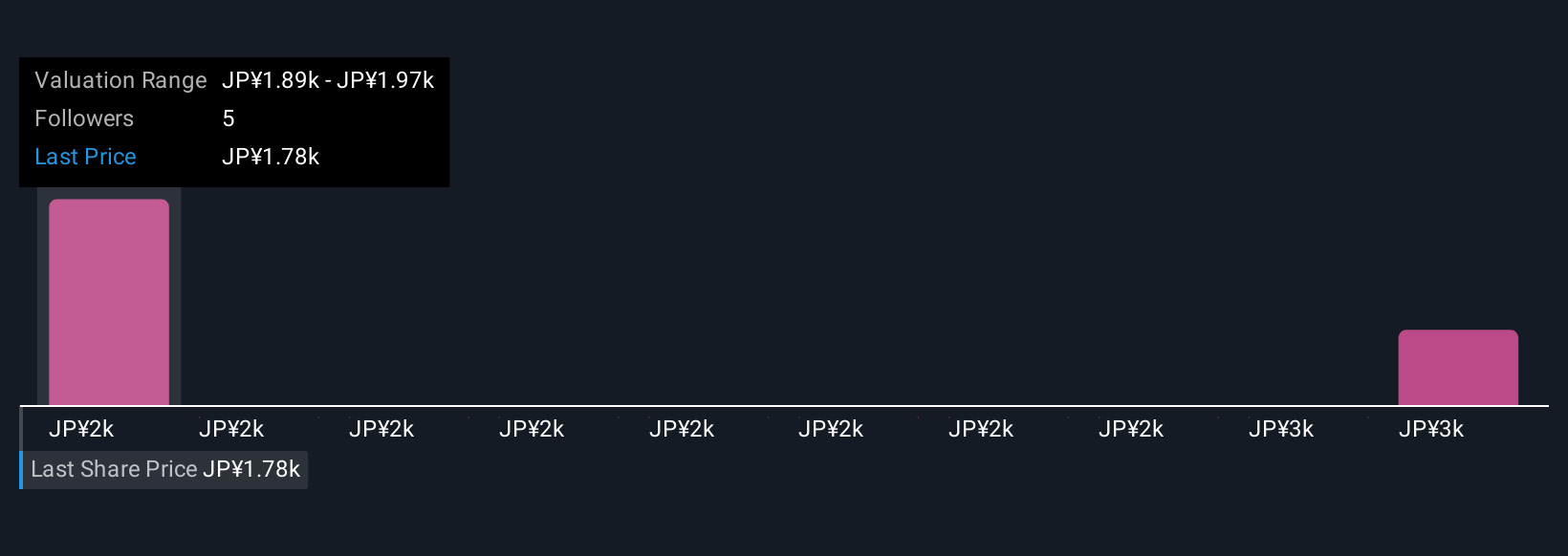

Despite retreating, Sysmex's shares might still be trading 10% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Sysmex - why the stock might be worth as much as 63% more than the current price!

Build Your Own Sysmex Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sysmex research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sysmex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sysmex's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6869

Sysmex

Engages in the development, manufacture, and sale of diagnostic instruments, reagents, and related software.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives