- Japan

- /

- Medical Equipment

- /

- TSE:4543

Terumo (TSE:4543): Evaluating Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Terumo (TSE:4543) continues to attract attention as investors assess its current valuation and long-term prospects. With muted short-term performance, many are curious how recent business developments could shape its outlook in the future.

See our latest analysis for Terumo.

Terumo’s share price has been under pressure this year, with a 16.8% year-to-date share price decline. This hints at some cooling of market momentum despite steady growth in core financials. However, looking further out, the company has still delivered a 26.8% total shareholder return over three years. This shows that longer-term investors have seen solid rewards even as sentiment in the past year has faded.

If you’re curious where other healthcare leaders are gaining ground, now’s the perfect time to see which names stand out with our See the full list for free.

With the stock now trading well below analyst targets and strong financial growth in the background, the key question is whether Terumo is undervalued at current levels or if recent declines have already factored in future upside.

Most Popular Narrative: 24.2% Undervalued

Terumo’s fair value is set at ¥3,293.57 by the most widely cited narrative, putting it well ahead of the last close price of ¥2,495.5. This signals that market pessimism may be overdone and there could be room for a comeback if key growth levers work out as expected.

Expansion of sales channels and volume commitments in China, especially in Neurovascular products, has enabled Terumo to gain market share and increase prices. This has counteracted typical negative VBP (Volume-Based Procurement) effects and positioned the company for future revenue growth in this key emerging market.

Want to know what’s driving this bullish price target? The estimates hinge on Terumo sustaining above-average growth rates and profit margins. Secrets behind these forecasts could surprise you. See the full financial logic powering the valuation.

Result: Fair Value of ¥3,293.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and delayed innovation could weigh on Terumo’s growth trajectory. This creates uncertainty around its ability to sustain higher profit margins.

Find out about the key risks to this Terumo narrative.

Another View: Valuation Through Market Multiples

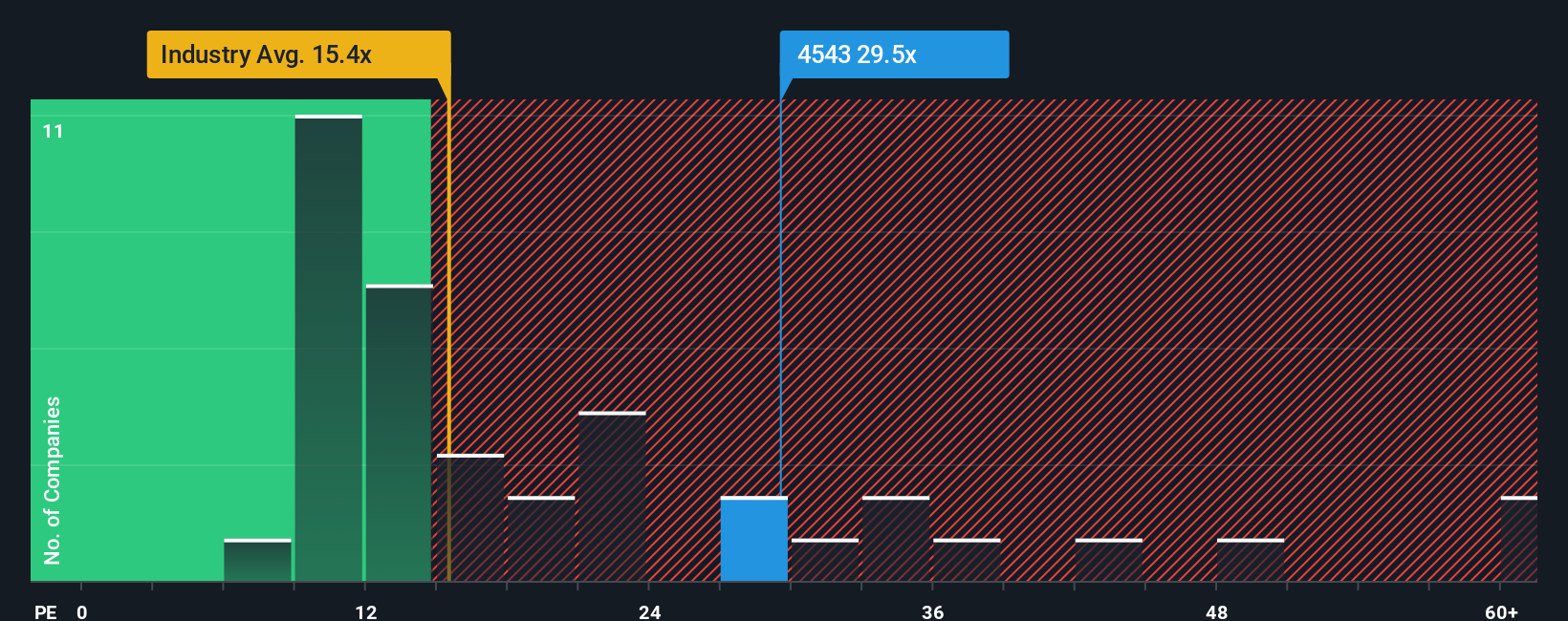

Looking at Terumo’s valuation from a price-to-earnings perspective reveals a different story. The company trades at 29.5x earnings, which is well above both its peer average of 20.6x and the industry average of 15.6x. Even compared to its fair ratio of 32.4x, the gap suggests that investors are paying a premium for Terumo’s growth outlook. This higher multiple may raise questions about risk, or it could indicate that the market sees potential for further gains.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Terumo Narrative

If you have a different perspective or want to analyze the numbers on your own terms, you can easily build your own narrative in just a few minutes with our tools. So why not Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Terumo.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity when so many potential winners are waiting. You’ll want to see what other smart investors are acting on right now.

- Start building consistent passive income by evaluating these 16 dividend stocks with yields > 3% with attractive yields above 3% and strong fundamentals.

- Capitalize on the growth of artificial intelligence by screening for these 24 AI penny stocks that drive innovation across industries.

- Spot undervalued gems before the market catches on by reviewing these 870 undervalued stocks based on cash flows featuring promising cash flow opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives