- Japan

- /

- Medical Equipment

- /

- TSE:4543

How Terumo’s Dividend Hike and Lower Guidance Could Influence TSE:4543 Investor Sentiment

Reviewed by Sasha Jovanovic

- On November 12, 2025, Terumo Corporation announced an increase in its second quarter and full-year dividend to ¥15.00 per share from ¥13.00 per share previously, and at the same time, revised its fiscal year 2026 earnings guidance downward due to updated foreign exchange assumptions and acquisition-related costs.

- This combination highlights management’s willingness to return more capital to shareholders despite acknowledging near-term profitability pressures and one-time business portfolio review expenses.

- We’ll examine how Terumo’s simultaneous dividend increase and lower earnings guidance update shape the company’s investment outlook going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Terumo Investment Narrative Recap

To invest in Terumo, an investor needs to believe in the company’s ability to drive growth through sustained demand and pricing initiatives in its established cardiovascular and blood solutions segments, while successfully managing exposure to foreign exchange volatility and acquisition-related costs. The recent combination of a dividend increase with a downward earnings revision does not appear to materially change the near-term catalyst, continuing volume and pricing gains in the US and China, nor does it directly resolve the biggest risk, which remains profit margin pressure from tariffs and structural pricing challenges.

Among the latest company developments, the revised 2026 earnings guidance on November 12 stands out: management lowered profit forecasts due to yen depreciation and acquisition expenses, even as revenue projections increased. This announcement is particularly relevant as it addresses the external and internal cost pressures that could shape earnings quality and investor sentiment around Terumo’s near-term growth trajectory.

In contrast, investors should be aware of how persistent pricing pressure in China and less favorable currency trends could weigh on future margins and...

Read the full narrative on Terumo (it's free!)

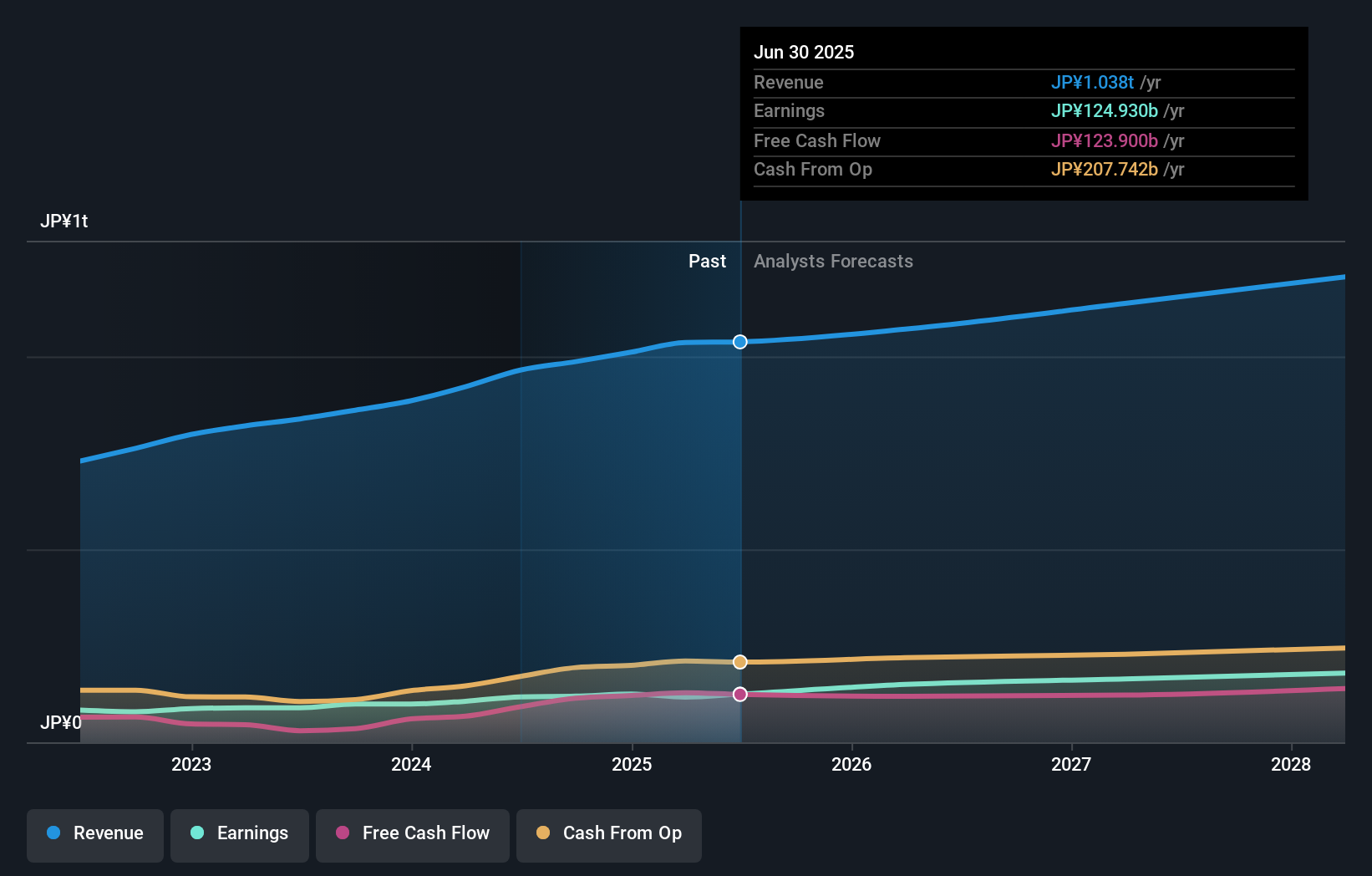

Terumo's narrative projects ¥1,228.6 billion revenue and ¥180.7 billion earnings by 2028. This requires 5.8% yearly revenue growth and a ¥55.8 billion earnings increase from ¥124.9 billion.

Uncover how Terumo's forecasts yield a ¥3294 fair value, a 29% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provides two independent fair value estimates for Terumo ranging from ¥2,686 to ¥3,294 per share. With ongoing downward revisions to earnings guidance impacting profitability, you’ll find opinions vary widely on where growth and valuation trends may head next.

Explore 2 other fair value estimates on Terumo - why the stock might be worth just ¥2686!

Build Your Own Terumo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terumo research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Terumo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terumo's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives