Stock Analysis

Three High Growth Tech Stocks In Japan With Promising Potential

Reviewed by Simply Wall St

Japan’s stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, buoyed by better-than-expected U.S. economic data and Japan's own impressive GDP growth in the second quarter. In this favorable environment, identifying high-growth tech stocks becomes crucial, as these companies often benefit from positive market sentiment and robust economic indicators.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Avant Group Corporation, with a market cap of ¥65.92 billion, operates through its subsidiaries to provide accounting, business intelligence, and outsourcing services.

Operations: Avant Group generates revenue primarily from three segments: Management Solutions Business (¥8.52 billion), Digital Transformation Promotion Business (¥8.85 billion), and Consolidated Financial Statements Disclosure Business (¥7.54 billion).

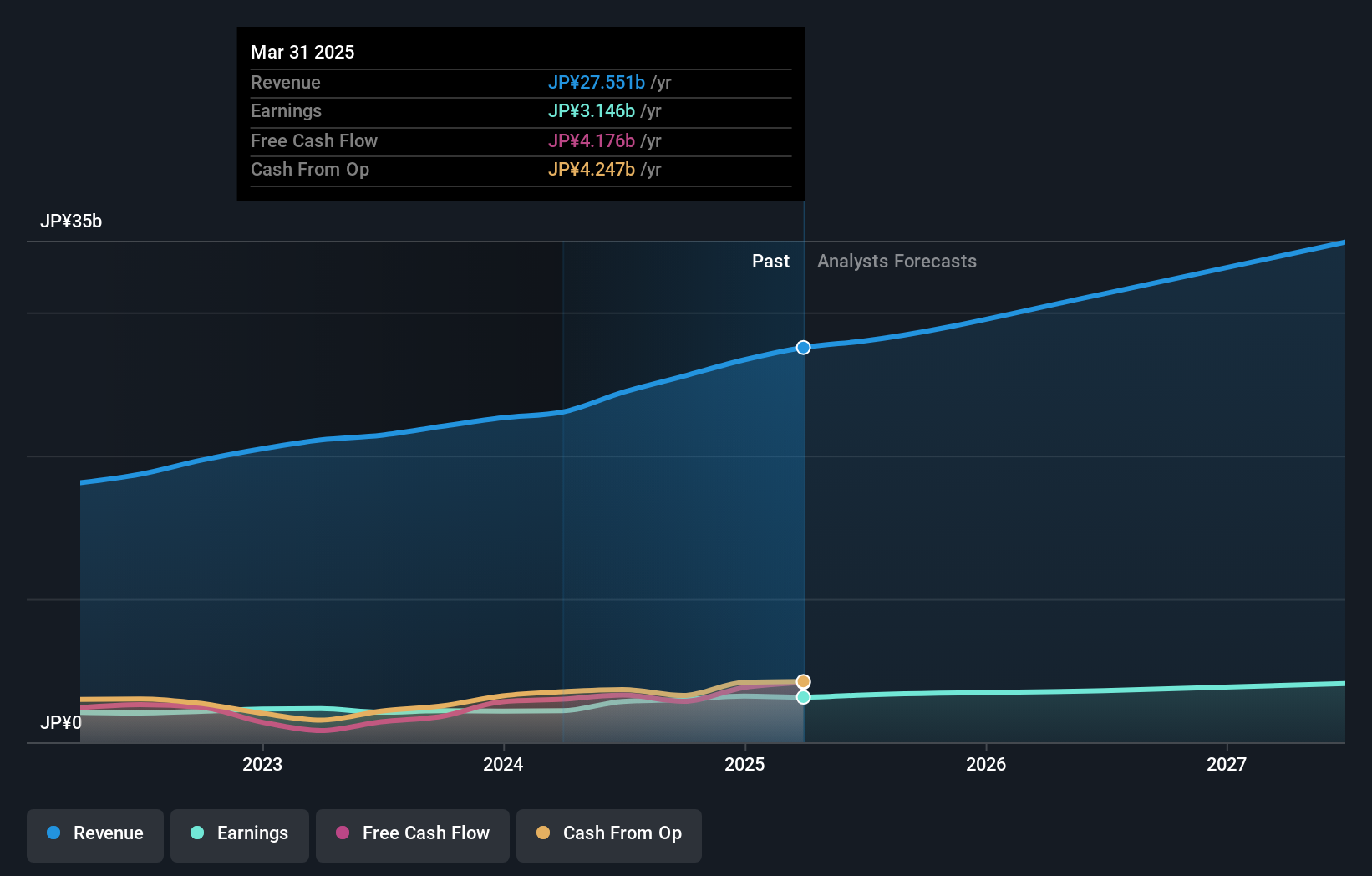

Avant Group, a notable player in Japan's high-growth tech sector, has demonstrated robust performance with earnings growing by 36.1% over the past year, outpacing the IT industry’s 10%. The company forecasts an annual profit growth of 18.9%, significantly higher than the JP market's 8.5%, and anticipates revenue to grow by 16.9% per year. Recent corporate guidance for FY2025 projects net sales of ¥28.8 billion and operating profit of ¥4.9 billion, supported by strategic R&D investments that bolster innovation and product development. In terms of shareholder value, Avant Group announced a dividend increase to ¥19 per share from last year's ¥15, with expectations for further growth to ¥25 per share next fiscal year. Additionally, between April and June 2024, they repurchased nearly 0.98% of shares at a cost of ¥477 million ($3 million), signaling confidence in their financial health and future prospects within the dynamic tech landscape in Japan.

- Click here to discover the nuances of Avant Group with our detailed analytical health report.

Gain insights into Avant Group's past trends and performance with our Past report.

Finatext Holdings (TSE:4419)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Finatext Holdings Ltd. operates in the fintech solution, big data analysis, and financial infrastructure sectors in Japan, with a market cap of ¥48.22 billion.

Operations: The company generates revenue through three primary segments: Fintech Solution Business (¥1.22 billion), Big Data Analysis Business (¥1.42 billion), and Financial Infrastructure Structure Business (¥3.43 billion). The Financial Infrastructure Structure Business is the largest contributor to its revenue streams.

Finatext Holdings, a prominent tech firm in Japan, is experiencing substantial growth with revenue projected to increase by 26% annually, outpacing the JP market's 4.3%. The company’s earnings are forecasted to surge by an impressive 64.3% per year over the next three years. Recent financials reveal a significant one-off loss of ¥185M impacting last year's results, yet their strategic R&D investments continue to drive innovation and product development. Notably, Finatext repurchased shares between April and June 2024 at a cost of ¥477 million ($3 million), reflecting confidence in its future prospects within the dynamic tech landscape.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥108.50 billion.

Operations: Medley, Inc. generates revenue through its recruitment and medical platforms in Japan and the United States. The company focuses on leveraging technology to streamline these sectors, contributing to its market presence valued at ¥108.50 billion.

Medley, Inc. has demonstrated robust growth, with earnings projected to rise by 30.5% annually over the next three years and revenue expected to grow 25% per year, significantly outpacing the JP market's 4.3%. The company invested heavily in R&D, with ¥1.2 billion allocated last year alone, driving innovation in its healthcare and software solutions segments. Medley's recent expansion into new geographic markets further solidifies its position as a dynamic player within Japan's tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Medley.

Explore historical data to track Medley's performance over time in our Past section.

Summing It All Up

- Click here to access our complete index of 128 Japanese High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3836

Avant Group

Through its subsidiaries, provides accounting, business intelligence, and outsourcing services.