Japan Tobacco (TSE:2914): Assessing Valuation Following Dividend Hike and Upbeat Financial Forecasts

Reviewed by Simply Wall St

Japan Tobacco (TSE:2914) just made headlines with an increase to its year-end dividend guidance and fresh financial forecasts. This gives investors clear indications of confidence in the company's revenue and earnings outlook for 2025.

See our latest analysis for Japan Tobacco.

Japan Tobacco’s upbeat dividend news and robust forecast have sparked renewed investor attention, fueling momentum in the stock. The share price has climbed sharply, delivering a 35.1% year-to-date gain and an impressive 35.9% total shareholder return over the last year. This highlights growing confidence in the company’s ongoing transformation.

If this kind of momentum makes you wonder what else is trending, now’s a great time to broaden your toolbox and discover fast growing stocks with high insider ownership

But with such major gains already realized and a bullish outlook now public, the big question remains: Is Japan Tobacco undervalued at current levels, or has the market already factored in its future growth potential?

Most Popular Narrative: 7.3% Overvalued

Japan Tobacco's most tracked narrative assigns a fair value below the latest close price, suggesting current optimism may be running ahead of fundamentals. This provides an opportunity for a closer examination of the structural shifts supporting this viewpoint.

Expansion into reduced-risk products and premium offerings is driving sustained margin improvement. Ongoing investment in innovation aims to secure future earnings growth. International acquisitions and market share gains are helping to offset declines in mature markets, diversifying revenue and strengthening global competitive positioning.

Curious which growth levers are doing the heavy lifting behind this valuation? The narrative weighs bold margin expansion assumptions and new market ventures. What does the underlying financial model suggest about the future mix of earnings power and revenue growth? See the full financial story inside the complete narrative.

Result: Fair Value of $5,099 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining domestic volumes and ongoing weakness in reduced-risk product profitability remain key challenges. These factors could derail the current margin expansion story.

Find out about the key risks to this Japan Tobacco narrative.

Another View: Numbers Behind the Multiples

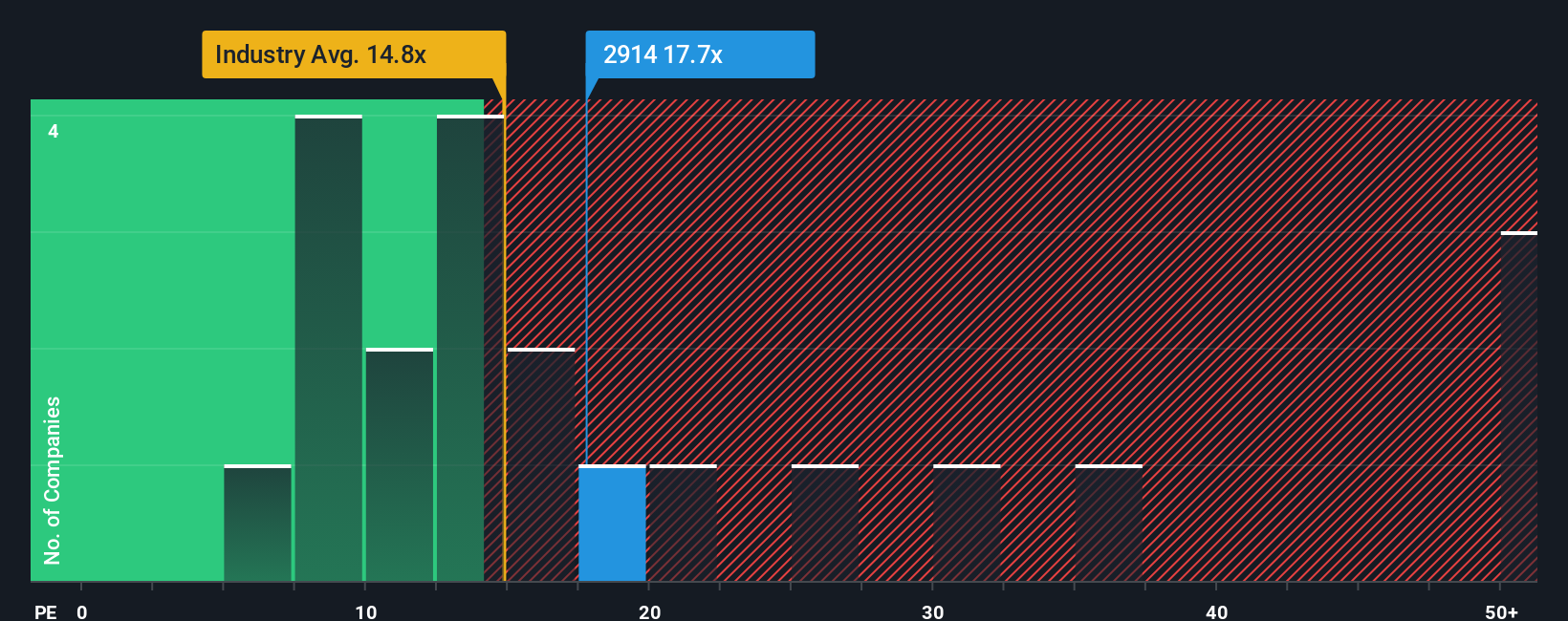

While the consensus price target suggests Japan Tobacco is fairly valued, a look at its current price-to-earnings ratio (18.1x) tells a different story. This figure sits well above the Asian Tobacco industry average of 14.8x, yet notably below its estimated fair ratio of 28.5x. The gap points to both market caution and upside potential, so which way will investor sentiment shift from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Japan Tobacco Narrative

If you see the numbers differently or want to dig deeper on your own, explore the data and shape your own story in just a few minutes. Do it your way

A great starting point for your Japan Tobacco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make sure you do not miss top opportunities outside Japan Tobacco. With just a few minutes on Simply Wall St, you can uncover stocks set for exciting potential growth, income, or innovation.

- Tap into future trends by finding tomorrow’s leaders among these 25 AI penny stocks, making waves in artificial intelligence.

- Boost your income stream as you track down stocks boasting strong yields via these 17 dividend stocks with yields > 3%.

- Position yourself for value gains by exploring these 848 undervalued stocks based on cash flows, currently flying under Wall Street’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2914

Japan Tobacco

A tobacco company, manufactures and sells tobacco products, pharmaceuticals, and processed foods in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives