Does the Drop in Nissin Foods Stock Signal a Missed Opportunity for 2025?

Reviewed by Bailey Pemberton

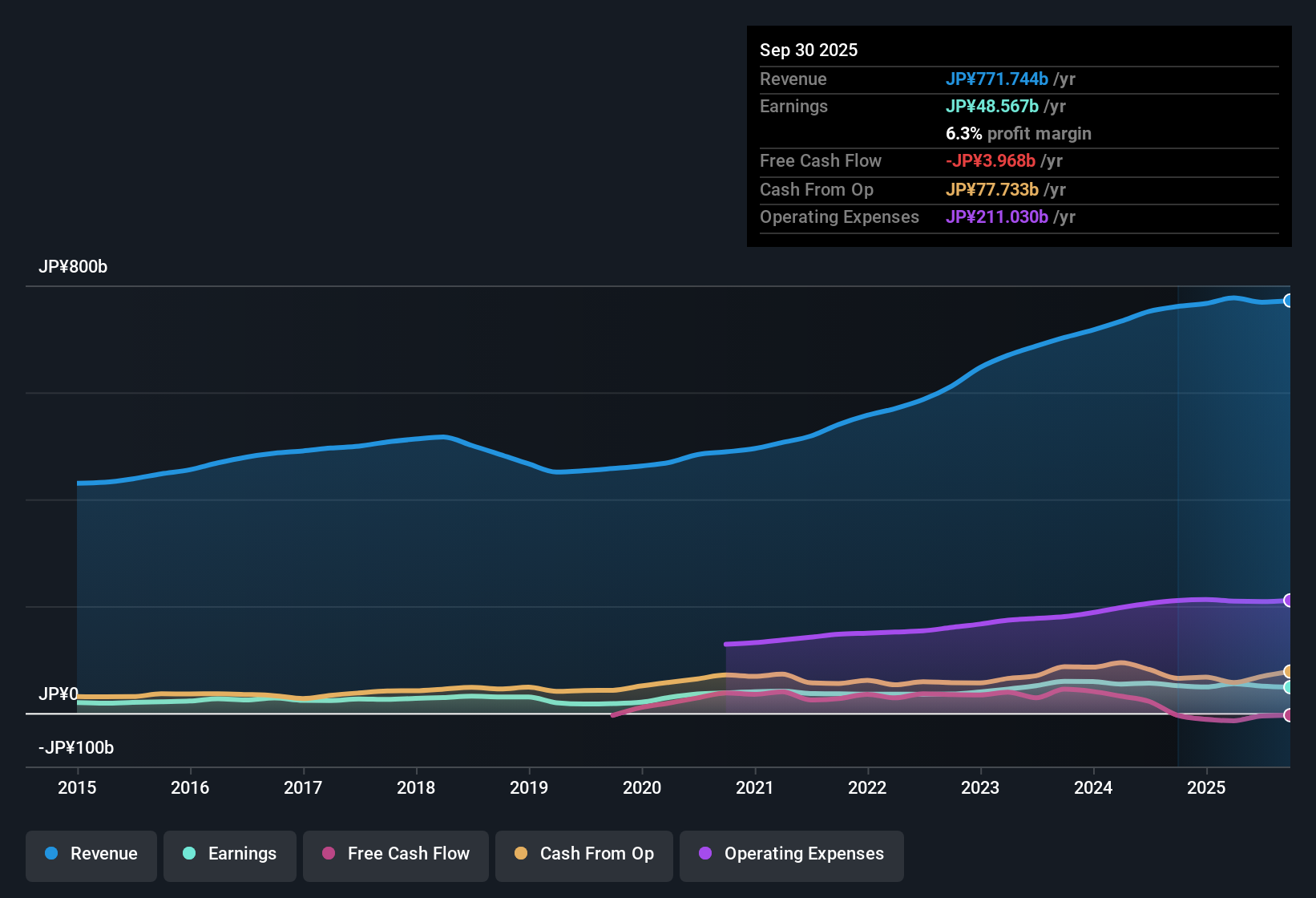

If you’re wondering what to do next with Nissin Foods HoldingsLtd stock, you’re not alone. It’s hard to ignore a company with such a long legacy in the food industry, especially when the share price tells a story of its own. Just this year, the stock has dropped 28.2%, adding to a one-year decline of 32.5%. Over the last five years, Nissin Foods HoldingsLtd is down 8.1%. It’s not just about the numbers. Broader market shifts and changing global appetites for defensive consumer stocks have been swirling in the background, shaping the mood for this well-known brand.

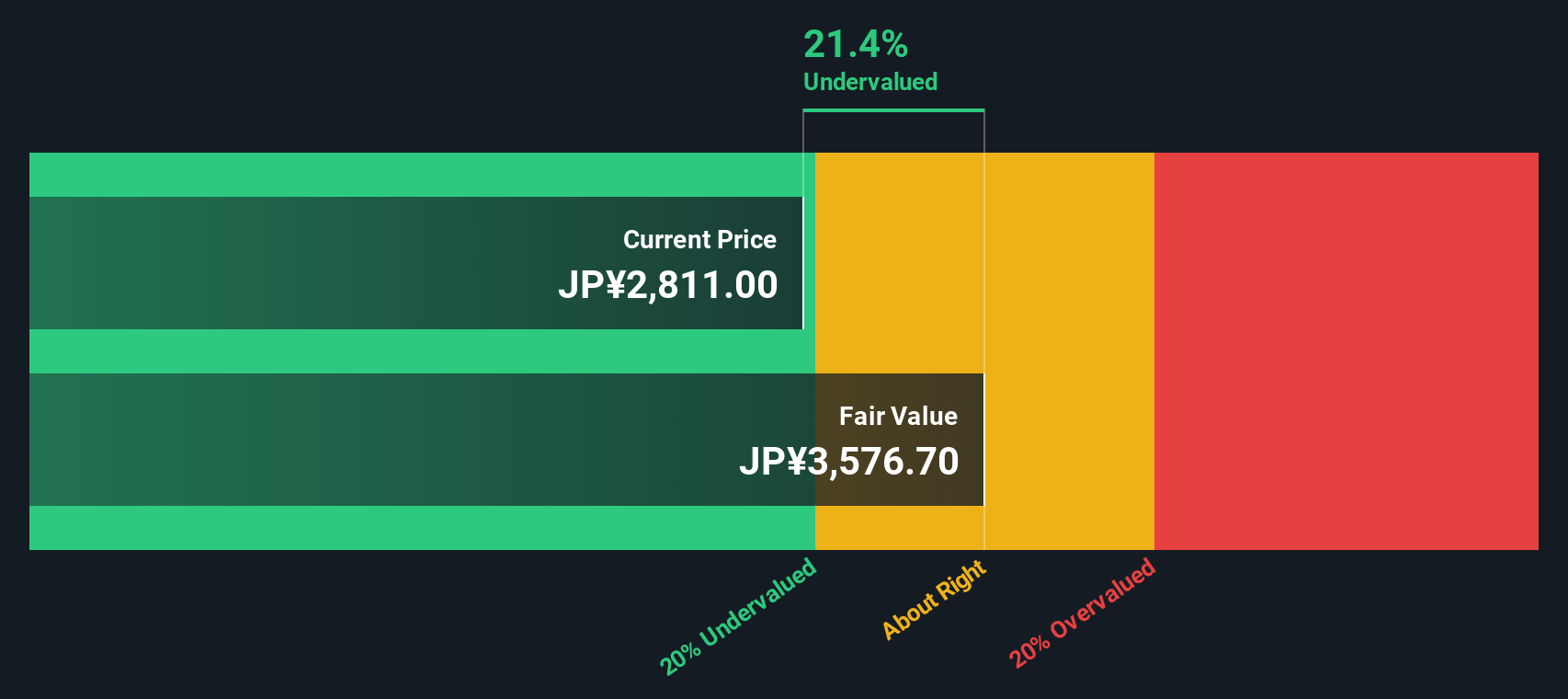

Despite the recent negative returns, the real question is whether the current price reflects the underlying value, or if the market is missing something. Interestingly, by our assessment, the company is undervalued in 5 out of 6 key valuation checks, giving Nissin Foods HoldingsLtd an eye-catching value score of 5. That is a rare mark for any established consumer goods giant and well worth a pause for closer inspection.

Let’s dig into how different valuation methods stack up for Nissin Foods HoldingsLtd, and stay tuned, because there is a smarter and even more insightful way to measure the real worth of this familiar stock coming up at the end.

Why Nissin Foods HoldingsLtd is lagging behind its peers

Approach 1: Nissin Foods HoldingsLtd Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the present value of a company by forecasting future cash flows and discounting them back to today. For Nissin Foods HoldingsLtd, this approach uses a 2 Stage Free Cash Flow to Equity method, relying on both analyst estimates and extrapolated projections.

The latest reported Free Cash Flow (FCF) stands at ¥7.7 Billion. Analyst estimates extend up to 2027, after which projections continue using reasonable long-term growth assumptions. According to these, FCF is expected to reach almost ¥45.3 Billion by the fiscal year ending March 2030, more than five times today’s levels. This trajectory is based on a mix of analyst expectations and model-based estimates, aiming to capture the company’s capacity to generate cash well into the future.

Using these projected numbers, the DCF analysis calculates an intrinsic value of ¥3,592 per share for Nissin Foods HoldingsLtd. Comparing this figure with the current share price reveals the stock trades at a 24.9% discount to its estimated fair value, which suggests significant undervaluation by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nissin Foods HoldingsLtd is undervalued by 24.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

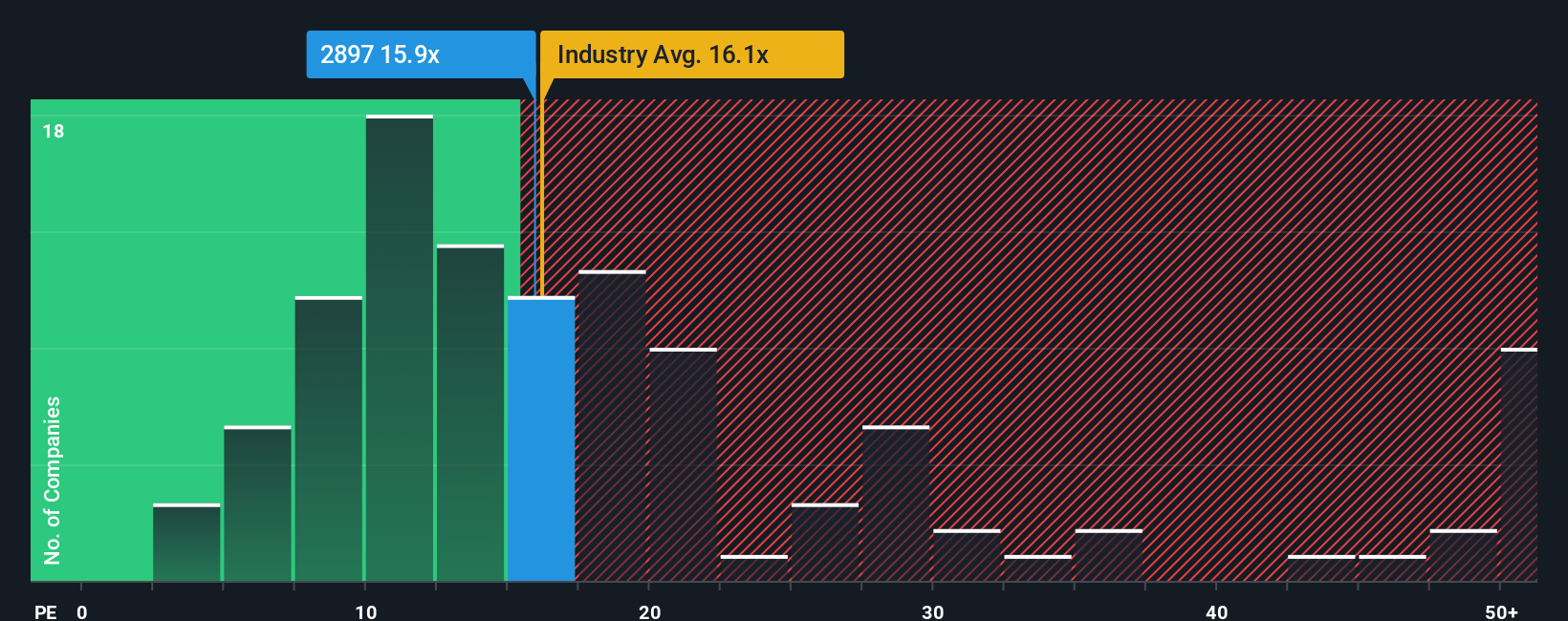

Approach 2: Nissin Foods HoldingsLtd Price vs Earnings

The price-to-earnings (PE) ratio is often the go-to metric for valuing profitable companies, and with good reason. It helps investors understand how much they are paying for each unit of current earnings, making it especially relevant for consumer brands like Nissin Foods HoldingsLtd which generate steady profits year after year.

What counts as a “normal” or “fair” PE ratio is not set in stone. Higher growth expectations typically justify paying a higher PE, while companies in riskier industries or with less reliable earnings warrant lower multiples. It is also common practice to compare the PE ratio of a target company with those of industry peers and the broader sector to judge relative value.

Currently, Nissin Foods HoldingsLtd trades at a PE ratio of 15.38x. This sits below both the peer average at 16.95x and the food industry average of 16.43x, suggesting the stock is attractively priced compared to its direct competitors. However, the real value emerges when we introduce Simply Wall St's proprietary “Fair Ratio” metric. For Nissin Foods HoldingsLtd, that Fair PE is 19.62x, a level determined by considering not just earnings but also factors like projected growth, company size, profit margins, and risk profile. This holistic approach is more insightful than simply lining up ratios against peers because it accounts for the unique strengths and challenges facing the business today.

With the current PE at 15.38x and a Fair Ratio of 19.62x, the shares appear undervalued on this measure, reinforcing the earlier DCF findings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nissin Foods HoldingsLtd Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives take stock research beyond the numbers by letting you define your own story for Nissin Foods HoldingsLtd, connecting what you believe about the company’s future to a forecast and, ultimately, a fair value estimation.

With Narratives, you can easily set your assumptions about future earnings, margins, and revenue, then see how these ideas translate into a price you think is fair. This is all available on the Simply Wall St Community page, where investors from around the world share their unique perspectives and see how their Narrative compares to others.

Narratives help you confidently decide whether to buy or sell by showing if your estimated Fair Value is above or below today’s price. They update automatically when new information appears, such as major company news or quarterly results.

For instance, on Nissin Foods HoldingsLtd, some investors’ Narratives set a high Fair Value based on international expansion potential, while others are more cautious due to rising costs, resulting in a much lower Fair Value. With Narratives, you get a living, dynamic view that brings your investment case to life.

Do you think there's more to the story for Nissin Foods HoldingsLtd? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissin Foods HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2897

Nissin Foods HoldingsLtd

Manufactures and sells instant foods in Japan, the United States, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives