Aohata (TSE:2830) Profit Recovery Challenges Bearish Narratives, But Valuation Premium Raises Concerns

Reviewed by Simply Wall St

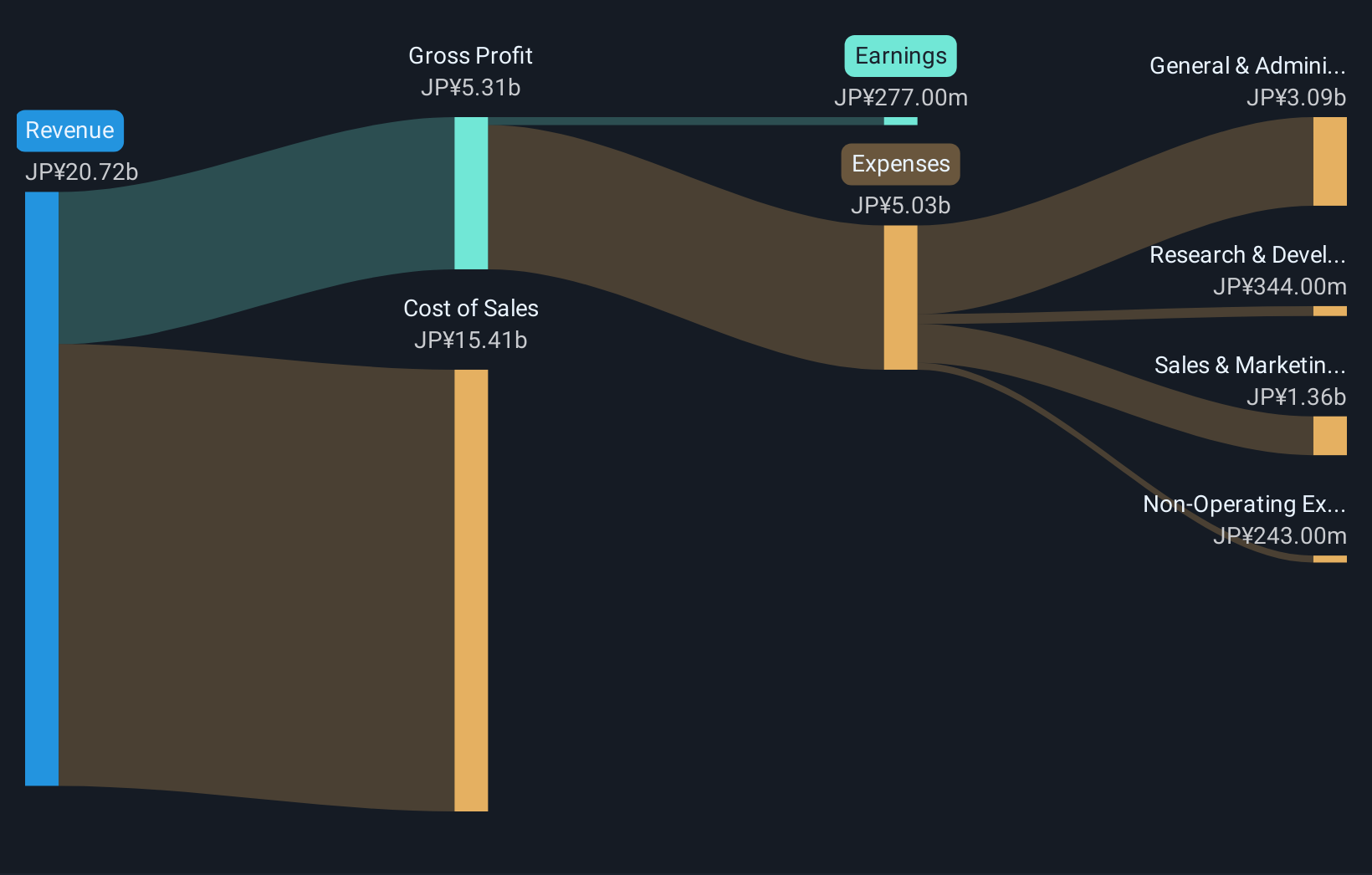

Aohata (TSE:2830) posted a net profit margin of 1.3%, a slight uptick from last year’s 1.2%, with EPS reflecting a notable 13.5% earnings growth over the past year. This marks a stark contrast to the company’s five-year average earnings decline of 24.4% per year. Despite this sharp turnaround, shares trade at an elevated ¥3,695, resulting in a lofty 110.2x Price-To-Earnings Ratio. This is far above the peer and industry averages, raising questions about valuation sustainability in light of continued share price volatility and longer-term profit declines.

See our full analysis for AOHATA.Next, we will see how these results measure up against the prevailing narratives. Some expectations may get confirmed, while others could be in for a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Holds Above 1% Despite Long-Term Declines

- Net profit margin ticked up to 1.3% from 1.2% last year, pausing a longer history of shrinking profits.

- What’s surprising is that, even with this modest increase, the prevailing market view says a net margin at this level underwhelms compared to sector resilience. This is notable since food manufacturers are generally seen as defensive safe-havens during market volatility.

- The data reminds us the recent uptick does not erase a negative five-year trend of 24.4% annual average earnings decline.

- Bulls highlighting “defensive sector support” run into a reality check as Aohata’s profitability recovery is tenuous, with no guidance suggesting broader margin expansion.

Share Price Sits Over 6x DCF Fair Value

- At ¥3,695, the current share price stands more than six times higher than the ¥610.38 DCF fair value and reflects a steep 110.2x P/E, which is well beyond the Japanese food industry average of 16.3x.

- The prevailing market view contends that such a premium is hard to defend, even for a sector regarded as stable, since peers and the industry command markedly lower multiples.

- Critics highlight that this valuation leaves little room for error, especially as earnings and revenue are not projected to grow. The premium may be at risk if sentiment wanes.

- Investors looking for defensive value may find the price tag diminishes some of Aohata’s appeal among sector alternatives.

Profit Recovery Fails to Alter Flat Growth Outlook

- The turnaround in annual earnings growth, with an increase of 13.5% over the last year, contrasts sharply with the company’s average earnings drop of 24.4% per year over the past five years.

- The prevailing market view cautions that, despite this headline improvement, sustained growth is not expected. Upside appears capped as longer-term declines keep weighing on sentiment.

- Bears emphasize that this one-year spike does not reflect a durable shift. Without improving revenue and share price stability, the risk of reverting to prior negative trends is high.

- What stands out is that earnings improvement alone is not enough. Investors want to see consistent delivery to justify the sharp valuation gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AOHATA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Aohata’s lofty valuation, limited consistent growth, and profits that are prone to fluctuate make its investment case much weaker than stable peers in the sector.

Put consistency first by checking out stable growth stocks screener. It is built for investors who want dependable earnings and revenue growth to weather market uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2830

Flawless balance sheet with proven track record.

Market Insights

Community Narratives