Why Kikkoman (TSE:2801) Is Up 10.6% After Raising Earnings Guidance on Currency Tailwinds – And What's Next

Reviewed by Sasha Jovanovic

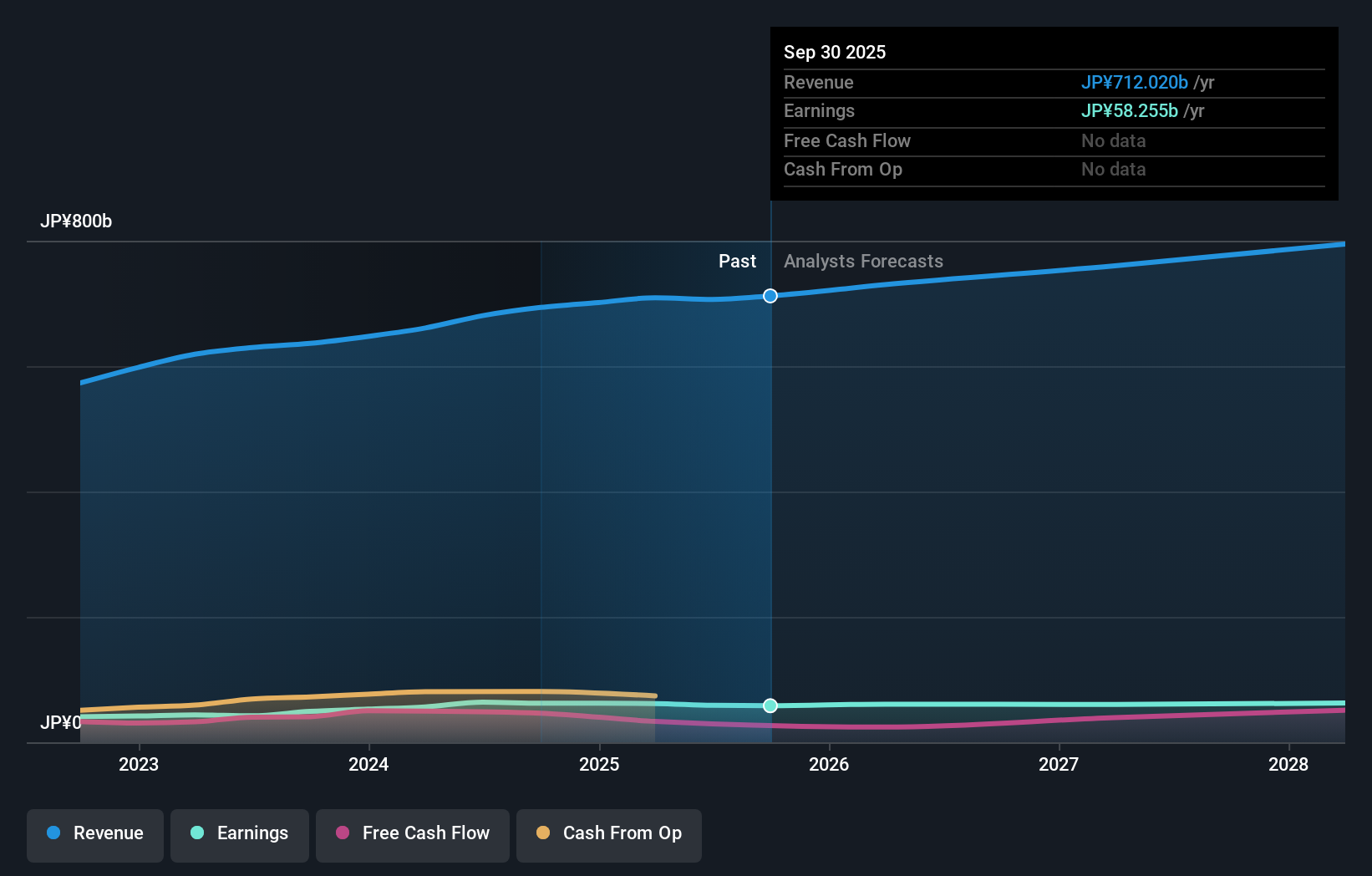

- Kikkoman Corporation recently raised its consolidated earnings guidance for the fiscal year ending March 31, 2026, now expecting revenue of ¥731.0 billion and profit attributable to owners of the parent of ¥60.0 billion, based on first-half performance and updated currency assumptions.

- This revised forecast highlights the influence of foreign exchange rates on Kikkoman’s profitability and management’s responsiveness to changing business conditions.

- Next, we’ll explore how the revised profit outlook tied to currency movement factors into Kikkoman’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Kikkoman's Investment Narrative?

To be a Kikkoman shareholder, you need to be comfortable with steady, moderate growth anchored by a global brand, recognizing that both currency fluctuations and evolving consumer tastes can sway near-term results. The recent earnings guidance upgrade, which is mostly a profit forecast tweak driven by updated foreign exchange rates and solid first-half performance, underlines how much the company's bottom line relies on external factors like the yen-dollar rate. This adjustment may not dramatically change the main short-term catalysts, which remain linked to stable sales, continued dividend reliability, and buyback activity. However, it does sharpen the spotlight on currency risk as the most immediate variable for the stock and could provide a modest sentiment boost given the improved profit forecast. Investors should still keep a close eye on expensive valuation metrics and relatively low expected growth, as these risks remain front and center, even after the news. Yet despite the upbeat guidance, Kikkoman remains vulnerable to swings in exchange rates.

Kikkoman's shares have been on the rise but are still potentially undervalued by 5%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Kikkoman - why the stock might be worth just ¥1461!

Build Your Own Kikkoman Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kikkoman research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kikkoman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kikkoman's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kikkoman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2801

Kikkoman

Through its subsidiaries, engages in the manufacture and sale of food products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives