Yomeishu Seizo (TSE:2540) One-Off Gain Inflates Earnings, Raising Caution on Premium Valuation

Reviewed by Simply Wall St

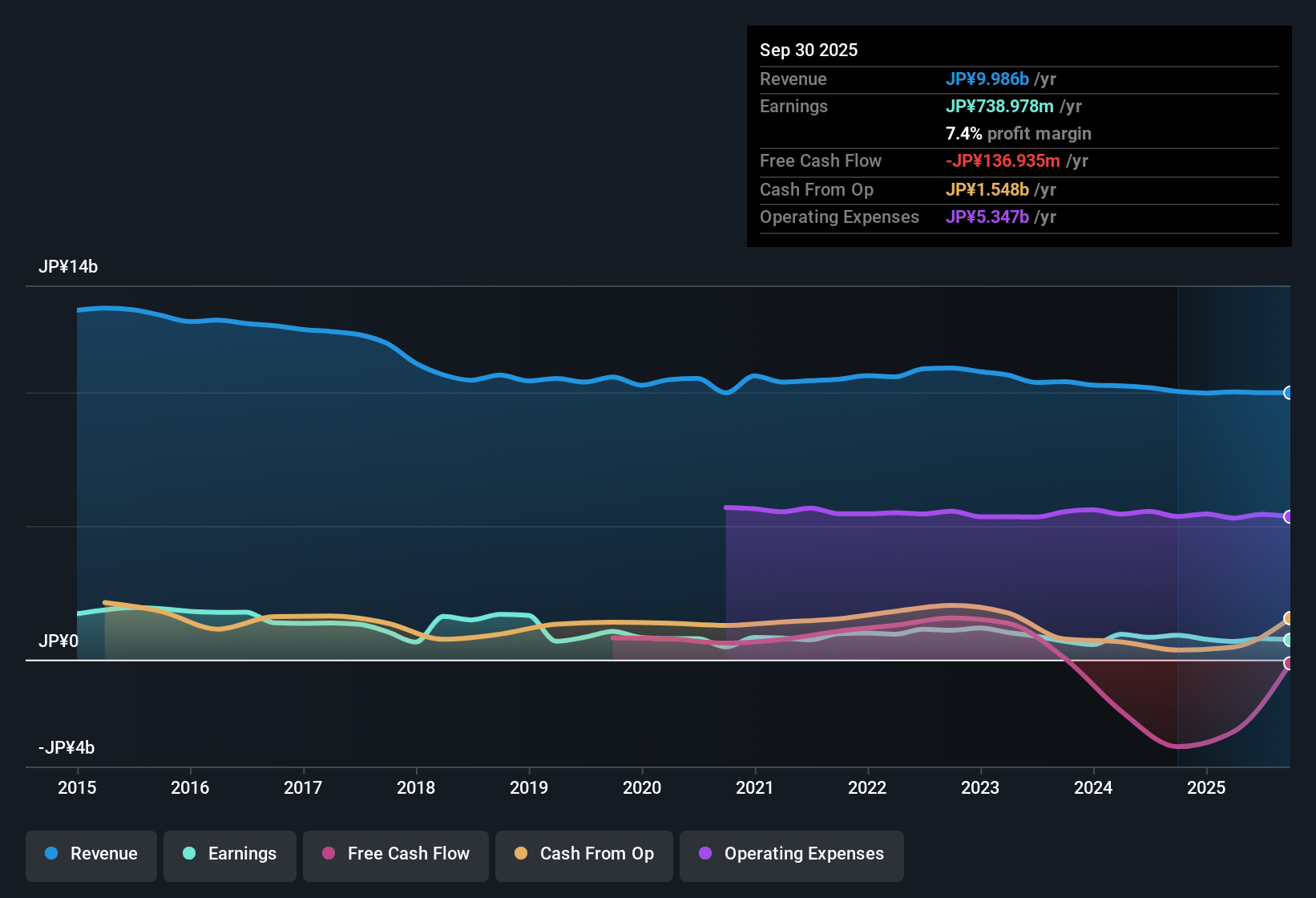

Yomeishu Seizo Ltd. (TSE:2540) reported that average annual earnings have fallen 1.6% over the past five years, while net profit margin dropped to 7.4% from 9.1% in the previous year. Profits for the most recent twelve months included a one-off gain of ¥278.0 million, inflating results beyond regular business performance. On a price-to-earnings basis, shares currently trade at 78 times earnings, well above both the Asian beverage industry average of 19.4x and its peer group's 18.2x. The market price of ¥4,155 stands significantly higher than an estimated fair value of ¥1,061.38.

See our full analysis for Yomeishu SeizoLtd.The real test is how these numbers compare to the prevailing narratives for Yomeishu Seizo Ltd. Some viewpoints could be reinforced, while others may be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain of ¥278 Million Distorts Profit Picture

- Recent net profit was bolstered by a substantial one-off gain of ¥278.0 million in the last twelve months, masking underlying earning trends from regular business activities.

- The prevailing market view suggests investors should be cautious about relying on this profit figure because it does not reflect the true performance of core operations.

- The drop in net profit margin from 9.1% to 7.4% highlights that profitability would have been noticeably weaker without the one-time benefit.

- With no recurring boost like this expected, future results could revert to pre-gain levels, which have shown a 1.6% annual decline over five years.

Valuation Premium Compared to Sector and DCF Fair Value

- Shares are currently valued at 78 times earnings and trade at ¥4,155, which is not only much higher than the Asian beverage industry average P/E of 19.4x and peers at 18.2x, but also sits well above the DCF fair value estimate of ¥1,061.38.

- The prevailing market view notes that this significant premium challenges the idea that Yomeishu Seizo is attractively valued.

- Such high multiples are often hard to justify without robust growth, but here, earnings have averaged a steady 1.6% decline per year.

- The market pricing reflects expectations far above fundamental trends, leading some investors to adopt a critical stance.

To see what the community is saying about Yomeishu Seizo Ltd., head to the full set of narratives and perspectives. See what the community is saying about Yomeishu SeizoLtd

Earnings Stability and Margin Downtrend Raise Red Flags

- The company's net profit margin dropped to 7.4% from 9.1% last year, and risks have been flagged around the stability of recent earnings and share price volatility over the last three months.

- The prevailing market view underscores how the shrinking margin and unstable earnings quality reinforce caution among investors.

- No material rewards were identified in the data, further supporting a careful approach as downside risks outweigh growth signals.

- The lack of positive earnings drivers sets Yomeishu Seizo apart from sector peers with stronger fundamentals.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yomeishu SeizoLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Yomeishu Seizo Ltd.’s high valuation, declining profit margins, and lack of positive earnings drivers make it much weaker than sector peers with healthier growth.

If you want to avoid shares trading at a steep premium to fundamentals, check out these 835 undervalued stocks based on cash flows for opportunities with stronger upside and more attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2540

Yomeishu SeizoLtd

Produces and sells alcoholic beverages and food products in Japan and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives