A Look at NH Foods (TSE:2282) Valuation Following Strategic Joint Venture with CPF

Reviewed by Simply Wall St

NH Foods (TSE:2282) has entered into a joint venture with Charoen Pokphand Foods, targeting the processed pork market in Japan and select Asian countries. This move is expected to enhance NH Foods’ regional growth prospects.

See our latest analysis for NH Foods.

NH Foods’ share price has steadily gained momentum this year, recently closing at ¥5,609 after climbing nearly 13% year-to-date. Its one-year total shareholder return stands at a healthy 9.6%. The recent partnership with CPF appears to be attracting fresh attention from investors as the company’s regional growth narrative takes shape.

If this kind of cross-border expansion sparks your interest, now is a good moment to broaden your investing universe and discover fast growing stocks with high insider ownership

But with shares already climbing over 13% this year and trading near their analyst targets, the big question is whether NH Foods is still an undervalued play or if future growth is fully reflected in its price.

Price-to-Earnings of 21.9x: Is it justified?

NH Foods currently trades at a price-to-earnings (P/E) ratio of 21.9x, which stands above both peer and industry averages and may signal a premium valuation.

The P/E ratio measures how much investors are paying for each yen of earnings. This is an important yardstick for food sector stocks. A higher P/E can indicate high expected growth or market optimism, but it could also mean the stock is overpriced relative to its earnings potential.

Compared to the JP Food industry average of 16.3x and its peer group average of 16.6x, NH Foods’ P/E of 21.9x looks expensive. However, our fair P/E ratio estimate is higher at 23.3x, suggesting the market could move toward this benchmark if growth expectations materialize.

Explore the SWS fair ratio for NH Foods

Result: Price-to-Earnings of 21.9x (OVERVALUED)

However, slowing revenue growth or a pullback in profit margins could quickly challenge the bullish outlook that is currently priced into NH Foods’ shares.

Find out about the key risks to this NH Foods narrative.

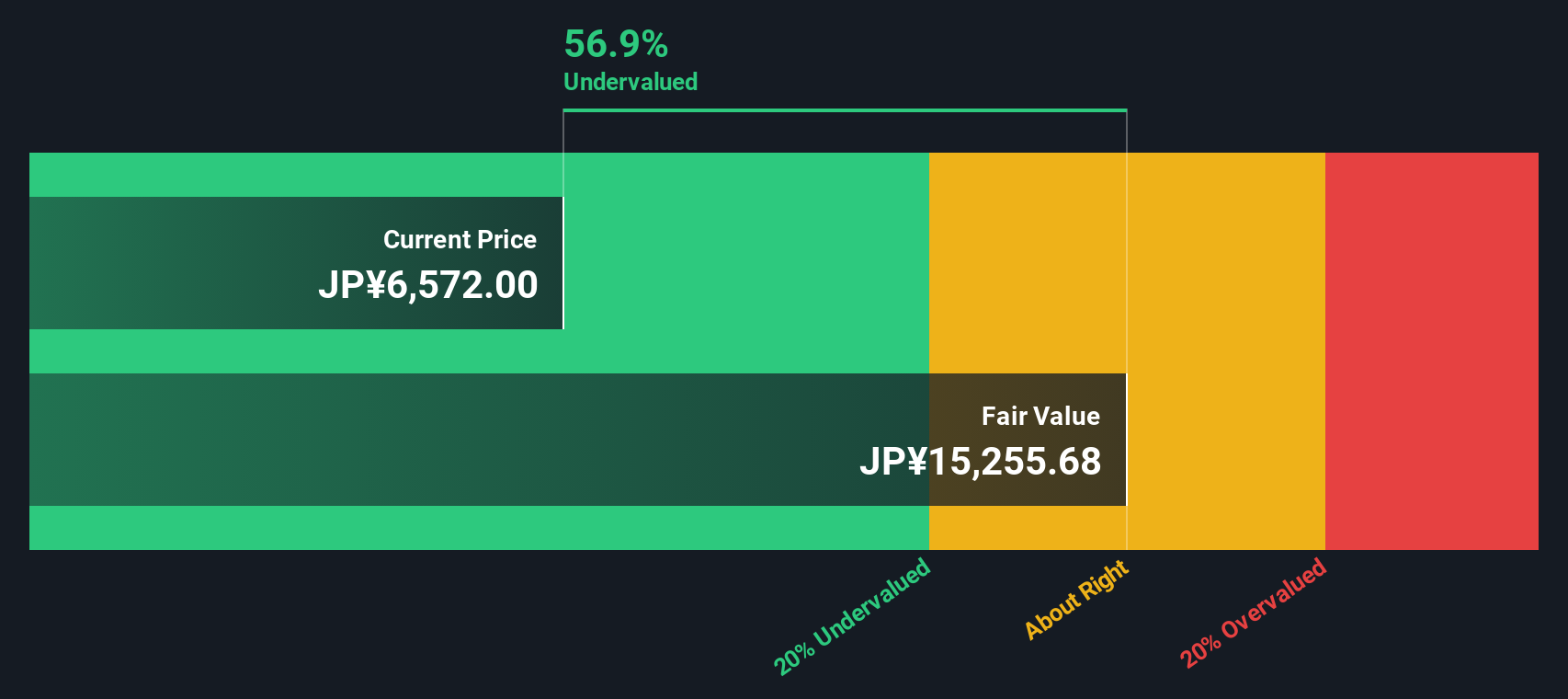

Another View: Discounted Cash Flow Sheds a Different Light

While NH Foods appears expensive when judged by earnings multiples, our DCF model offers a notably different perspective. By estimating future cash flows, it suggests the stock could be trading at a substantial discount to intrinsic value. Is the market overlooking hidden growth, or are investors exercising excessive caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NH Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 854 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NH Foods Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily create your own narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding NH Foods.

Ready to Maximize Your Investing Journey?

Seize the momentum and hunt for standout opportunities beyond NH Foods. Use the Simply Wall St Screener to get ahead of the curve, spot tomorrow’s trends, and make confident moves while others watch and wait.

- Supercharge your returns with these 21 dividend stocks with yields > 3%, offering yields above 3% to boost your income portfolio with stable, high-payout stocks.

- Catalyze your growth strategy by tapping into these 26 AI penny stocks, featuring innovative companies shaping artificial intelligence breakthroughs.

- Outpace the market with these 854 undervalued stocks based on cash flows to find solid businesses trading below their intrinsic cash flow value before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2282

NH Foods

Engages in manufacturing and selling ham, sausage, processed food, meat, and dairy product in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives