Is There Room for Further Gains in Yamazaki Baking After 22% Jump in 2024?

Reviewed by Simply Wall St

Thinking about what to do with your Yamazaki Baking shares? You are not alone. With the stock up 22.1% in the past year and an impressive 115.4% gain over three years, investors are understandably curious about whether there is more room to rise, or if recent price strength is running out of steam. After all, the stock's seven-day dip of -0.8% and a slightly negative return in the past month might point to some cautious re-evaluation in the market. However, if you zoom out, Yamazaki Baking’s 14.9% year-to-date move and 94.5% return over five years are notable.

Much of this renewed attention traces back to broader shifts in Japan's consumer sector, as investors look for steady growth outside tech and energy. Yamazaki, with its established brand and consistent sales, tends to attract buyers when risk appetite shifts toward defensive names. The question remains whether the company is undervalued after this rally, or if the recent run-up has pushed the price too high.

At this point, the numbers start to matter. Looking at six key valuation checks, Yamazaki Baking passes three, giving it a value score of 3 out of 6. This is neither a compelling bargain nor a clear case of overvaluation, and suggests a need for further research.

Next, we will examine the different valuation approaches and look at exactly where Yamazaki stands out, and where there may be concerns. If you are aiming to get ahead of other investors, stay tuned for a different way to think about valuation that could provide additional insight.

Yamazaki Baking delivered 22.1% returns over the last year. See how this stacks up to the rest of the Food industry.Approach 1: Yamazaki Baking Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to their present value. This approach helps investors assess whether a stock’s price accurately reflects its anticipated performance.

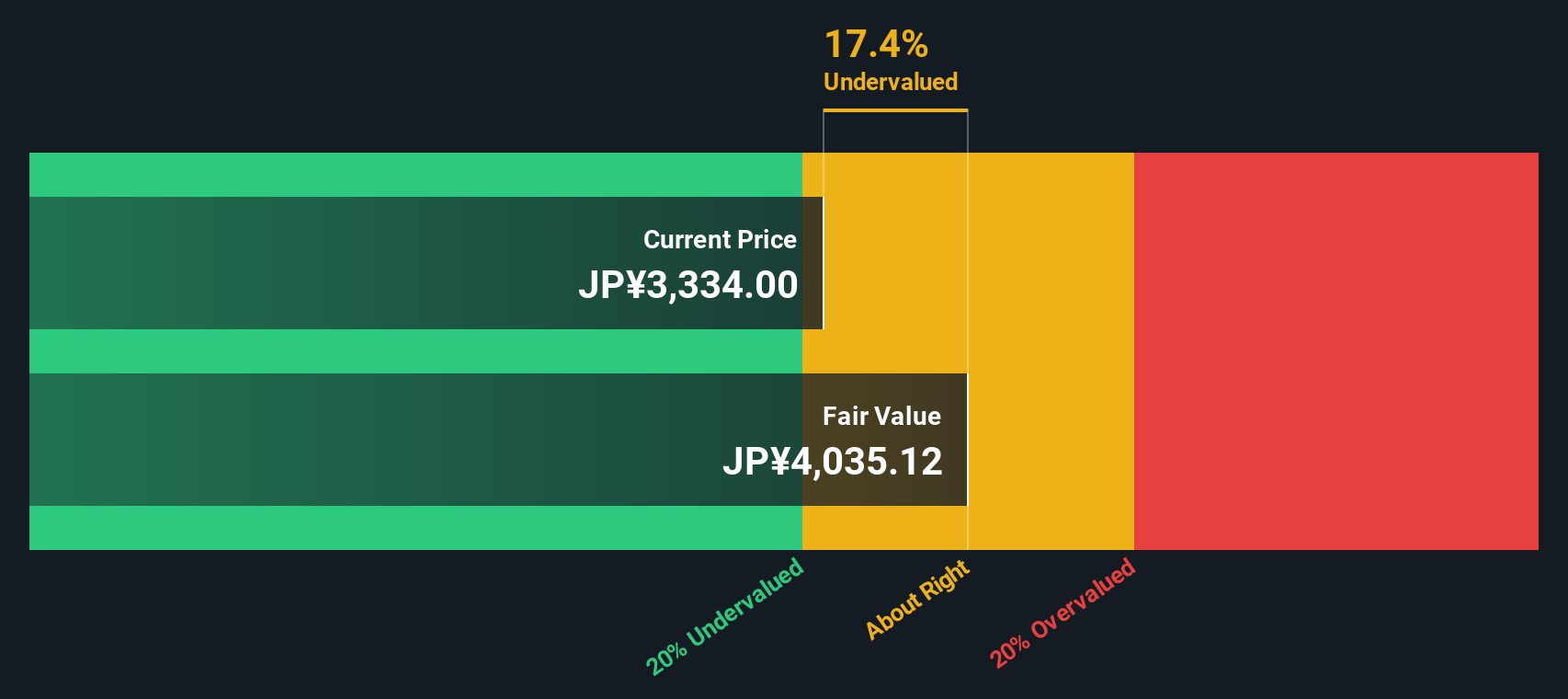

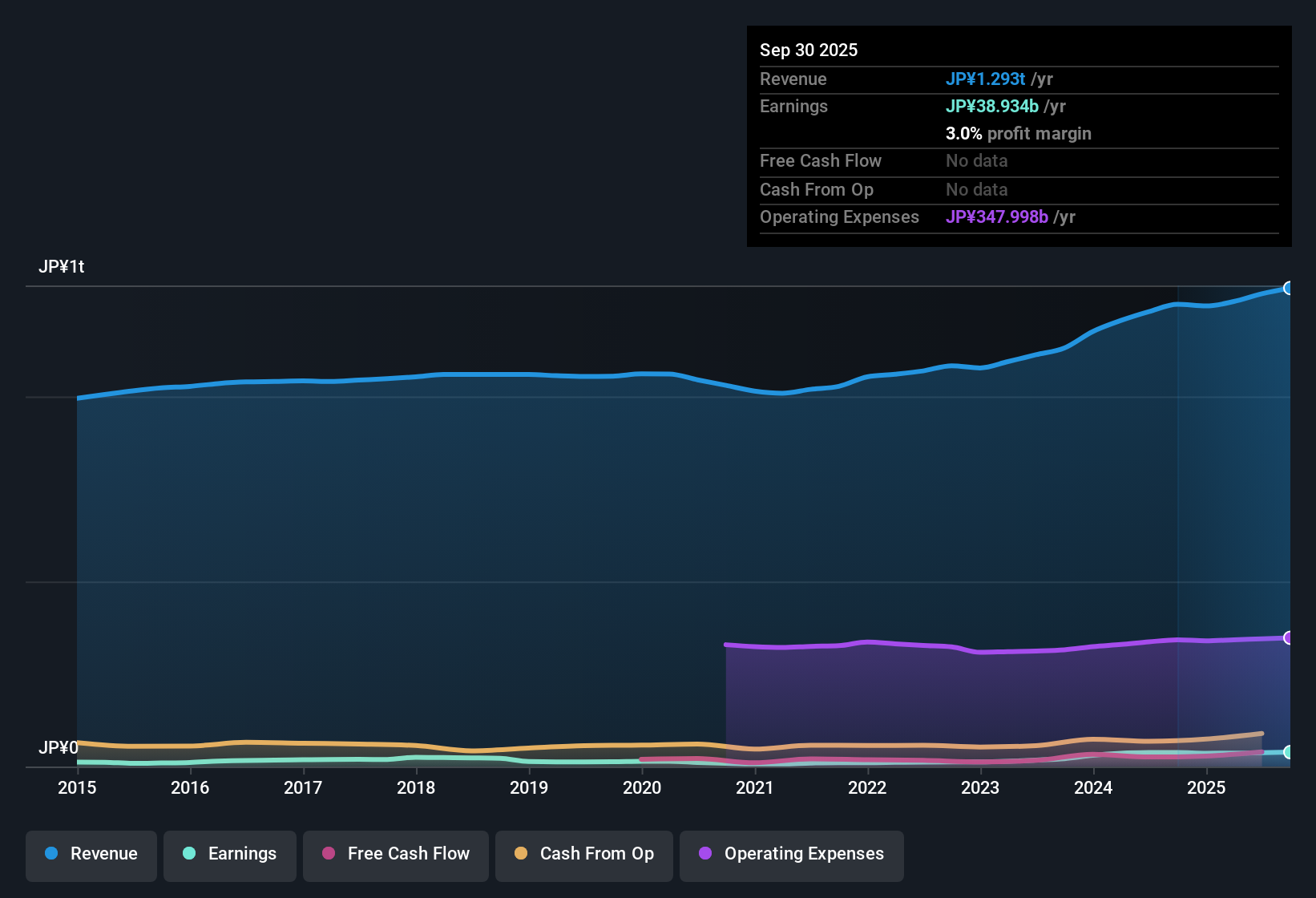

For Yamazaki Baking, the latest reported Free Cash Flow (FCF) is ¥42.6 billion. Analyst forecasts project annual FCF to range between ¥34.6 billion and ¥45.9 billion over the next decade, with much of the long-term outlook extrapolated beyond the first five years. These projections incorporate analyst estimates for the near term and model-based growth rates for the period from 2029 onwards. All cash flow figures are reported in Japanese yen (¥).

Based on the DCF methodology, the estimated intrinsic value of Yamazaki’s shares is ¥4,035. This represents a 17.1% discount compared to the current market price, suggesting that the stock is underappreciated by the market at this time.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Yamazaki Baking.

Approach 2: Yamazaki Baking Price vs Earnings

The price-to-earnings (PE) ratio is widely used to value profitable companies like Yamazaki Baking because it reflects what investors are willing to pay today for future earnings. A higher PE can indicate expectations for stronger earnings growth, while a lower PE often signals either muted growth prospects or perceived risks. The "normal" or "fair" PE for any stock is set by balancing growth potential, profitability, and risk in the context of the wider market.

Yamazaki Baking currently trades at a PE ratio of 17.7x. This is slightly above the food industry average of 16.9x, but a bit below the peer average of 18.8x. This suggests that the market views Yamazaki as relatively stable, but not pricing in outsized growth compared to its closest competitors.

To give a more tailored picture, Simply Wall St’s proprietary Fair Ratio provides a benchmark PE of 20.3x for Yamazaki Baking. This benchmark accounts not just for industry comparisons, but also factors like the company’s earnings growth, margins, risk profile, and market cap. Unlike a simple peer or industry comparison, the Fair Ratio adjusts for what makes Yamazaki unique. This aims for a more accurate sense of value in this context.

With the current PE ratio just 2.6 points below the Fair Ratio, the difference is meaningful. This suggests Yamazaki Baking’s shares are somewhat undervalued relative to their fundamental prospects and industry position.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Yamazaki Baking Narrative

Earlier, we alluded to a smarter way to think about valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you define your own story for a company, linking your assumptions about Yamazaki Baking’s future revenue, earnings, and profit margins directly to a fair value estimate.

Instead of relying only on traditional models, Narratives turn your perspective into numbers by connecting the company’s story to a dynamic financial forecast and an updated fair value. On Simply Wall St’s platform, millions of investors use Narratives within the Community page to easily create and compare different investment viewpoints.

With this approach, you can see at a glance if it is time to buy or sell by comparing your Narrative’s fair value to the current price. Narratives update automatically as new information emerges, such as news or quarterly results. For example, one investor might set a bold growth Narrative for Yamazaki Baking, seeing the fair value much higher than today’s price, while another takes a cautious view leading to a lower estimate. Building and comparing Narratives empowers you to make truly informed investment decisions with clarity and confidence.

Do you think there's more to the story for Yamazaki Baking? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2212

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives