Bourbon (TSE:2208) Margin Gains Bolster Bullish Narratives as Profit Growth Accelerates

Reviewed by Simply Wall St

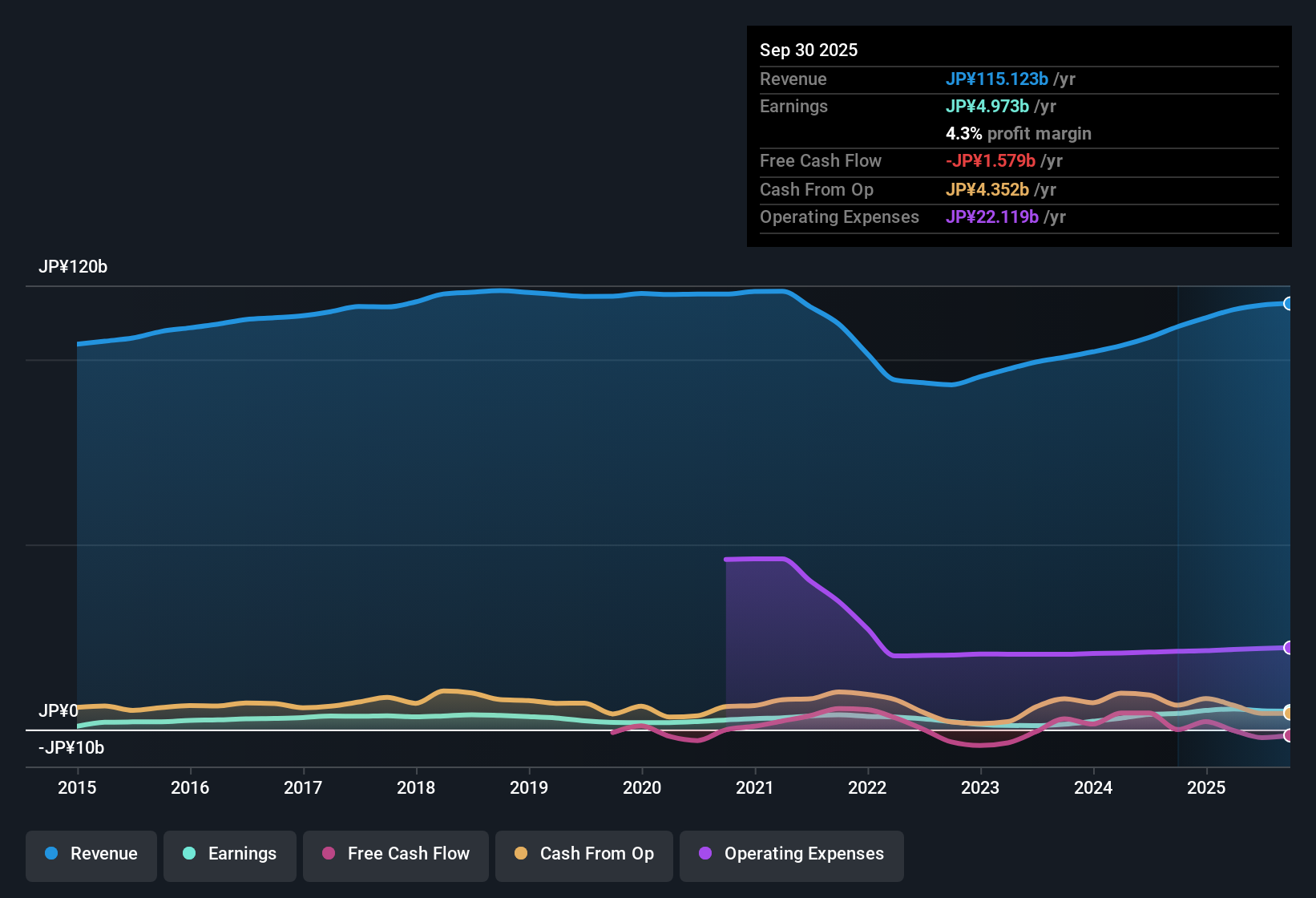

Bourbon (TSE:2208) delivered an 11.6% annual growth in earnings over the past five years, with the latest year seeing that pace accelerate to 14.7%. Net profit margins improved from 4% to 4.3%. The company’s high quality earnings and efficient operations give investors confidence about continued improvements in profitability and earnings quality.

See our full analysis for Bourbon.Next, we will see how these headline results compare to the broader market narratives and what they mean for Bourbon’s outlook.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher to 4.3%

- Net profit margins climbed from 4% to 4.3% over the past year, reflecting a meaningful strengthening in how efficiently Bourbon converts its sales into bottom-line gains.

- Stronger profitability heavily supports the bullish case that Bourbon is benefitting from operational improvements and quality earnings.

- Bulls point to consecutive years of improved margins as evidence that management's focus on efficiency is working.

- These margin gains address concerns about stagnant or declining profitability, giving investors renewed optimism about continued future growth.

Trading at 11.8x Earnings, a Sector Discount

- Bourbon’s price-to-earnings ratio of 11.8x stands well below both the Japanese food industry average (16.3x) and peer group (17.8x). This positions the company as a relative value play for investors seeking quality at a lower price.

- This deep discount versus sector multiples adds weight to arguments that the stock is underappreciated compared to its peers.

- Market skeptics may argue that the lower multiple reflects perceived risks or a lack of high-growth potential.

- Sustained margin improvements and stronger profit growth challenge that caution, suggesting current multiples could be conservative if positive trends continue.

Improving Profit Trend Shows No New Risks

- Earnings have accelerated to a 14.7% growth rate in the latest year, with no new risk signals identified in published data.

- This trend fits a prevailing market view that ongoing profit and revenue growth, paired with few flagged risks, can reinforce investor confidence in Bourbon’s overall outlook.

- Those watching for warning signs may be reassured by the absence of newly reported risks even as profit growth speeds up.

- However, steady performance and risk control do not guarantee future results in a competitive food sector, so the market may wait to see if these gains are sustained over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bourbon's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bourbon’s consistent earnings growth and sector discount are balanced by lingering concerns over its ability to consistently outperform peers in a competitive market.

If you value stable results and want assurance of dependable long-term performance, target stable growth stocks screener (2101 results) for companies with a proven track record of steady growth across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bourbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2208

Bourbon

Manufactures and sells confectionery, beverages, food, frozen desserts, and other products in Japan.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives