As Japan's stock markets face significant volatility, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down 6.0%, investors are increasingly looking for resilient opportunities amidst the turbulence. Despite these challenges, there remain promising small-cap stocks that exhibit strong fundamentals and growth potential. In this article, we explore three undiscovered gems in Japan's market that stand out for their solid financial health and strategic positioning in key industries.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| AOKI Holdings | 31.03% | -0.48% | 28.75% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 130.22% | 1.61% | -0.98% | ★★★★★☆ |

| Cresco | 8.62% | 7.79% | 9.50% | ★★★★★☆ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| Toho Bank | 96.49% | -0.88% | 18.78% | ★★★★☆☆ |

| Yukiguni Maitake | 158.67% | -5.22% | -32.27% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yukiguni Maitake (TSE:1375)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yukiguni Maitake Co., Ltd., along with its subsidiaries, specializes in the production and sale of mushrooms and other processed foods in Japan, with a market cap of ¥36.66 billion.

Operations: Yukiguni Maitake generates its revenue primarily from the sale of mushrooms, accounting for ¥33.13 billion, with additional income from other processed foods totaling ¥310 million.

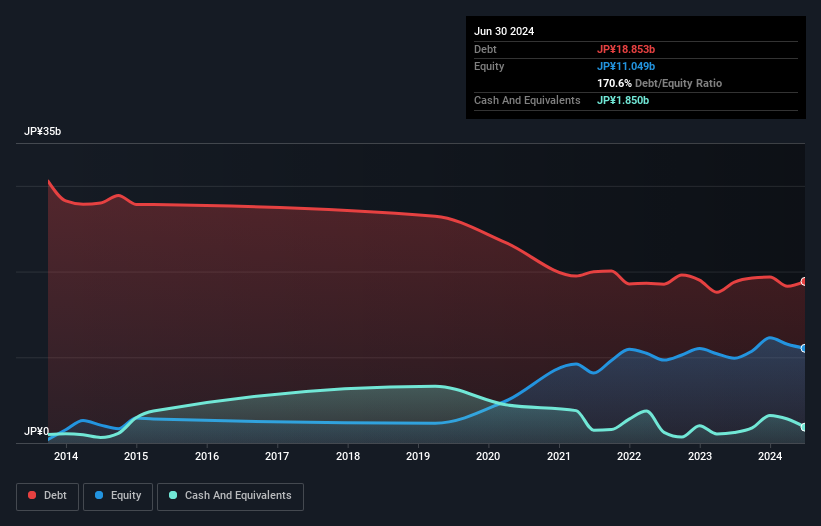

Yukiguni Maitake, a small cap in Japan's food industry, has seen its earnings decline by 32.3% annually over the past five years. Despite this, the company repurchased shares recently and trades at 65.7% below estimated fair value. Its net debt to equity ratio stands at 134.4%, considered high but improved from 1144.9% five years ago. Recent board meetings discussed personnel changes and amendments to the Articles of Incorporation, signaling strategic shifts ahead for Yukiguni Maitake.

- Click here and access our complete health analysis report to understand the dynamics of Yukiguni Maitake.

Gain insights into Yukiguni Maitake's past trends and performance with our Past report.

Maruzen (TSE:5982)

Simply Wall St Value Rating: ★★★★★★

Overview: Maruzen Co., Ltd. specializes in the manufacture and sale of commercial kitchen equipment, with a market cap of ¥46.26 billion.

Operations: The company generates revenue primarily from the manufacture and sale of commercial kitchen equipment. With a market cap of ¥46.26 billion, its financial performance is driven by this core business segment.

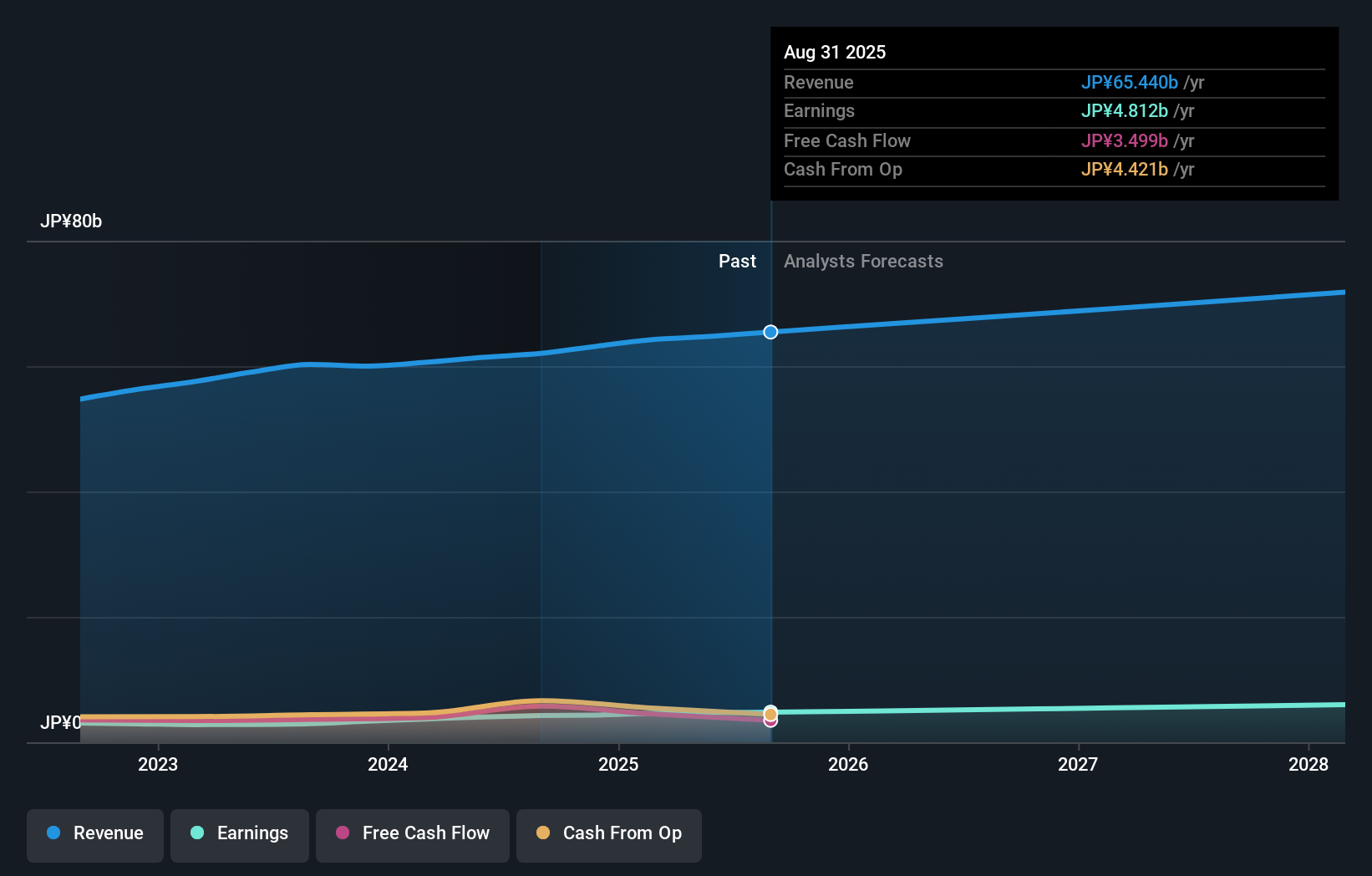

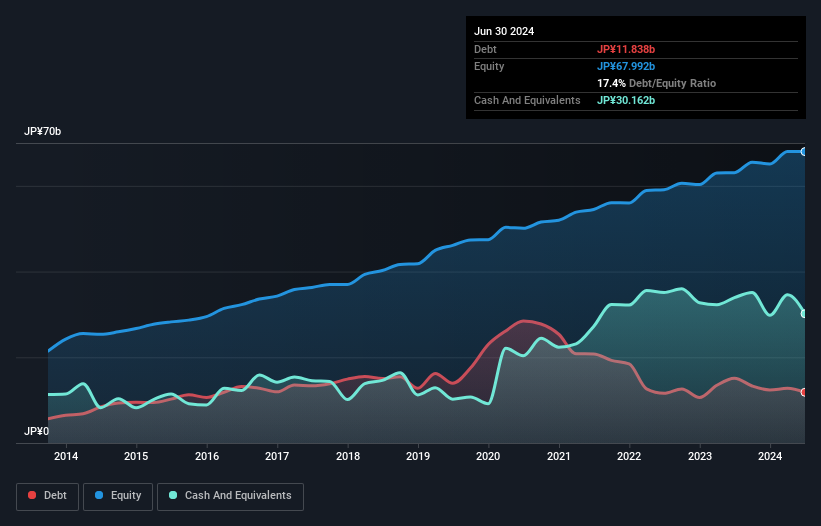

Maruzen, a small-cap gem in Japan, is trading at 48.1% below its estimated fair value and has no debt compared to five years ago when its debt-to-equity ratio was 1.4%. The company reported a robust earnings growth of 42.5% over the past year, outpacing the Machinery industry’s 17.3%. With high-quality earnings and free cash flow positive status, Maruzen's profitability suggests strong future prospects. Earnings are forecasted to grow at an annual rate of 6.47%.

- Delve into the full analysis health report here for a deeper understanding of Maruzen.

Examine Maruzen's past performance report to understand how it has performed in the past.

FJ Next Holdings (TSE:8935)

Simply Wall St Value Rating: ★★★★★★

Overview: FJ NEXT Holdings Co., Ltd. is involved in the planning, development, sale, and brokerage of real estate properties in Japan with a market cap of ¥38.08 billion.

Operations: FJ NEXT Holdings generates revenue primarily through the planning, development, sale, and brokerage of real estate properties in Japan. The company has a market cap of ¥38.08 billion.

FJ Next Holdings, a promising player in Japan's real estate sector, trades at 40.8% below its estimated fair value. Over the past year, earnings grew by 18.3%, outpacing the Consumer Durables industry's -2.6%. The company's debt to equity ratio improved from 30.2% to 17.4% over five years, and interest payments are well covered with EBIT at 254x coverage. For FY2025, FJ Next forecasts net sales of ¥103 billion and net income of ¥5 billion (¥152 per share).

Make It Happen

- Investigate our full lineup of 696 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5982

Maruzen

Engages in the manufacture and sale of commercial kitchen equipment.

Flawless balance sheet with solid track record and pays a dividend.