Could Nissui’s (TSE:1332) Streamlined Operations Mark a Shift in Its Competitive Strategy?

Reviewed by Sasha Jovanovic

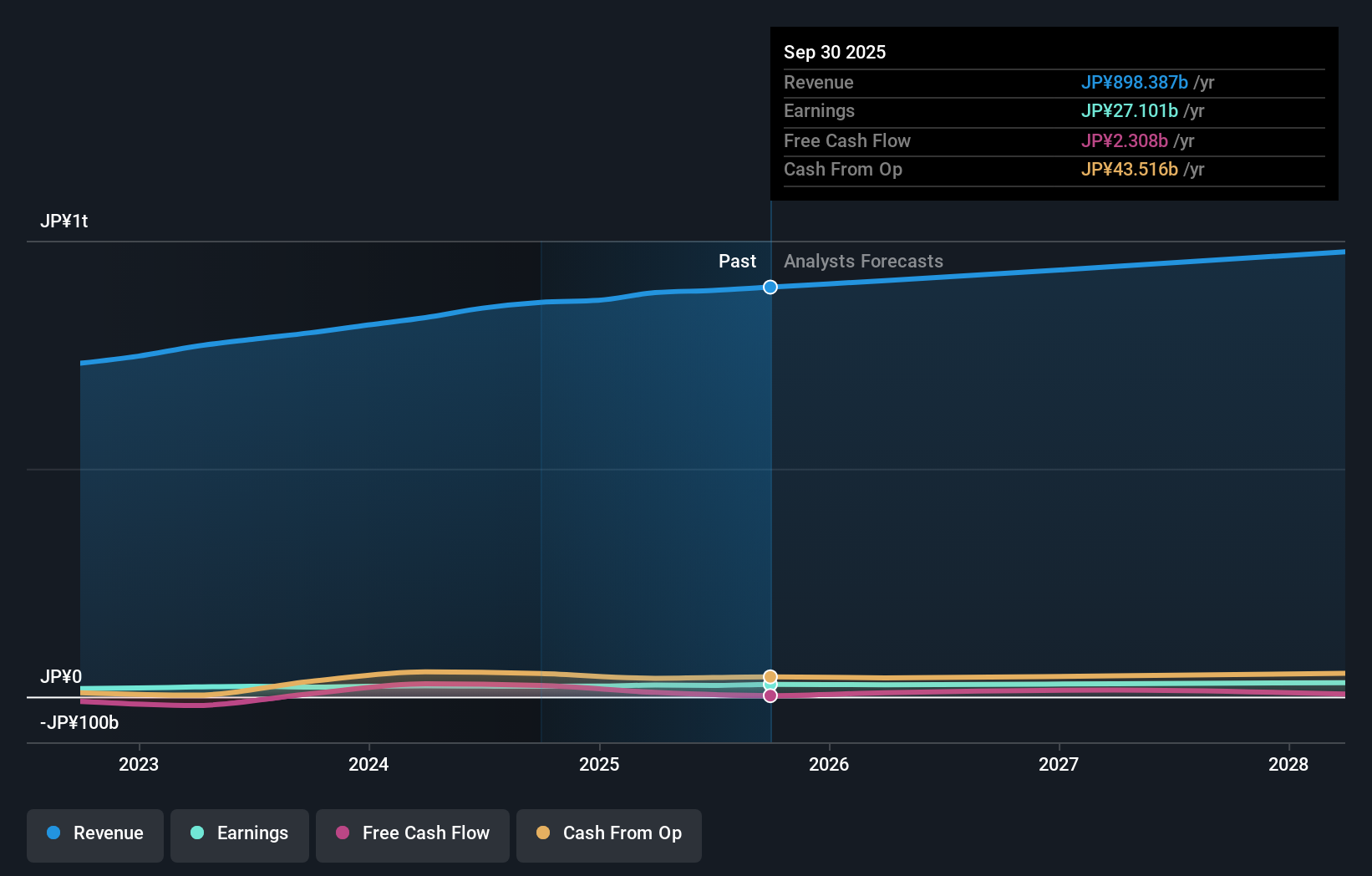

- Nissui Corporation reported its consolidated financial results for the six months ended September 30, 2025, with net sales increasing by 2.8% and operating profit rising by 14.6%, reflecting improved operational efficiency.

- The removal of Seinan Suisan Co., Ltd. from the consolidation scope signals a significant structural shift that could influence Nissui’s future operations.

- We'll explore how operational efficiency improvements may shape perceptions of Nissui’s investment outlook going forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Nissui's Investment Narrative?

The big picture for Nissui shareholders hinges on steady revenue growth, operational improvement, and maintaining competitive value in a slower-growing sector. The latest half-year results, showing an uptick in both net sales and operating profit, add weight to the idea that management’s focus on efficiency is translating into stronger margins. The decision to remove Seinan Suisan from consolidation is significant but doesn’t appear, based on recent market moves, to have had a major impact on short term catalysts like profit forecasts or guidance. Key levers now revolve around execution under the new CEO and the upcoming reinvestment of buyback cash, while risks remain from relatively low returns on equity and a board that is still bedding in. Short-term, Nissui’s story is more about disciplined operations than rapid expansion or major structural shifts.

However, fewer seasoned directors could raise questions about board stability, something investors should stay alert to.

Exploring Other Perspectives

Explore another fair value estimate on Nissui - why the stock might be worth 29% less than the current price!

Build Your Own Nissui Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nissui research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nissui research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nissui's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissui might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1332

Nissui

Engages in marine, food products, fine chemicals, distribution, and marine-related/engineering businesses in Japan and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives