- Japan

- /

- Capital Markets

- /

- TSE:8698

Is Monex Group’s (TSE:8698) Dividend Hike a Sign of Strength or Strategic Caution?

Reviewed by Sasha Jovanovic

- Monex Group recently announced its second quarter financial results for the fiscal year ending March 31, 2026, and raised its interim dividend forecast from 15.20 yen to 15.30 yen per share.

- This move highlights the company's commitment to balancing shareholder returns and growth initiatives as it pursues a 15% return on equity.

- We'll explore how the increased dividend forecast helps shape Monex Group's investment narrative around stakeholder value and growth focus.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Monex Group's Investment Narrative?

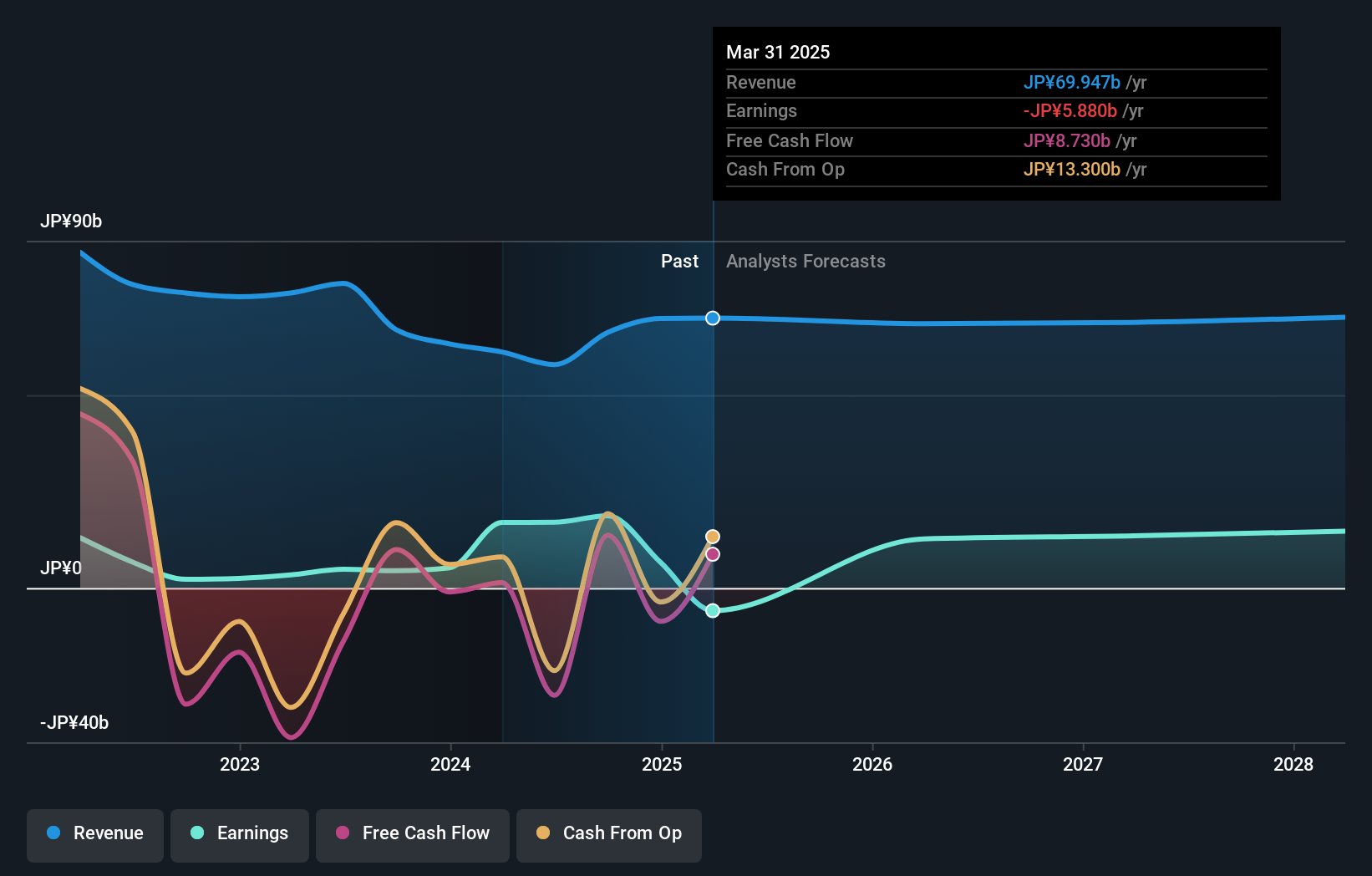

To make sense of Monex Group's investment case, you'd need to see both a near-term turnaround in profitability and a strategic path to sustainable growth. The company’s slight bump in its interim dividend comes as it continues prioritizing shareholder returns, despite being unprofitable and facing revenue decline. While the raised dividend signals confidence in management’s own forecasts and a desire to reassure investors, this change is minor and does little to erase the more pressing risks: volatile earnings, challenging sector conditions, and questions about how future web3 product launches will translate to stable financials. Analyst price targets show only a modest upside from current levels, suggesting the market remains cautious. So, while the dividend tweak fits with Monex Group's ambition for better stakeholder value, it does not shift the big picture catalysts or risks in a significant way.

In contrast, it’s important to recognize the continued pressure from persistent revenue declines that investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Monex Group - why the stock might be worth just ¥885!

Build Your Own Monex Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monex Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Monex Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monex Group's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8698

Monex Group

An online financial institution, provides retail online brokerage services.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives