- Japan

- /

- Capital Markets

- /

- TSE:8628

Matsui Securities (TSE:8628): Assessing Valuation After Dividend Increase and Ahead of Q2 2026 Earnings Call

Reviewed by Simply Wall St

Matsui Securities (TSE:8628) has just announced a higher interim dividend, increasing it to JPY 25.00 per share for the second quarter. This is up from JPY 22.00 a year earlier. This move comes ahead of the company’s Q2 2026 earnings call, scheduled for October 29, 2025.

See our latest analysis for Matsui Securities.

The recent bump in Matsui Securities’ dividend seems to have caught some positive attention, with the share price gaining 3.3% over the past 90 days, even as the year-to-date price return remains negative. Despite these short-term moves, the stock’s total shareholder return shows a modest decline of 1.8% over the past year. Gains stretch to nearly 15% across both three and five years, suggesting the longer-term picture remains resilient.

If this momentum has you interested in spotting more ideas, now’s the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With a stronger dividend and a recent uptick in share price, is Matsui Securities now trading below its true worth, or has the market already reflected further growth expectations in its valuation?

Price-to-Earnings of 18.4x: Is it justified?

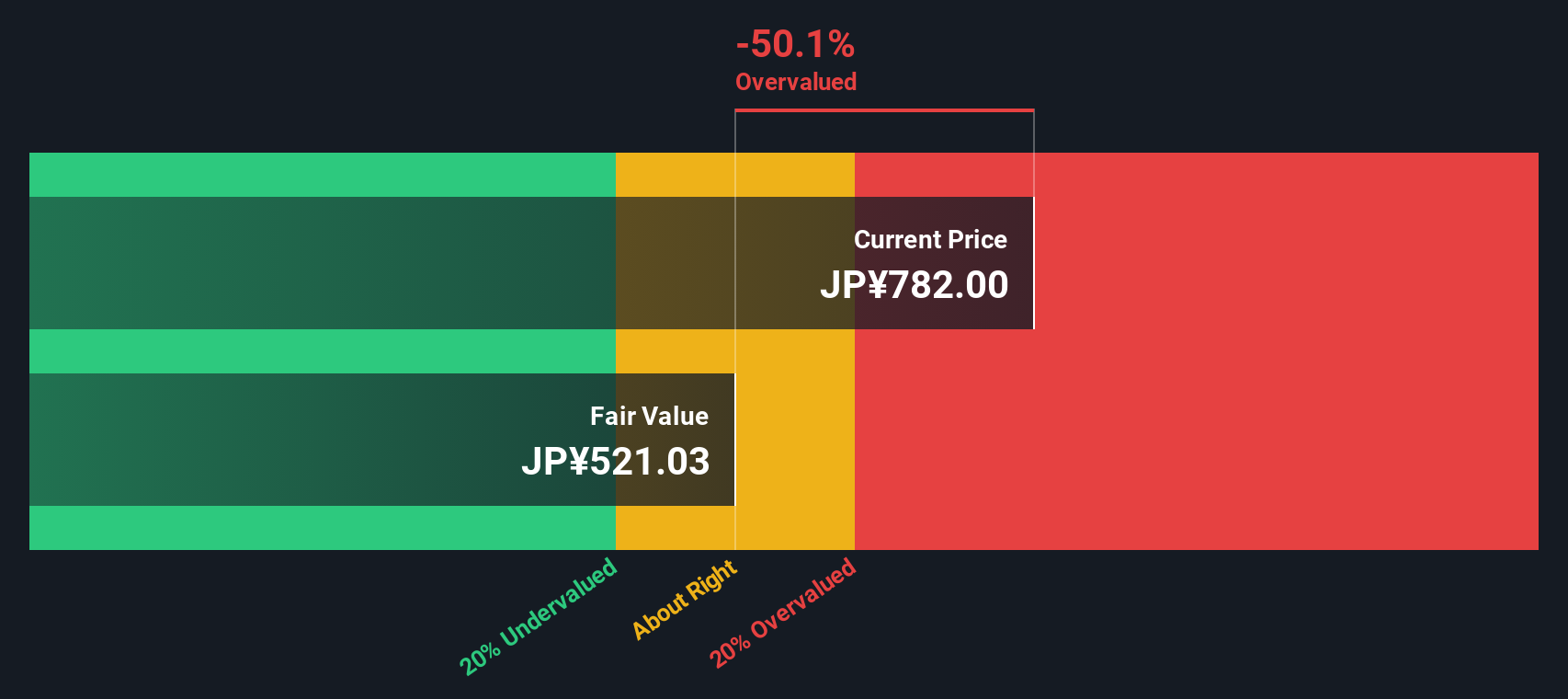

Matsui Securities currently trades on a price-to-earnings (P/E) ratio of 18.4x, which is notably higher than both its industry peers and the level statistical models suggest is fair. With the last close at ¥782, the stock appears to be valued at a premium relative to the broader capital markets group.

The P/E ratio measures the price investors are willing to pay for each yen of earnings, providing an instant snapshot of market expectations for future profitability. In capital markets, it is particularly relevant, as earnings exposure and growth rates can influence valuations more than in stable sectors.

The P/E of 18.4x stands out compared to the industry average of 14x. Additionally, regression models suggest a fair P/E should be about 12.6x, highlighting the idea that Matsui Securities may need to deliver significant outperformance to justify such a premium. Without profit expansion or a sector re-rating, this valuation leaves little margin for error.

Explore the SWS fair ratio for Matsui Securities

Result: Price-to-Earnings of 18.4x (OVERVALUED)

However, slower revenue or net income growth than expected could quickly challenge the stock's premium valuation, especially if sector sentiment shifts.

Find out about the key risks to this Matsui Securities narrative.

Another View: Discounted Cash Flow Model

Looking from a different angle, our SWS DCF model estimates Matsui Securities’ fair value at ¥522.15 per share. This is quite a gap from the market price of ¥782, suggesting the stock may be overvalued versus its underlying cash flows. Could the current optimism be overstating the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Matsui Securities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Matsui Securities Narrative

If you have a different perspective or want to dig deeper, you can shape your own insights and see how your view compares. Do it your way

A great starting point for your Matsui Securities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Amplify your portfolio with strategies tailored to sectors on the brink of transformation, using key screens that spotlight unique winners and emerging trends.

- Capitalize on high-potential, undervalued businesses by seizing the opportunity with these 870 undervalued stocks based on cash flows before the rest of the market catches on.

- Access stable income streams by checking out these 16 dividend stocks with yields > 3%, which offers yields above 3% and a track record of rewarding shareholders.

- Ride the momentum of technological disruption when you get in early with these 24 AI penny stocks, which pushes boundaries in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8628

Matsui Securities

Provides online securities brokerage services to retail investors in Japan.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives