- Japan

- /

- Consumer Finance

- /

- TSE:8584

JACCS’ Dividend Steadiness Amid Profit Pressures: What Does It Reveal About Capital Priorities (TSE:8584)?

Reviewed by Sasha Jovanovic

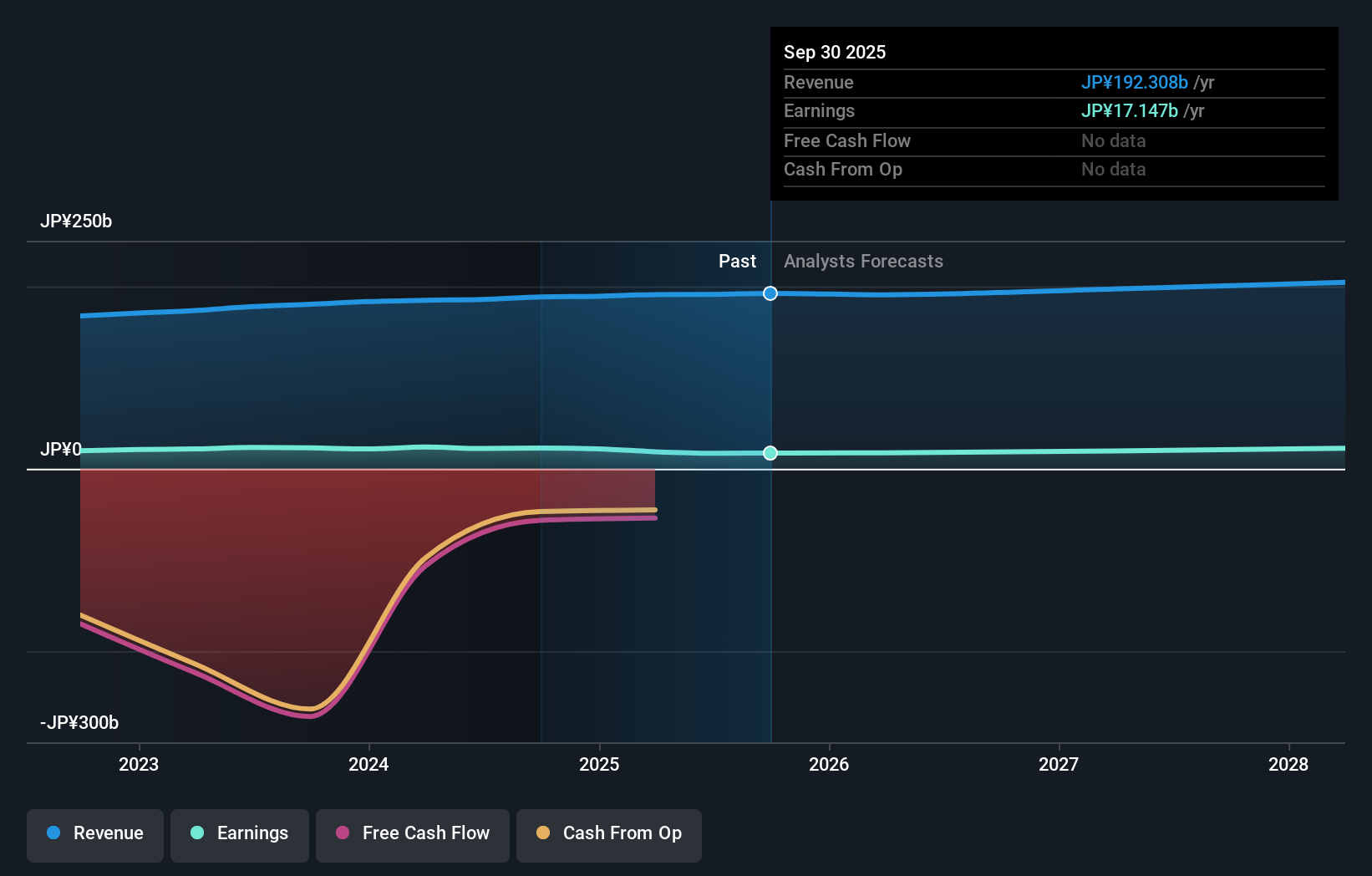

- JACCS Co., Ltd. recently reported a 1.4% increase in operating revenues for the six months ended September 30, 2025, while noting declines in several profit metrics but improved its equity-to-asset ratio and maintained a dividend forecast of 200 yen per share for the fiscal year ending March 2026.

- The company outperformed its earlier financial forecasts thanks to a faster-than-expected domestic credit market recovery and lower financial expenses influenced by stable policy interest rates.

- We'll explore how the swift rebound in JACCS's domestic credit market share affects its broader investment narrative amid changing sector dynamics.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is JACCS' Investment Narrative?

For anyone looking at JACCS as a potential investment, the central story hinges on the company’s ability to adapt to shifting patterns in the domestic credit market while keeping its financial footing steady. The recent earnings report, showing modest revenue growth but declines in profit, throws a spotlight on cost pressures and the challenge of maintaining profitability. Yet, the better-than-expected performance, driven by a swifter rebound in credit business share and lower financial expenses, suggests the company is performing well against immediate industry headwinds. This also means that some of the previous risk concerns, such as waning domestic demand or sharply rising funding costs, may be less pressing in the short term. However, with profit guidance unchanged and management citing potential headwinds from higher expenses and overseas results, the path ahead is not without hurdles. On the flip side, future increases in domestic expenses remain a key risk investors should watch for.

Despite retreating, JACCS' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on JACCS - why the stock might be worth just ¥9551!

Build Your Own JACCS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JACCS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free JACCS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JACCS' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8584

JACCS

Operates as a consumer finance company in Japan and internationally.

Undervalued average dividend payer.

Market Insights

Community Narratives