- Japan

- /

- Capital Markets

- /

- TSE:8473

SBI Holdings (TSE:8473) Forms AI Semiconductor Alliance with Preferred Networks to Enhance Growth

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of SBI Holdings stock here.

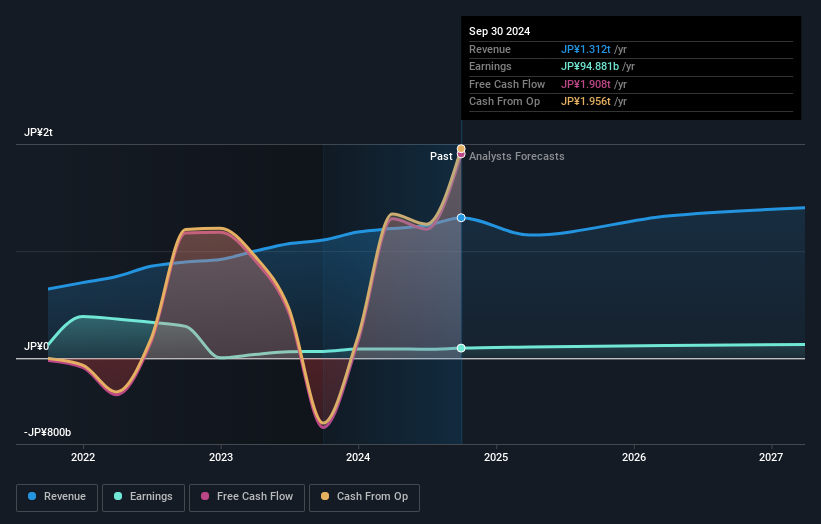

Core Advantages Driving Sustained Success for SBI Holdings

The impressive earnings growth of 36.1% over the past year highlights SBI Holdings' financial health. This growth is further supported by a forecasted earnings increase of 15.1% annually, surpassing the JP market average of 8.9%. The company's strategic alliance with Preferred Networks to develop AI semiconductors positions it well within the burgeoning tech sector. Moreover, trading at 41% below its estimated fair value of ¥5715.16, the stock appears undervalued, offering potential investment appeal. The experienced board of directors, with an average tenure of 7.9 years, provides stability and strategic insight, enhancing SBI's market positioning.

To dive deeper into how SBI Holdings's valuation metrics are shaping its market position, check out our detailed analysis of SBI Holdings's Valuation.Critical Issues Affecting the Performance of SBI Holdings and Areas for Growth

Despite strong earnings, the company's Return on Equity (ROE) at 6.3% remains below the industry threshold of 20%, indicating room for improvement in asset utilization. Additionally, the revenue growth forecast of 4.5% per year, although slightly above the JP market average, is modest compared to industry leaders. The dilution of shareholder value, with a 10% increase in shares outstanding, further complicates investor sentiment. Volatile dividend payments over the past decade may also deter income-focused investors, highlighting areas for financial restructuring.

Learn about SBI Holdings's dividend strategy and how it impacts shareholder returns and financial stability.Emerging Markets Or Trends for SBI Holdings

The strategic partnership with Preferred Networks presents significant opportunities for market expansion, particularly in AI semiconductor development. This collaboration aligns with Japan's national strategy to enhance digital infrastructure, potentially boosting SBI's influence in the tech sector. Analysts predict a stock price target over 20% higher than the current level, suggesting substantial upside potential. Such alliances and market positioning could enable SBI to capitalize on emerging tech trends and strengthen its competitive edge.

See what the latest analyst reports say about SBI Holdings's future prospects and potential market movements.Regulatory Challenges Facing SBI Holdings

Economic headwinds and regulatory changes pose significant threats to SBI Holdings. The management's vigilance over economic indicators reflects concerns about potential impacts on consumer spending and sales. Regulatory developments could introduce operational challenges, requiring agility in compliance. Furthermore, ongoing supply chain disruptions necessitate strategic measures to ensure operational continuity, underscoring the need for proactive risk management to safeguard market share.

To gain deeper insights into SBI Holdings's historical performance, explore our detailed analysis of past performance.Conclusion

SBI Holdings demonstrates a strong financial trajectory with a significant earnings growth of 36.1% over the past year and an anticipated annual increase of 15.1%, which outpaces the JP market average. This positions the company for continued success, especially with its strategic partnership in AI semiconductor development aligning with national digital infrastructure goals. However, challenges such as a lower-than-industry ROE of 6.3% and shareholder dilution need addressing to enhance asset utilization and investor confidence. Despite these issues, the company's current trading price of ¥3370, significantly below its estimated fair value of ¥5715.16, suggests substantial upside potential, indicating that with strategic improvements, SBI Holdings could strengthen its market position and capitalize on emerging tech trends.

Turning Ideas Into Actions

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8473

Undervalued with solid track record and pays a dividend.