- Japan

- /

- Diversified Financial

- /

- TSE:8425

Is Mizuho Leasing Still an Opportunity After 23% Rally Ahead of 2025?

Reviewed by Simply Wall St

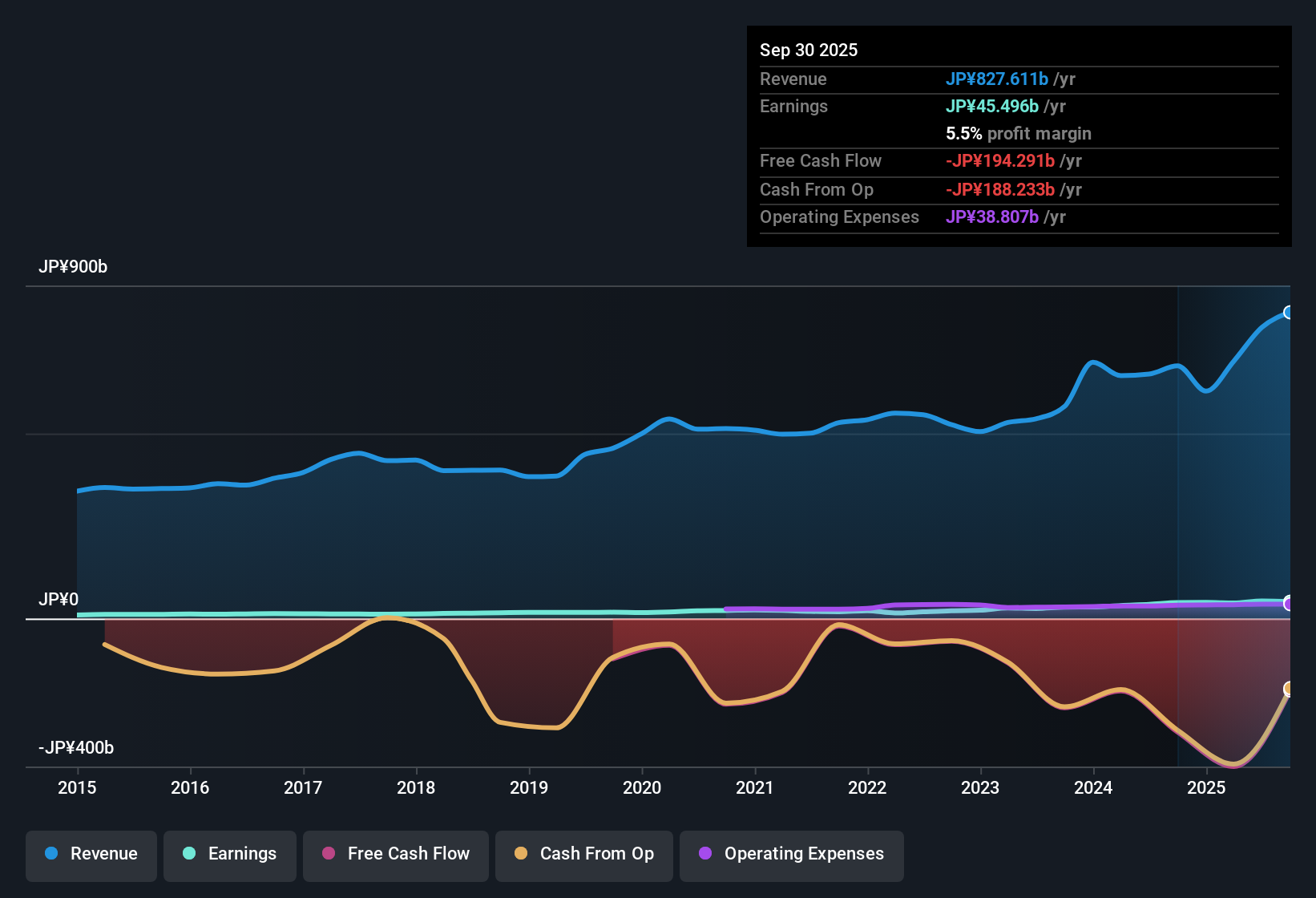

If you are weighing your next move with Mizuho Leasing Company stock, you are not alone. Investors have been watching this name closely, especially as its longer-term gains have started turning heads. Consider this: shares are up 33.1% over the last year, and the five-year return stands at a stunning 175.7%. Even after such impressive performance, the company has still managed a 1.6% climb over the past month, despite a slight dip of 1.0% this past week. Throughout the year, Mizuho Leasing has notched an eye-catching 23.1% gain.

What is driving this momentum? Beyond broad market optimism, recent sector trends have started to favor companies like Mizuho Leasing, fueling speculation about continued growth. While there have been some modest pauses in the rally, which is normal behavior after a strong run, the overall pattern suggests that investors are re-evaluating the company’s risk and growth prospects.

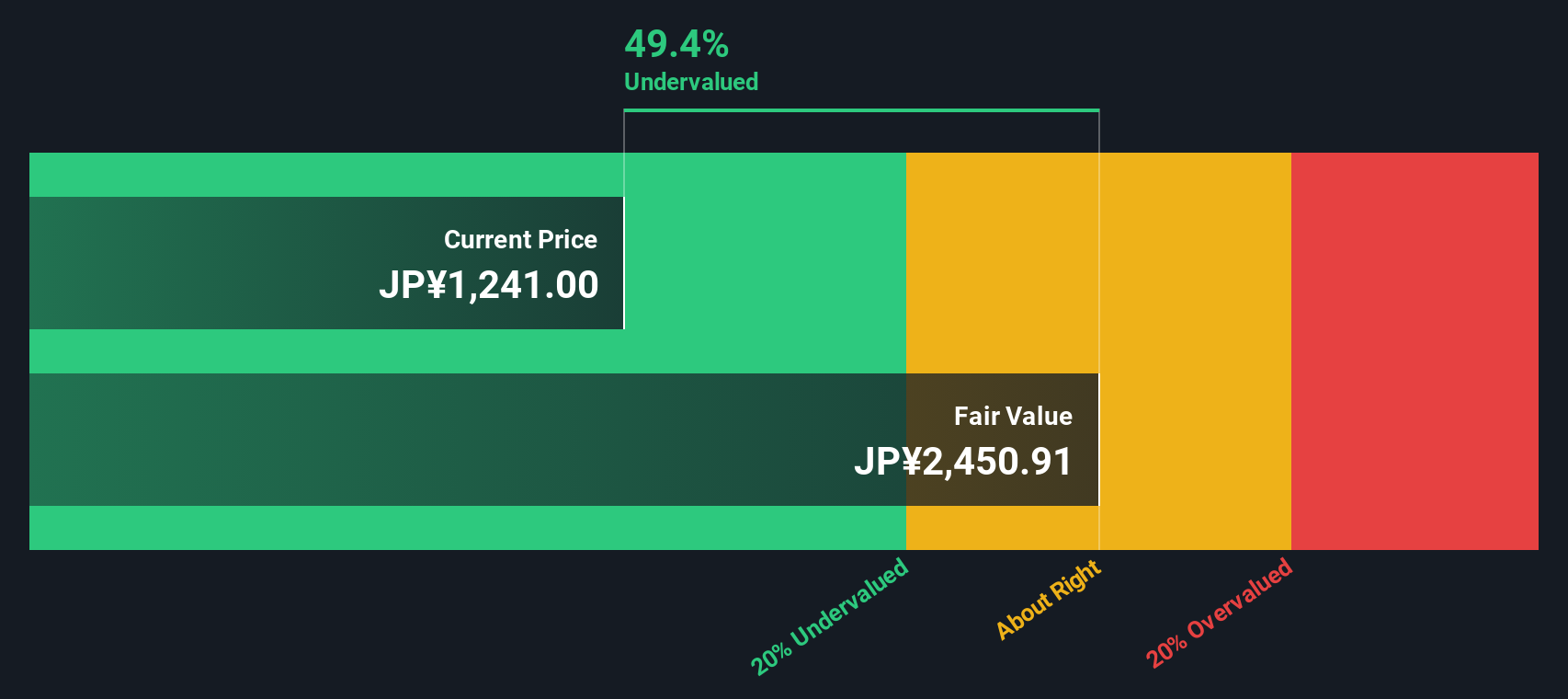

If you take a valuation-focused lens, Mizuho Leasing earns a value score of 4 out of 6, meaning it appears undervalued in four of the six checks commonly used by analysts. This positions it as a compelling candidate for those hunting for quality at a reasonable price.

Let’s break down these valuation benchmarks and see how Mizuho Leasing measures up to each. Plus, at the end of the piece, we will look at a smarter way to judge the company’s worth that many investors overlook.

Mizuho Leasing Company delivered 33.1% returns over the last year. See how this stacks up to the rest of the Diversified Financial industry.Approach 1: Mizuho Leasing Company Excess Returns Analysis

The Excess Returns model is designed to evaluate how much value a company is generating above its cost of equity. Essentially, it measures the profit a company creates from its investments after accounting for the minimum rate investors require for taking on risk. This model is particularly useful for financial businesses like Mizuho Leasing, as it shines a light on the efficiency of capital allocation and the strength of ongoing returns.

For Mizuho Leasing Company, the data tells an impressive story. The current book value for each share stands at ¥1,369.01, while its stable earnings per share reach ¥126.28, a figure based on the company’s median return on equity over the past five years. The cost of equity per share is ¥72.66, leaving an excess return of ¥53.62 for each share. The company's average return on equity, 10.20%, comfortably exceeds its cost threshold, with a stable book value per share of ¥1,237.97. This points to consistent profitability above what investors typically demand.

Based on this model, the estimated intrinsic value is about 41.8% higher than the current share price, meaning the stock is considered undervalued by a substantial margin.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Mizuho Leasing Company.

Approach 2: Mizuho Leasing Company Price vs Earnings

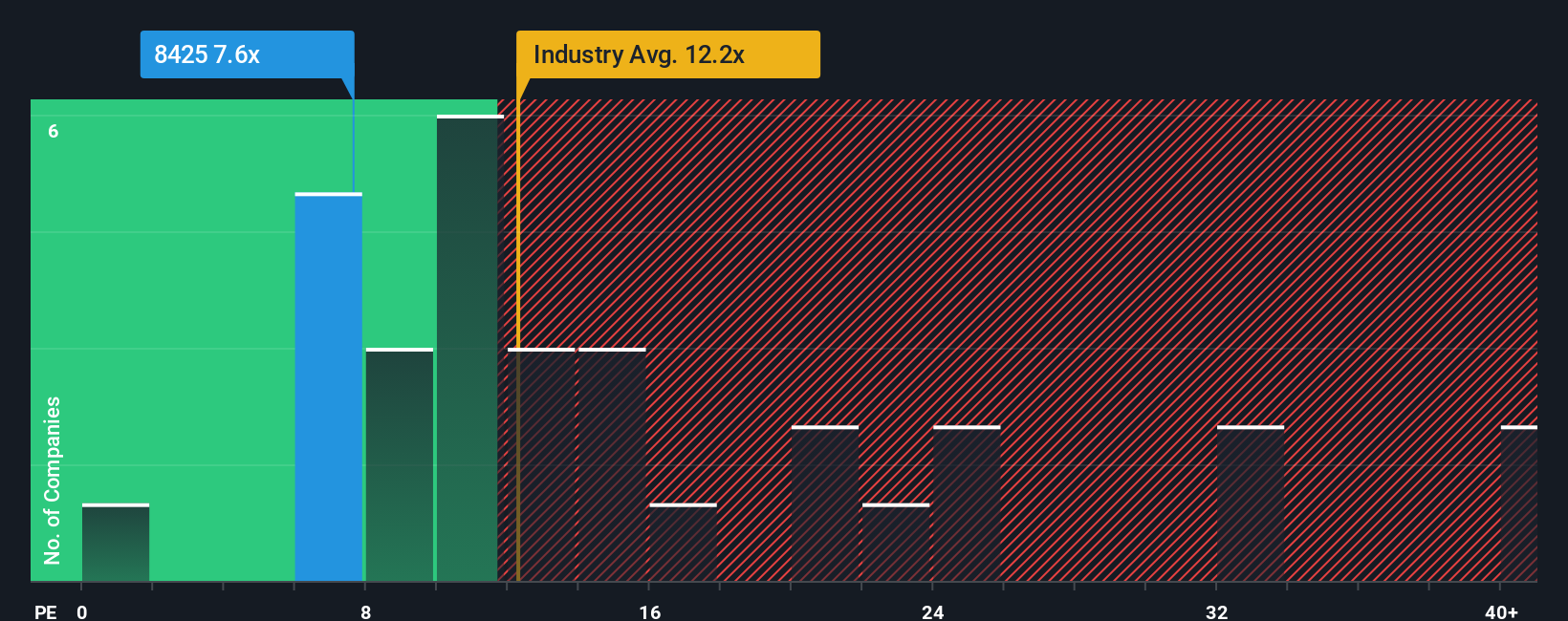

For a profitable company like Mizuho Leasing, the price-to-earnings (PE) ratio is a reliable way to gauge market expectations and relative value. The PE ratio helps investors understand how much they are paying for each yen of earnings. This is especially insightful for steady businesses with consistent profitability.

Generally, what counts as a "normal" or "fair" PE ratio depends on growth prospects and risk. Fast-growing or lower-risk companies tend to deserve higher multiples. Slower-growing or riskier companies warrant lower PE ratios.

Mizuho Leasing currently trades at a PE of 7.68x. This is noticeably below the average for its industry, which stands at 13.12x, and also under the peer average of 11.39x. On a surface comparison, this might signal that Mizuho Leasing is undervalued by traditional standards.

However, Simply Wall St’s proprietary “Fair Ratio” goes further than standard benchmarks. The Fair Ratio is tailored to reflect not just comparisons with industry and peers but also factors like growth outlook, profit margins, company size and unique risk profile. This provides a deeper, more customized view of valuation for Mizuho Leasing specifically.

When we examine how the actual PE ratio compares to the Fair Ratio, the gap is minimal. This suggests that, based on both broader sector context and company-specific traits, the market price is closely aligned with underlying fundamentals.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Mizuho Leasing Company Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative lets you combine your story about a company with financial forecasts like fair value estimates, future revenue, earnings, and profit margins. By connecting the company’s big picture, such as its strategy, risks, or competitive strength, directly to financial outcomes, Narratives make it easier to see why a stock is priced the way it is and where it might head next.

Narratives are easy to create and follow on Simply Wall St’s Community page, already used by millions of investors. They show you at a glance how your fair value compares to the current price, helping you decide whether to buy, hold, or sell. When new information like earnings results or fresh news appears, your Narrative updates, keeping your forecasts and story current.

For Mizuho Leasing Company, some investors believe its fair value could surge much higher if market optimism continues, while others take a conservative view and see limited upside. Narratives allow you to quickly see and compare these perspectives in one place, making smarter investment decisions much more accessible.

Do you think there's more to the story for Mizuho Leasing Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8425

Mizuho Leasing Company

Engages in the provision of general leasing services in Japan and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives