- Japan

- /

- Capital Markets

- /

- TSE:7177

GMO Financial Holdings (TSE:7177) Profit Margin Doubles, Reinforcing Tech-Led Efficiency Narrative

Reviewed by Simply Wall St

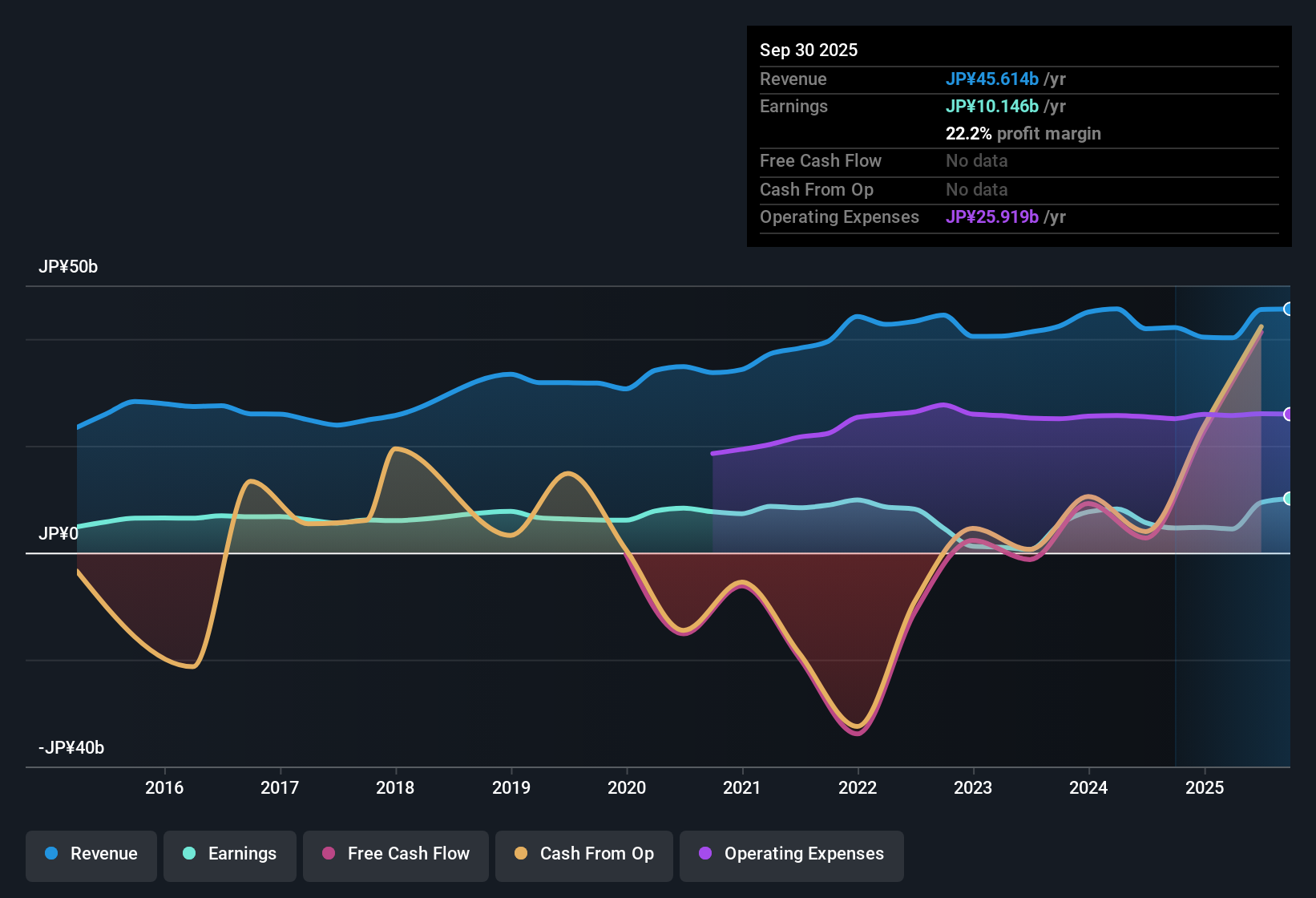

GMO Financial Holdings (TSE:7177) reported net profit margins of 22.2%, a strong jump compared to last year's 11%, as earnings over the past year grew by 119.6% despite a five-year average decline of 5.2% per year. While current valuation metrics look attractive, trading at 10.5x EPS and below both industry and peer averages, investors may weigh these positives against slower forecasted revenue growth of 2.9% per year, lagging Japan's 4.5% market average. The quality of recent earnings and robust profitability jump are notable, but a watchful eye remains on dividend sustainability risks as shares trade above their estimated fair value.

See our full analysis for GMO Financial Holdings.The next section puts these headline results up against the most widely followed narratives to see whether they reinforce the consensus or challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Surge as Digital Strength Shines

- Net profit margin climbed to 22.2%, nearly doubling from last year’s 11%, reflecting a sharp improvement in operational efficiency and profitability.

- The prevailing market view heavily supports the link between GMO’s strong reputation for digital innovation and these steeper margins. This suggests the company is viewed as a reliable, tech-forward financial brand.

- This margin improvement aligns with the perception of GMO as a safe choice in Japan’s evolving fintech ecosystem, emphasizing steady, tech-driven results rather than speculative upside.

- Despite the stability, some observers note that major new catalysts, such as disruptive product launches, have not driven these gains. Instead, consistent execution is seen as the underlying driver.

Forecasted Revenue Trails the Sector

- Annual revenue growth is projected at 2.9% per year, lagging the Japanese market’s 4.5% average. This suggests GMO may not fully capture the broader sector’s momentum.

- While analysis credits the company’s resilience and digital positioning, it highlights tension between this cautious revenue outlook and the market’s generally neutral to mildly optimistic stance.

- The narrative recognizes GMO as a defensive, tech-enabled player. However, it stresses that without sector-beating revenue growth, the company’s upside versus peers could remain limited.

- This slower growth rate may reinforce GMO’s role as a stable hold, but not a high-growth leader, in an industry where fintech adoption is accelerating.

Valuation: Good Value but Pricey vs Fair Value

- Shares trade at 10.5x earnings, a clear discount to industry (15x) and peer (16.1x) multiples. Yet, the current share price of 900.00 sits well above GMO’s DCF fair value of 353.25, introducing a significant premium versus intrinsic worth.

- The market’s generally positive perception of GMO’s consistent fundamentals and strong profit margins contrasts with caution around buying above fair value.

- This valuation tension may keep sentiment more muted. Investors appear unwilling to lean fully bullish until either sector growth or share price better aligns with the company’s strong fundamentals.

- The premium pricing relative to DCF fair value could limit near-term upside, reinforcing the message that GMO’s quality comes at a cost.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on GMO Financial Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite GMO’s strong digital execution and profitability, its muted revenue outlook and premium pricing raise concerns about limited near-term upside when compared to growth-driven peers.

If you’re seeking better value for growth, use our these 831 undervalued stocks based on cash flows to pinpoint companies that trade below intrinsic worth and could offer bigger upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7177

GMO Financial Holdings

Through its subsidiaries, offers financial product trading and crypto currency exchange services in Japan and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives