Japan's stock markets have recently experienced sharp losses, with the Nikkei 225 Index falling 6.0% and the broader TOPIX Index down 5.6%. Amidst this backdrop, investors are increasingly focusing on dividend stocks as a potential source of steady income. In such volatile times, a good dividend stock is characterized by stable earnings, a strong balance sheet, and a consistent track record of paying dividends. With these criteria in mind, let's explore three top Japanese dividend stocks for July 2024.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.76% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.68% | ★★★★★★ |

| Globeride (TSE:7990) | 3.78% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.19% | ★★★★★★ |

| Nissin (TSE:9066) | 4.42% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.10% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.59% | ★★★★★★ |

| Innotech (TSE:9880) | 4.21% | ★★★★★★ |

Click here to see the full list of 394 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

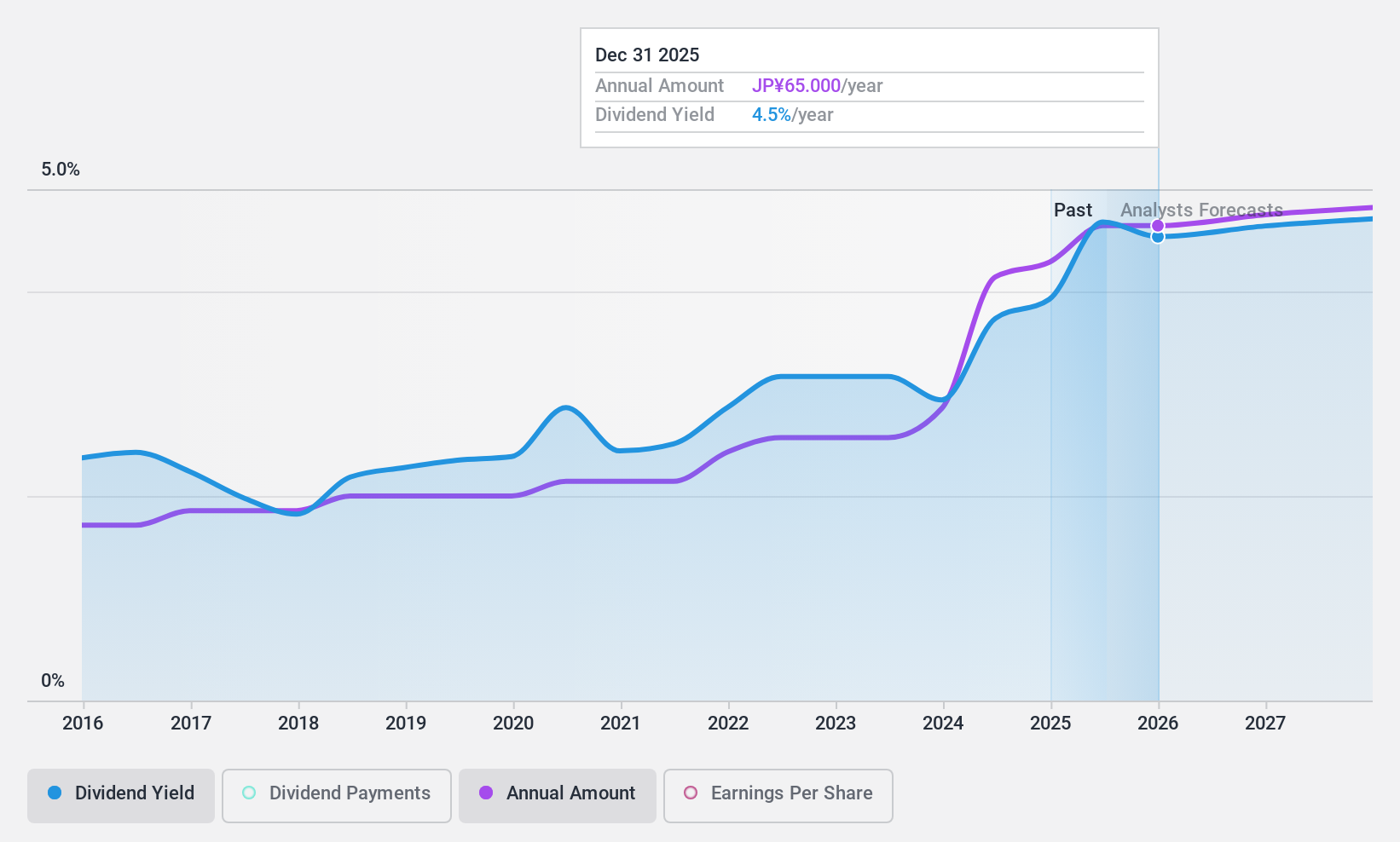

Toagosei (TSE:4045)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Toagosei Co., Ltd., with a market cap of ¥183.56 billion, manufactures, distributes, and sells chemical products both in Japan and internationally through its subsidiaries.

Operations: Toagosei Co., Ltd. generates revenue through various segments, including commodity chemicals, acrylic products, adhesives, and performance chemicals.

Dividend Yield: 3.6%

Toagosei has demonstrated stable and growing dividends over the past decade, with a current yield of 3.58%, placing it in the top 25% of dividend payers in Japan. The company’s dividends are well-covered by earnings (payout ratio: 48.9%) and cash flows (cash payout ratio: 65.9%). Recent buyback activity includes an increase of ¥1 billion to repurchase an additional 800,000 shares, enhancing shareholder value further.

- Click here to discover the nuances of Toagosei with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Toagosei's share price might be too optimistic.

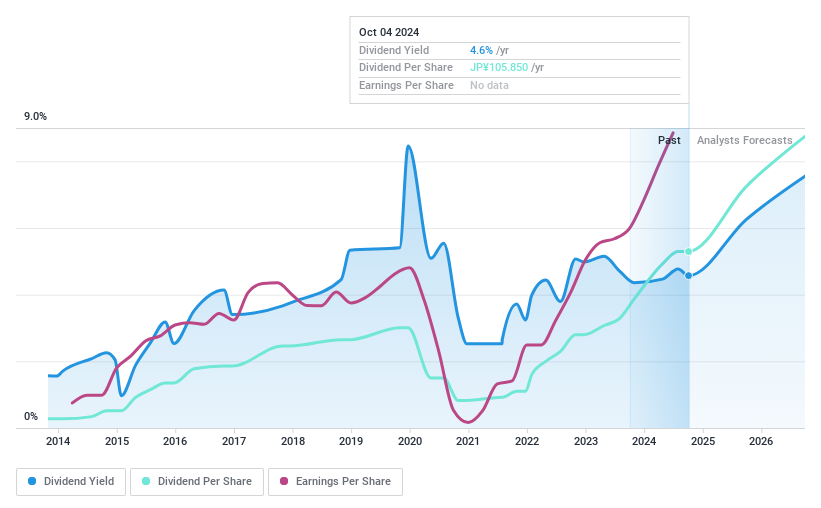

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd. and its subsidiaries offer a range of financial products and services in Japan, with a market cap of ¥223.57 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through diverse financial products and services within Japan.

Dividend Yield: 3.7%

Financial Partners Group Ltd. offers a compelling dividend yield of 3.75%, placing it in the top 25% of Japanese dividend payers. Its dividends are well-covered by earnings (payout ratio: 37.9%) and cash flows (cash payout ratio: 32.4%). However, the company has an unstable dividend track record over the past decade and carries a high level of debt, recently increasing its debt by ¥33 billion with Sumitomo Mitsui Banking Corporation among others.

- Get an in-depth perspective on Financial Partners GroupLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Financial Partners GroupLtd's shares may be trading at a discount.

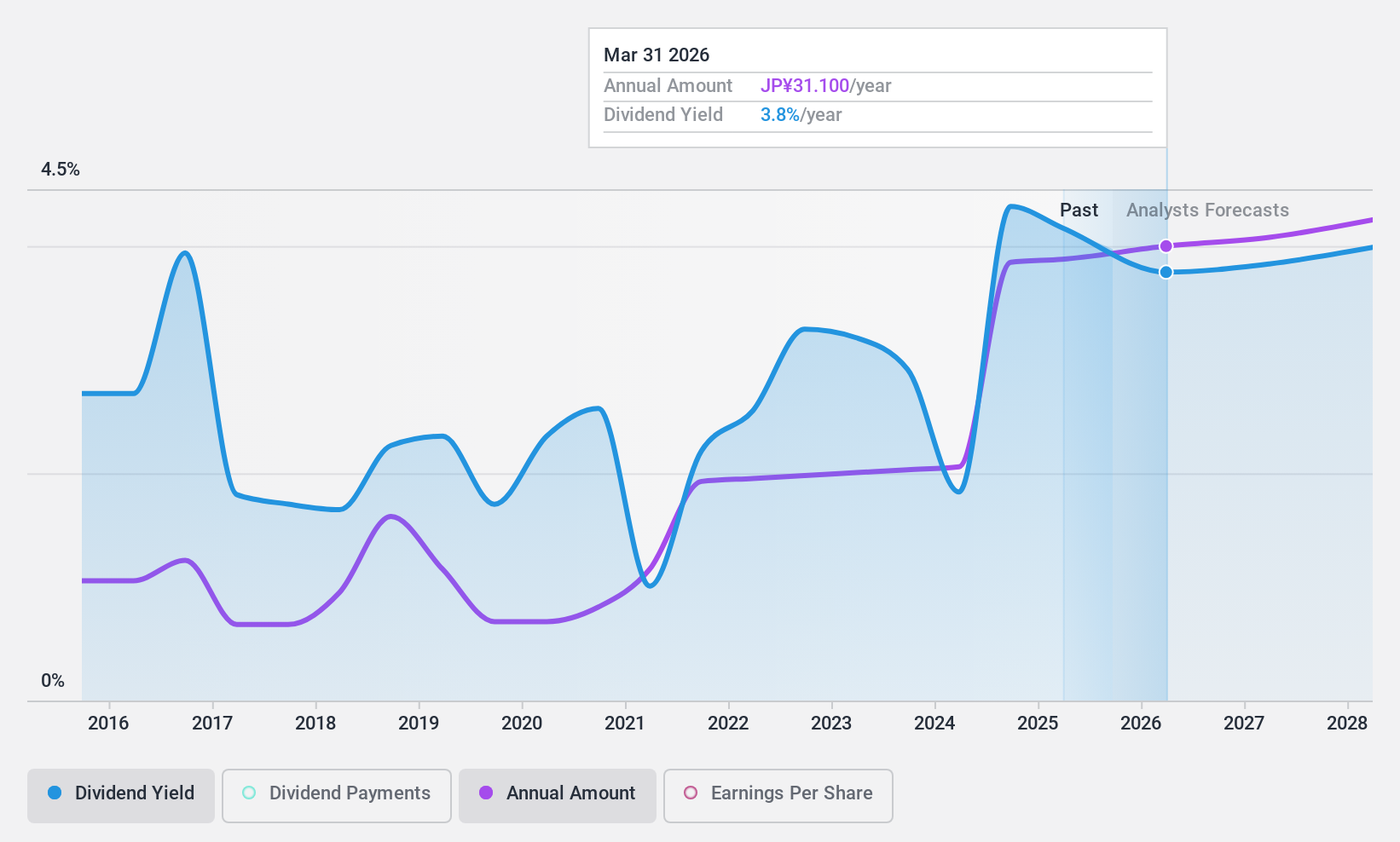

Monex Group (TSE:8698)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monex Group, Inc. is an online financial institution offering retail brokerage services in Japan, the United States, China, and Australia with a market cap of ¥190.32 billion.

Operations: Monex Group, Inc. generates revenue primarily through its retail online brokerage services in Japan, the United States, China, and Australia.

Dividend Yield: 4.1%

Monex Group's dividend yield of 4.07% ranks in the top 25% of Japanese dividend payers, though its payments have been volatile over the past decade. The company's dividends are well-covered by earnings but not by free cash flows. Recent developments include a ¥5 billion share repurchase program to return unutilized cash to shareholders, indicating a potential focus on enhancing shareholder value despite forecasted earnings declines.

- Navigate through the intricacies of Monex Group with our comprehensive dividend report here.

- The analysis detailed in our Monex Group valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Delve into our full catalog of 394 Top Japanese Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toagosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4045

Toagosei

Manufactures, distributes, and sells chemical products in Japan and internationally.

Flawless balance sheet 6 star dividend payer.