Stock Analysis

Amid a backdrop of Japan's stock markets experiencing notable gains, with the Nikkei 225 Index rising by 2.6% and the TOPIX Index up by 3.1%, investors are increasingly attentive to opportunities within this vibrant market landscape. In such an environment, dividend stocks like Komatsu emerge as potentially appealing options for those seeking steady income streams combined with exposure to Japan’s export-driven economic sectors. In considering what makes a good dividend stock in these conditions, it's essential to look at companies that not only offer attractive yields but also demonstrate robust financial health and the potential for sustainable payouts, particularly in a market buoyed by strong industrial performance and policy shifts.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

| Globeride (TSE:7990) | 3.86% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.15% | ★★★★★★ |

| Japan Pulp and Paper (TSE:8032) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.47% | ★★★★★★ |

| Innotech (TSE:9880) | 3.93% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.38% | ★★★★★☆ |

Click here to see the full list of 375 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Komatsu (TSE:6301)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komatsu Ltd. is a global manufacturer and distributor of construction, mining, and utility equipment with a market capitalization of approximately ¥4.66 trillion.

Operations: Komatsu Ltd.'s revenue is primarily derived from its Construction, Mining, and Utility Equipment segment, which generated ¥3.62 billion, followed by Industrial Machinery Others at ¥0.20 billion and Retail Finance contributing ¥0.10 billion.

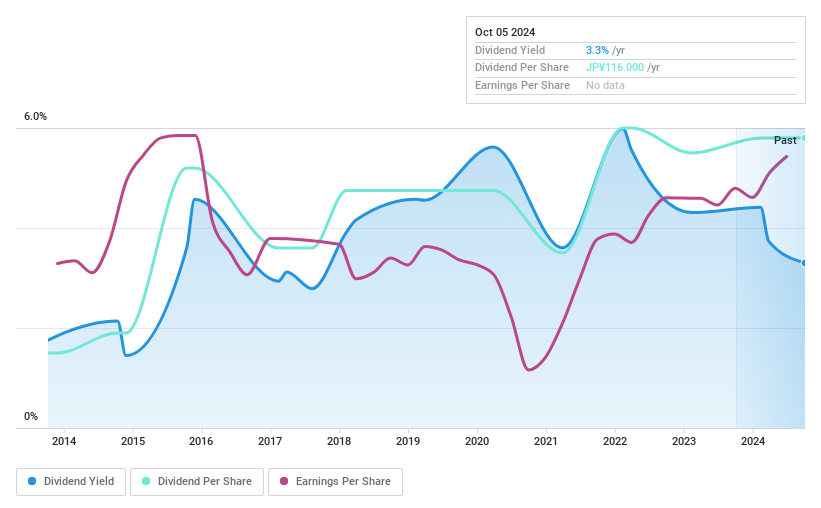

Dividend Yield: 3.3%

Komatsu has demonstrated a mixed track record in dividend reliability, with payments showing volatility over the past decade. Despite this, the dividends are well-supported by earnings and cash flows, with a payout ratio of 40.1% and a cash payout ratio of 67.3%. Recently, Komatsu committed to shareholder returns through significant share repurchases totaling ¥56 billion and announced an increase in its annual dividend to ¥95 per share from last year's ¥75.

- Navigate through the intricacies of Komatsu with our comprehensive dividend report here.

- Our expertly prepared valuation report Komatsu implies its share price may be lower than expected.

Chiyoda IntegreLtd (TSE:6915)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chiyoda Integre Co., Ltd. is engaged in the manufacturing and selling of structural and functional parts for various products across global markets, with a market capitalization of approximately ¥35.67 billion.

Operations: Chiyoda Integre Co., Ltd. generates its revenue primarily from the manufacturing and sales of structural and functional parts for diverse products internationally.

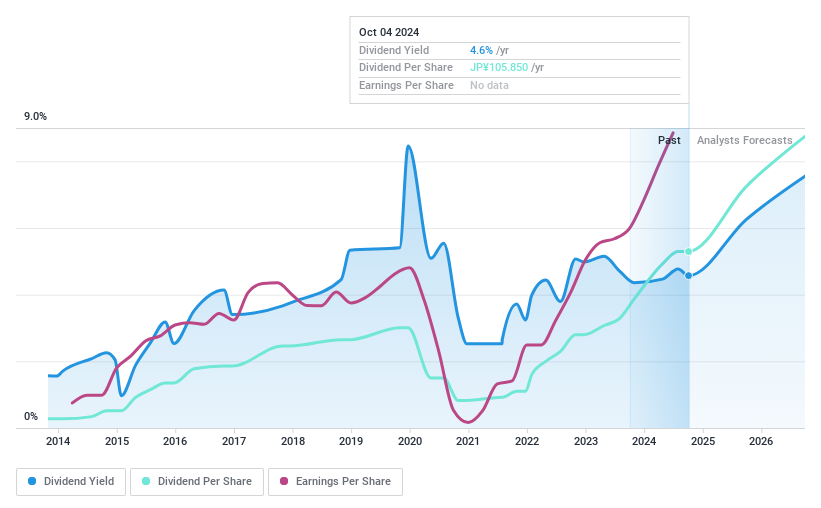

Dividend Yield: 3.4%

Chiyoda Integre Ltd. maintains a conservative dividend profile, with a payout ratio of 45.4% and cash flow coverage at 39.4%, indicating dividends are well-supported by earnings and cash flows. Despite trading 33% below its estimated fair value, the company's dividend history shows inconsistency, marked by volatility over the past decade. Recent activities include a share buyback where 223,300 shares were repurchased for ¥640.85 million, completing the set target announced earlier this year on March 27, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Chiyoda IntegreLtd.

- Our comprehensive valuation report raises the possibility that Chiyoda IntegreLtd is priced lower than what may be justified by its financials.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Partners Group Ltd, operating in Japan, offers a diverse range of financial products and services through its subsidiaries and has a market capitalization of approximately ¥202.14 billion.

Operations: Financial Partners Group Ltd generates its revenue primarily through the sale of a variety of financial products and services across Japan.

Dividend Yield: 4.1%

Financial Partners Group Ltd. has been actively managing its capital structure, evidenced by recent share repurchases totaling ¥756.25 million and securing debt financing of ¥33 billion for real estate investments. Despite a volatile dividend history over the past decade, the company maintains a dividend yield of 4.32%, placing it in the top quartile of Japanese dividend payers. Its dividends are well-covered by earnings and cash flows with payout ratios at 37.9% and cash payout ratios at 32.4%, respectively, suggesting sustainability despite its high debt levels.

- Click to explore a detailed breakdown of our findings in Financial Partners GroupLtd's dividend report.

- The analysis detailed in our Financial Partners GroupLtd valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Get an in-depth perspective on all 375 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Komatsu is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6301

Komatsu

Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, Rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

Flawless balance sheet with solid track record and pays a dividend.