- Japan

- /

- Hospitality

- /

- TSE:3350

Metaplanet (TSE:3350): Valuation in Focus After Recent Share Price Pullback

Reviewed by Simply Wall St

Metaplanet (TSE:3350) has drawn fresh attention following recent moves in its stock price. Investors are watching to see whether current valuation levels reflect the company’s underlying fundamentals or short-term market shifts.

See our latest analysis for Metaplanet.

After an impressive run earlier this year, Metaplanet’s recent 1-month share price return of -27.7%, along with even sharper pullbacks over 7 and 90 days, shows momentum is cooling in the short term. Still, investors who held firm for the past year have seen an extraordinary 1-year total shareholder return of 161.7%, and the gains are even more staggering over the past three and five years. This pattern hints that while excitement has waned lately, the longer-term story remains a powerful one. Both optimism and caution appear to be in play as the market recalibrates expectations.

If you’re curious about what other companies have delivered outsized returns from rapid growth and investor interest, take a moment to explore fast growing stocks with high insider ownership.

The real question now is whether Metaplanet’s steep pullback has left shares trading below their true value, or if the market has already factored in all that future growth and left little room for upside.

Price-to-Earnings of 44.4x: Is it justified?

Metaplanet commands a price-to-earnings (P/E) ratio of 44.4x, which stands out against its current share price of ¥415. This signals the market is attributing a high valuation to the company’s earnings, potentially reflecting strong growth expectations or investor enthusiasm, but also raising questions about premium pricing.

The P/E multiple is a standard measure for comparing how much investors are willing to pay for every unit of company earnings. In sectors such as hospitality, where profit cycles can be volatile, a high P/E may suggest optimism about future profit growth or confidence in the company’s ability to sustain its expansion. However, it is also a warning that expectations may be running high, so future performance needs to justify this elevated baseline.

Compared to the Japanese Hospitality industry average of 23.3x and the peer group average of 15.4x, Metaplanet’s P/E is significantly higher. This premium is even more intriguing given the estimated fair P/E of 72.3x, which the market could eventually aspire to if current growth trends hold. The company is seen as expensive relative to the industry but may still be undervalued versus its fair ratio.

Explore the SWS fair ratio for Metaplanet

Result: Price-to-Earnings of 44.4x (OVERVALUED)

However, slowing momentum and elevated expectations present risks. Any earnings disappointment or shifts in market sentiment could quickly stall Metaplanet's impressive run.

Find out about the key risks to this Metaplanet narrative.

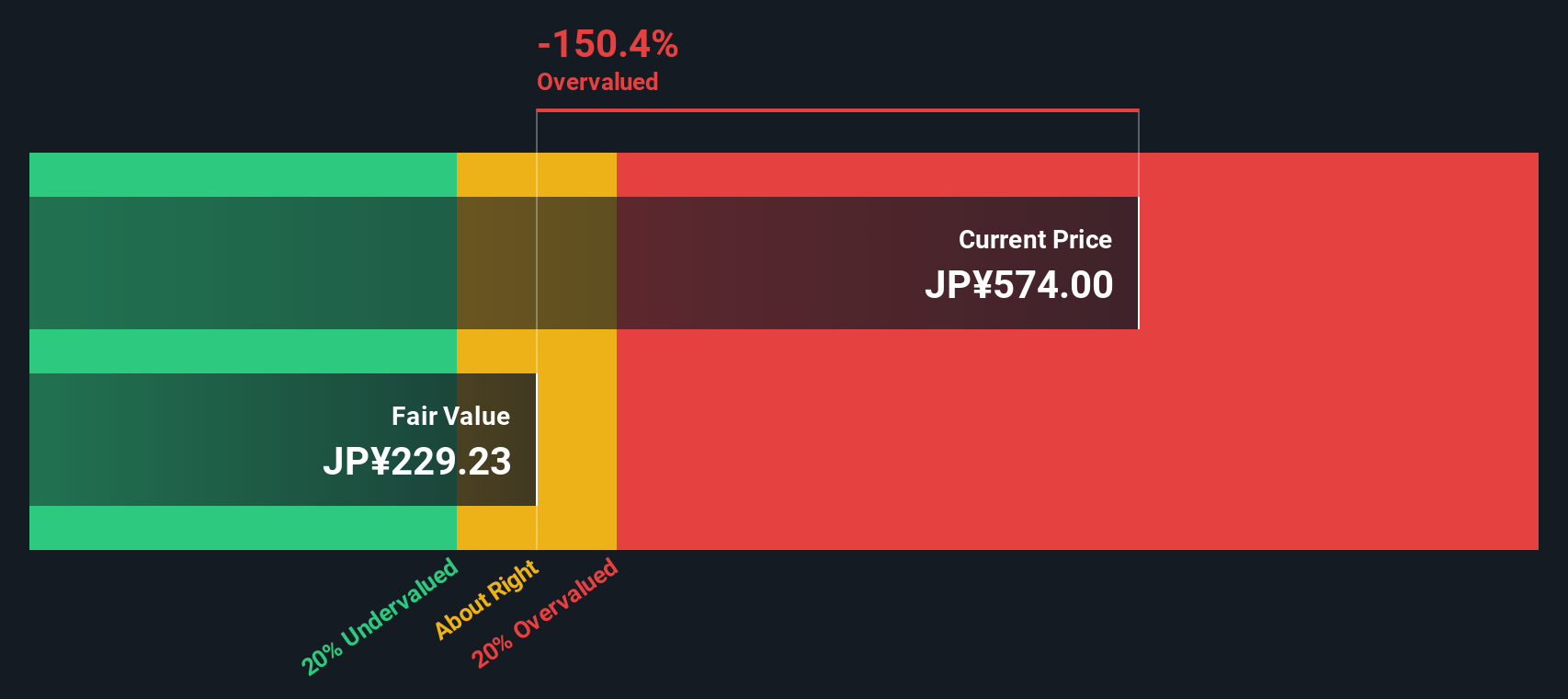

Another View: Discounted Cash Flow Model

While the market’s current premium pricing for Metaplanet looks steep based on earnings multiples, our SWS DCF model suggests a very different story. According to this approach, Metaplanet is trading well above its intrinsic value, with the share price more than 70% higher than the DCF estimate. Does this signal caution, or is the market seeing something the model cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Metaplanet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Metaplanet Narrative

If you want to dig deeper or believe there’s another side to this story, you can quickly create your own narrative and perspective. Do it your way.

A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always a step ahead. Broaden your horizons with exciting stock opportunities you can find right now on Simply Wall Street's free screener tools.

- Boost your portfolio with steady income by checking out these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

- Get ahead of the AI revolution by reviewing these 24 AI penny stocks, which are set to disrupt major industries with intelligent automation and rapid growth potential.

- Seize your chance to invest early in innovation by browsing these 27 quantum computing stocks, which is driving breakthroughs in quantum computing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives