- Japan

- /

- Hospitality

- /

- TSE:2157

Discovering Koshidaka Holdings And 2 Hidden Small Cap Gems In Japan

Reviewed by Simply Wall St

As Japan's stock markets have shown positive momentum, with the Nikkei 225 Index gaining 2.45% and the TOPIX Index up 0.45%, investors are increasingly interested in small-cap opportunities that could benefit from this favorable environment. In this context, identifying stocks such as Koshidaka Holdings and other hidden gems can be particularly rewarding, especially when these companies exhibit strong fundamentals and potential for growth amid current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ohashi Technica | NA | 1.57% | -20.55% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Koshidaka Holdings (TSE:2157)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. engages in the karaoke and bath house businesses both domestically in Japan and internationally, with a market cap of ¥91.71 billion.

Operations: Koshidaka Holdings generates revenue primarily from its karaoke business, which accounts for ¥61.25 billion. The company also earns from real estate management, contributing ¥1.59 billion to its revenue streams.

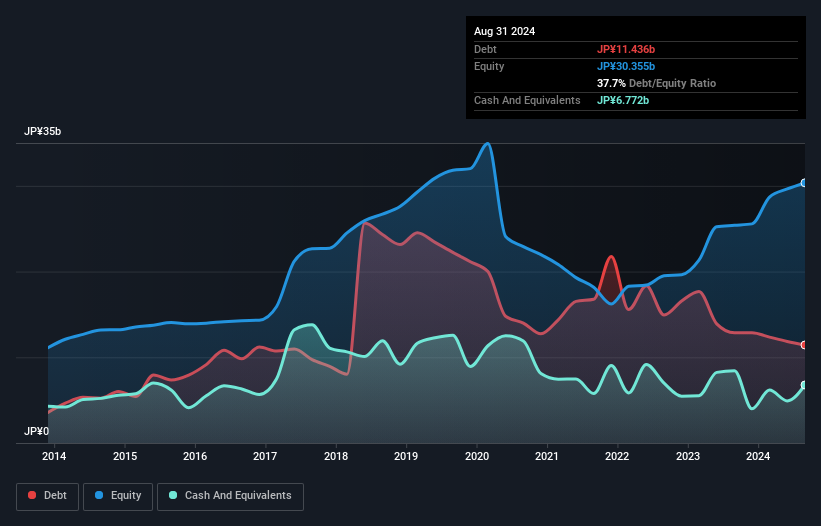

Koshidaka Holdings seems to be a promising player in its industry, with a price-to-earnings ratio of 13.6x, which is below the hospitality industry average of 21.9x, suggesting it trades at good value. The company's net debt to equity ratio stands at a satisfactory 15.4%, having reduced from 69.9% over five years, indicating improved financial health. Recent dividend guidance shows an increase to ¥12 per share for the second quarter and fiscal year ending August 2025, reflecting confidence in future earnings growth projected at 6.5% annually despite last year's negative earnings growth of -5.2%.

- Unlock comprehensive insights into our analysis of Koshidaka Holdings stock in this health report.

Explore historical data to track Koshidaka Holdings' performance over time in our Past section.

Nojima (TSE:7419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nojima Corporation operates digital home electronics retail stores in Japan and internationally, with a market capitalization of approximately ¥201.52 billion.

Operations: Nojima Corporation generates revenue primarily from its Digital Home Electronics Specialty Store Operation Business, which contributes ¥273.98 billion, and the Career Show Management Business, adding ¥350.30 billion. The Internet Business and Foreign Operation segments also provide significant income at ¥66.93 billion and ¥75.74 billion respectively.

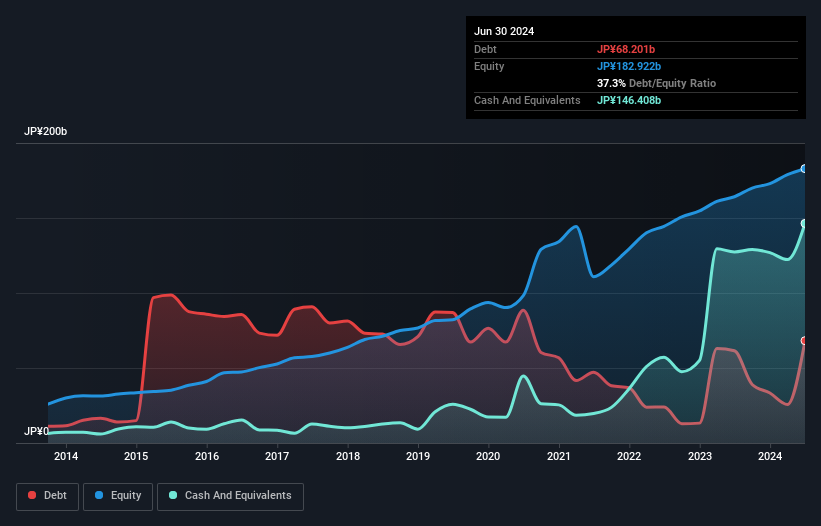

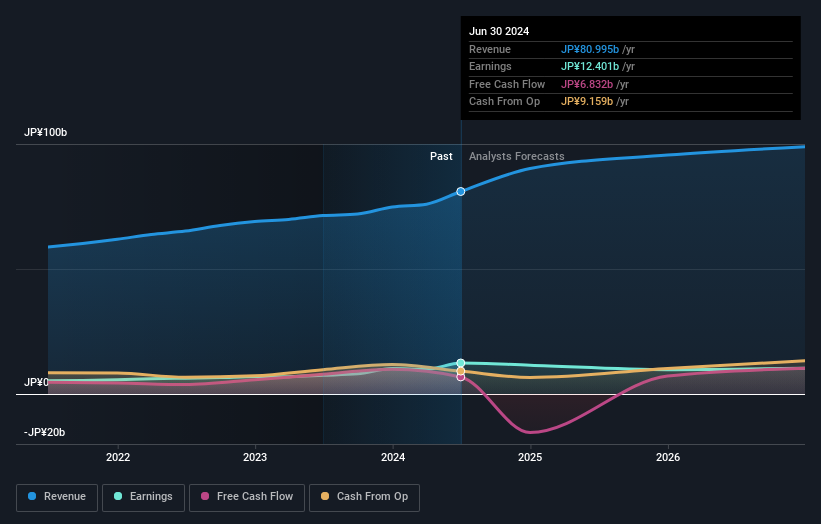

Nojima, a promising player in Japan's retail sector, has seen its earnings grow by 8.3% over the past year, outpacing the industry average of 5.3%. Over five years, its debt-to-equity ratio fell significantly from 105.8% to 37.3%, indicating improved financial health and more cash than total debt. The company repurchased shares worth ¥2.98 billion recently and trades at a substantial discount of 77.9% below estimated fair value, suggesting potential upside for investors seeking value opportunities in this space.

- Click here and access our complete health analysis report to understand the dynamics of Nojima.

Review our historical performance report to gain insights into Nojima's's past performance.

Mitsubishi Pencil (TSE:7976)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mitsubishi Pencil Co., Ltd. is a company that manufactures and supplies writing instruments in Japan, with a market capitalization of approximately ¥147.92 billion.

Operations: Mitsubishi Pencil generates revenue primarily from its Writing Instruments and Writing Instruments Peripherals Business, which reported ¥78.68 billion in revenue.

Mitsubishi Pencil, a notable player in the writing instruments industry, recently announced a joint venture with Linc Limited to bring advanced Japanese technology to India. This collaboration is expected to leverage Mitsubishi's expertise and Linc's distribution network. Over the past year, Mitsubishi has seen earnings grow by 65.8%, bolstered by a significant one-off gain of ¥5.1 billion. The company also repurchased 325,400 shares for ¥755.74 million between August and September 2024, enhancing shareholder value while maintaining financial flexibility with its debt-to-equity ratio at 14%.

- Get an in-depth perspective on Mitsubishi Pencil's performance by reading our health report here.

Assess Mitsubishi Pencil's past performance with our detailed historical performance reports.

Next Steps

- Reveal the 731 hidden gems among our Japanese Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koshidaka Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2157

Koshidaka Holdings

Operates a karaoke business and a bath house business in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.