Morito (TSE:9837) Margin Beat Reinforces Bull Case, But One-Off Gain Clouds Profit Picture

Reviewed by Simply Wall St

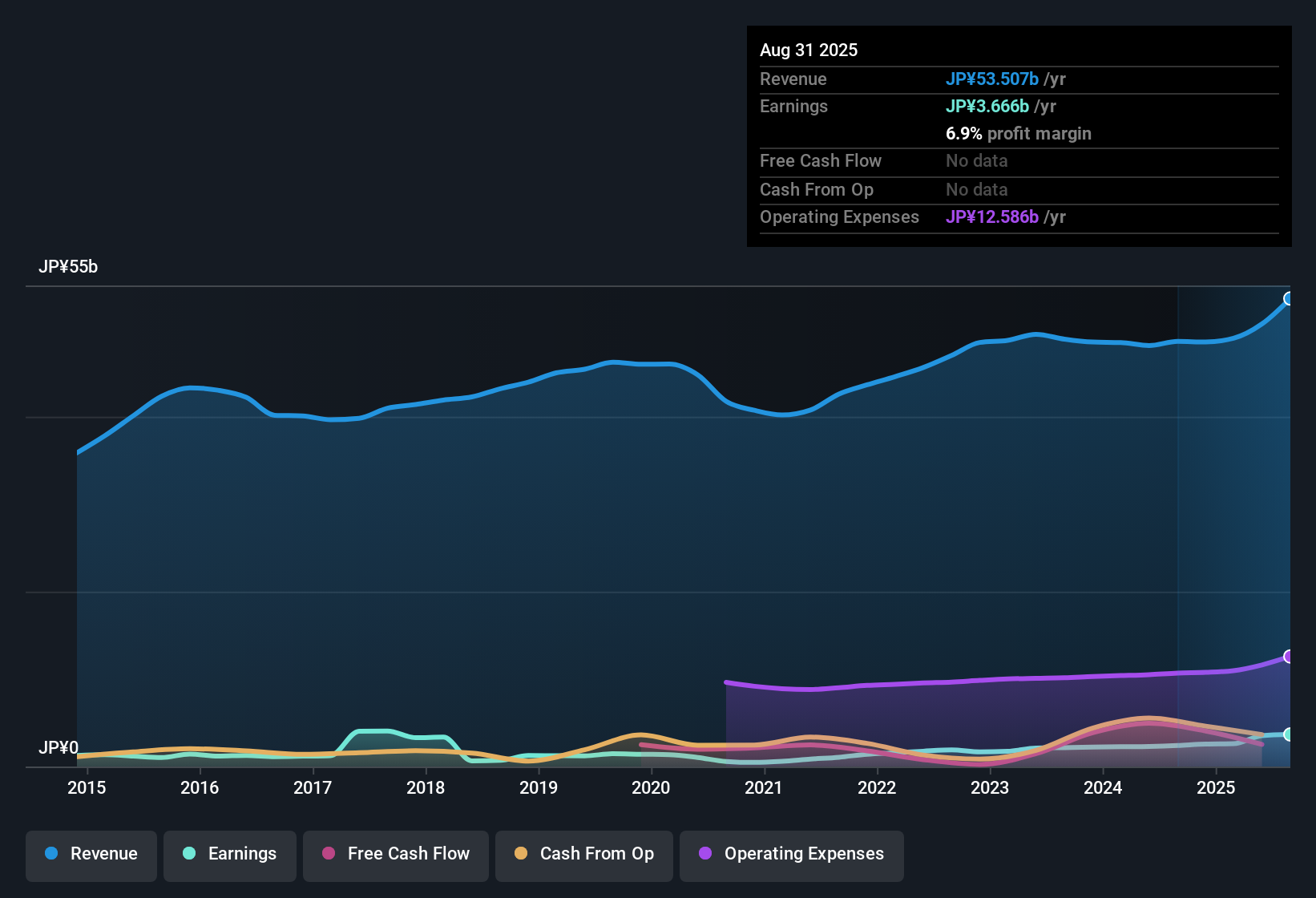

Morito (TSE:9837) delivered net profit margins of 6.9%, up from 5% last year, with earnings growth over the past year reaching 52.3%. This far outpaces its five-year average of 28.9% per year. Revenue is projected to grow at 7.88% annually, outstripping Japan's broader market forecast of 4.4% growth. However, earnings are expected to decline by 14.8% per year over the next three years due to a recent ¥1.6 billion one-off gain that boosted results. Shareholders now face a compelling mix of strong valuation and revenue prospects, weighed against the volatility introduced by non-recurring income in recent reports.

See our full analysis for Morito.The next section puts these performance numbers up against the narratives followed by investors and analysts, highlighting where the stories align and where expectations might shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Boosts Margins, Not Recurring Profits

- Morito's ¥1.6 billion one-off gain has temporarily pushed net profit margins to 6.9%, up from 5% last year. Management notes these figures overstate the company's core profitability.

- Stable operating results and a conservative balance sheet provide support for the case that Morito is a steady, defensive pick. Bulls point to reliable dividend payments and consistent demand for apparel components.

- Margins benefited from non-recurring gains, indicating underlying profitability is lower than the headline suggests.

- Bulls emphasize steady operations as a draw for long-term, risk-averse investors but acknowledge that margin expansion is not sustainable without further operational improvements.

Earnings Growth Outpaces Sector, But Not Forecast to Last

- Recent annual earnings growth of 52.3% far exceeded the five-year average of 28.9%. Current revenue is projected to grow at 7.88% annually, ahead of Japan's market-wide 4.4% forecast.

- Despite this streak of above-average growth, projections show earnings declining by 14.8% per year going forward, highlighting a disconnect between past outperformance and future expectations.

- Bears argue that one-off factors explain the exceptional growth and that the true run-rate is less impressive once these are stripped out.

- Forecast earnings declines may temper any enthusiasm driven by recent headline growth numbers, especially for momentum-focused investors.

Valuation Discount Versus Peers and Fair Value

- Morito shares trade at a price-to-earnings ratio of 11x, below both the peer average of 12.6x and the industry average of 13.1x. The current share price of ¥1,552 sits well below the DCF fair value estimate of ¥2,070.02.

- The favorable valuation heavily supports those looking for a margin of safety, as the market currently prices Morito at a discount while steady sector demand underpins investor interest.

- Current market multiples provide a buffer for investors even as forecasts turn negative, contrasting with many peers priced closer to fair value or premiums.

- Broader trends show steady demand for defensive, fairly priced stocks, putting Morito’s discount into focus for value-focused fund managers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Morito's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Morito’s impressive growth streak is set to reverse, with forecast earnings declines and recent gains driven largely by one-off items rather than sustained momentum.

If you want companies where future growth is more consistent and less dependent on non-recurring gains, check out stable growth stocks screener that keep delivering steady results through all conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9837

Morito

Engages in the manufacture and sale of apparel-related materials and household goods and products in Japan, Asia, Europe, and the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives