Why Mizuno (TSE:8022) Is Up 7.9% After Strong Earnings and Stock Split Announcement

Reviewed by Sasha Jovanovic

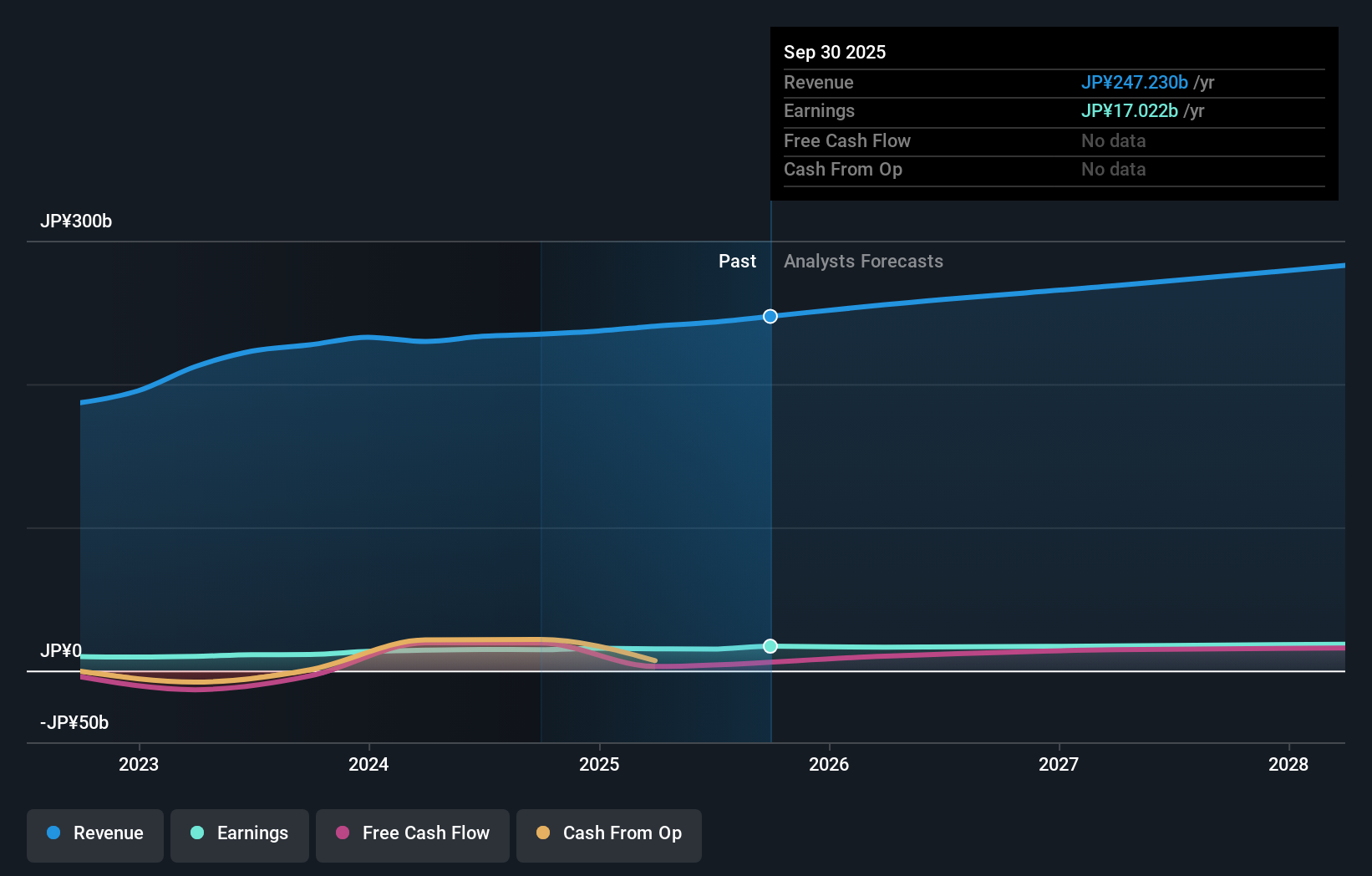

- Mizuno Corporation reported strong financial results for the first half of the fiscal year ending March 31, 2026, posting a 5.8% rise in net sales and a 22% increase in profit attributable to owners of the parent, compared to the previous year.

- The company’s decision to proceed with a stock split and maintain its dividend forecast highlights management’s confidence in both ongoing stability and future business prospects.

- We’ll explore how Mizuno’s robust earnings growth and stock split reinforce its investment narrative within the broader sportswear sector.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Mizuno's Investment Narrative?

To see lasting value in Mizuno, investors need to believe the company can translate its heritage and brand strength into consistent earnings growth, even as the broader sportswear sector faces competitive pressures and changing consumer tastes. The recent financial results, which showed a solid 5.8% sales increase and a 22% jump in profits, clearly give management reason for optimism, especially as they move forward with a stock split and keep the dividend forecast intact. This upbeat report could shift attention back to short-term catalysts, like the momentum from higher sales and greater accessibility post-split, possibly boosting sentiment and liquidity in the near term. However, risks remain: low return on equity, a modest profit margin, and underperformance relative to the wider Japanese market haven't gone away. Taken together, the news adds a positive signal but may only serve as a short-term tailwind unless sustained improvement is seen in profitability and market share. In contrast, board independence issues still present governance concerns that investors should be aware of.

Mizuno's shares have been on the rise but are still potentially undervalued by 33%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Mizuno - why the stock might be worth just ¥3300!

Build Your Own Mizuno Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mizuno research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Mizuno research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mizuno's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8022

Mizuno

Manufactures and sells sports products in Japan, the rest of Asia, Europe, the Americas, and Oceania.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives