Stock Analysis

I'LL Explore Three Undiscovered Gems in Japan with Promising Potential

Reviewed by Simply Wall St

Recent trends in the Japanese market have seen a retreat from record highs amid speculation of intervention to support the yen, affecting export-focused industries and investor sentiment towards Japanese assets. As investors navigate these shifts, uncovering stocks with promising potential involves looking beyond surface-level metrics to understand deeper market dynamics and company fundamentals in this evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ITOCHU-SHOKUHIN | NA | -0.49% | 11.48% | ★★★★★★ |

| System ResearchLtd | 13.69% | 10.06% | 14.89% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 1.22% | -0.23% | ★★★★★★ |

| KurimotoLtd | 17.04% | 3.22% | 19.20% | ★★★★★★ |

| NJS | NA | 4.22% | 1.83% | ★★★★★★ |

| Techno Smart | NA | 5.05% | -2.17% | ★★★★★★ |

| NPR-Riken | 13.26% | 6.00% | 32.17% | ★★★★★☆ |

| GakkyushaLtd | 22.47% | 5.11% | 19.19% | ★★★★★☆ |

| Marusan Securities | 5.16% | 0.97% | 11.87% | ★★★★★☆ |

| Toyo Kanetsu K.K | 45.07% | 2.00% | 11.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

I'LL (TSE:3854)

Simply Wall St Value Rating: ★★★★★★

Overview: I'LL Inc. is a Japanese company specializing in system solutions with a market capitalization of ¥68.09 billion.

Operations: This company generates its revenue primarily through the sale of goods, consistently achieving a gross profit margin above 40% in recent years. Its cost of goods sold (COGS) typically constitutes a significant portion of revenue, with general and administrative expenses also forming a substantial part of operating costs.

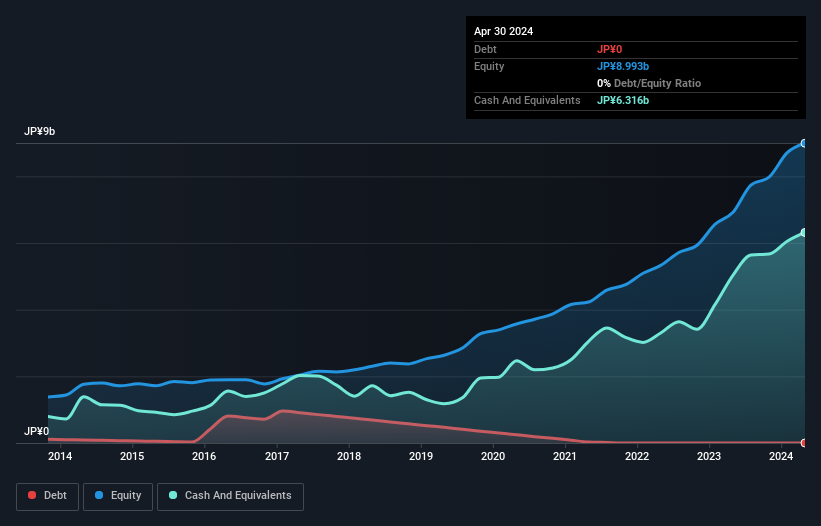

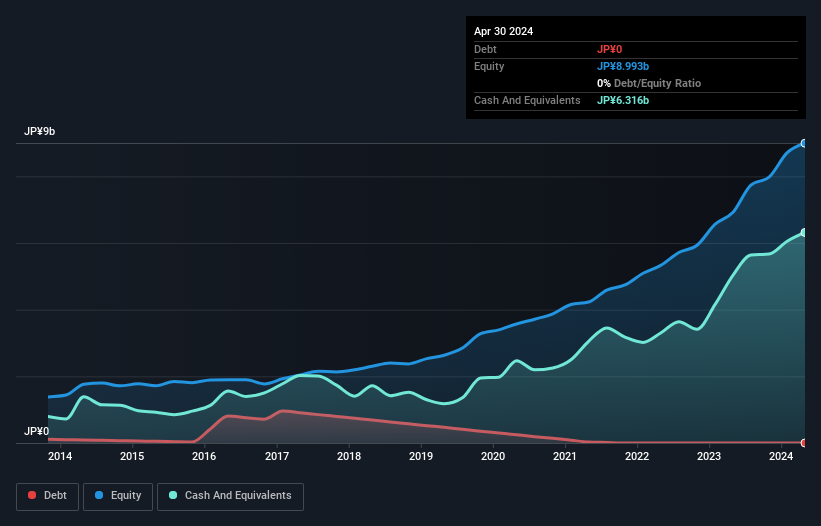

I'LL Inc., a lesser-known Japanese entity, has demonstrated robust financial health and growth potential. Over the past year, earnings surged by 39.2%, outpacing the software industry's growth of 13.1%. This trend is expected to continue with forecasts predicting a 12.32% annual growth in earnings. Impressively, the company remains debt-free, having eradicated its debt from five years ago when the debt-to-equity ratio stood at 17.8%. With high-quality past earnings and no concerns over cash runway due to profitability, I'LL is poised for further success as it prepares to announce Q3 results on June 07, 2024.

- Delve into the full analysis health report here for a deeper understanding of I'LL.

Assess I'LL's past performance with our detailed historical performance reports.

I'LL (TSE:3854)

Simply Wall St Value Rating: ★★★★★★

Overview: I'LL Inc. is a Japanese company specializing in system solutions with a market capitalization of ¥68.09 billion.

Operations: This company generates its revenue primarily through the sale of goods, consistently achieving a gross profit margin above 40% in recent years. Its cost of goods sold (COGS) typically constitutes a significant portion of revenue, with general and administrative expenses also forming a substantial part of operating costs.

I'LL Inc., a lesser-known Japanese entity, has demonstrated robust financial health and growth potential. Over the past year, earnings surged by 39.2%, outpacing the software industry's growth of 13.1%. This trend is expected to continue with forecasts predicting a 12.32% annual growth in earnings. Impressively, the company remains debt-free, having eradicated its debt from five years ago when the debt-to-equity ratio stood at 17.8%. With high-quality past earnings and no concerns over cash runway due to profitability, I'LL is poised for further success as it prepares to announce Q3 results on June 07, 2024.

- Delve into the full analysis health report here for a deeper understanding of I'LL.

Assess I'LL's past performance with our detailed historical performance reports.

PKSHA Technology (TSE:3993)

Simply Wall St Value Rating: ★★★★★☆

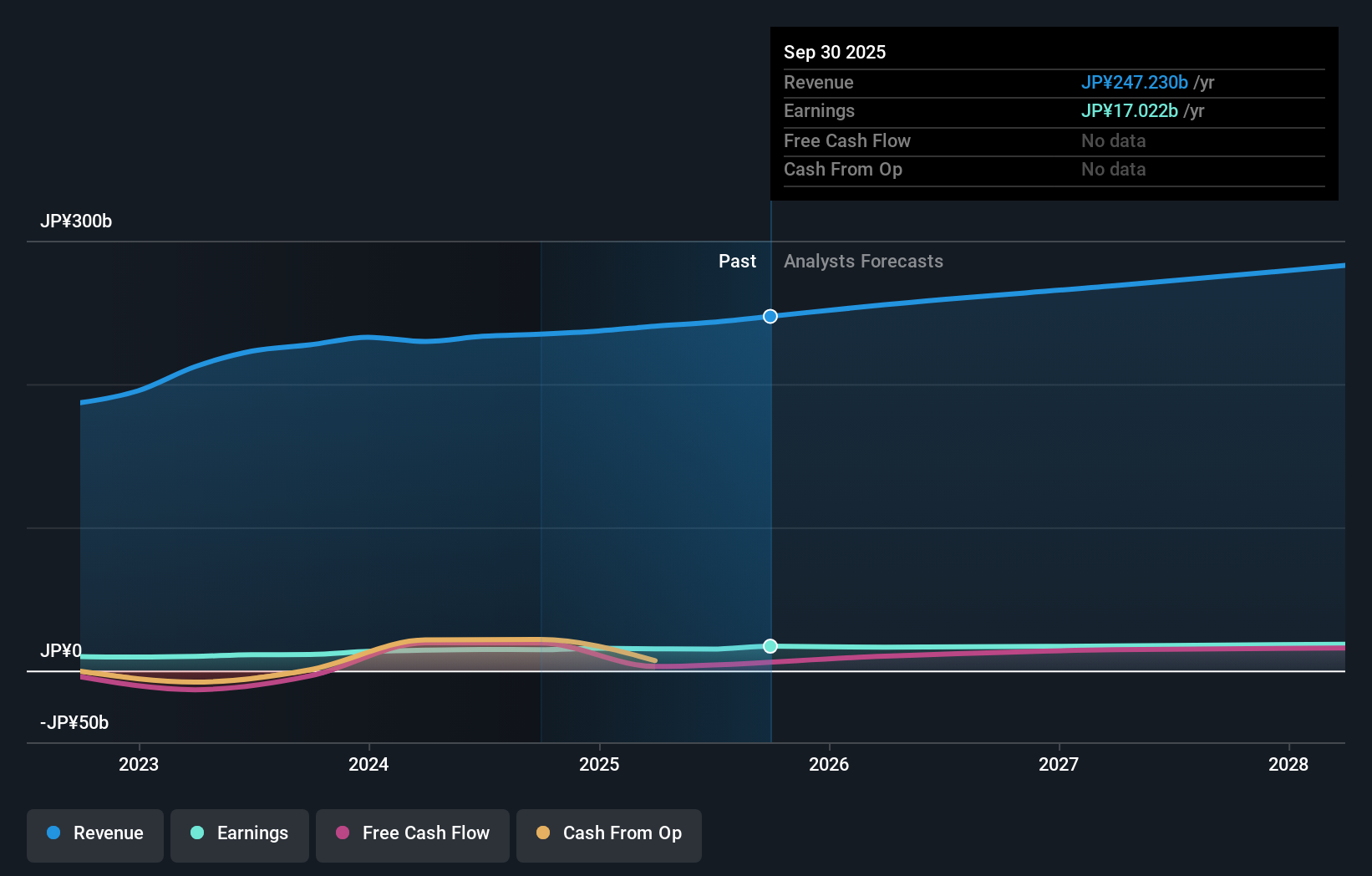

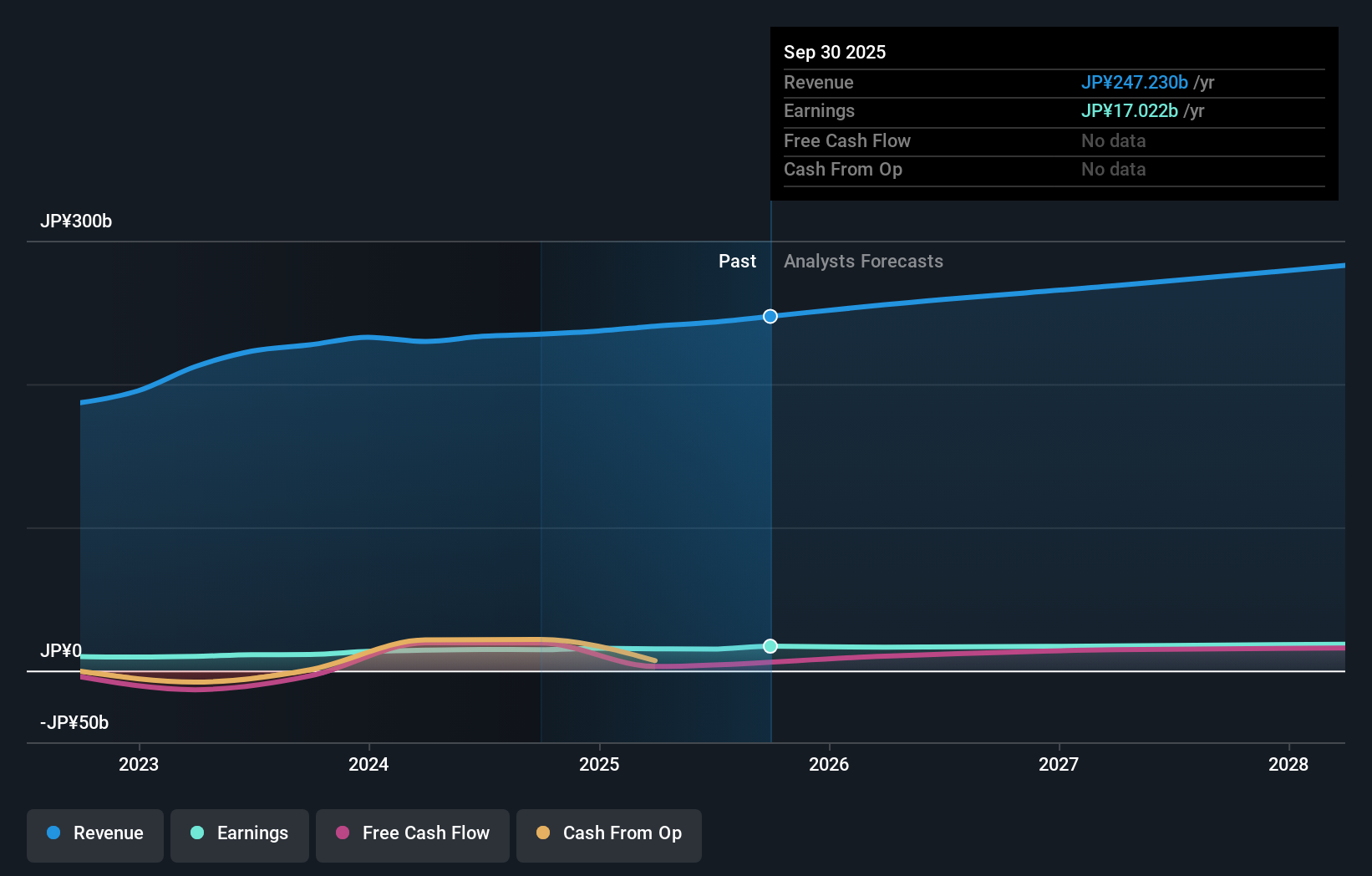

Overview: PKSHA Technology Inc. specializes in creating algorithmic solutions in Japan, with a market capitalization of ¥116.32 billion.

Operations: This company generates its revenue primarily through the sale of technological solutions, with a consistent gross profit margin averaging around 50% in recent years. The cost of goods sold (COGS) has steadily increased, reflecting the growing scale of its operations, yet it has managed to sustain a notable size of gross profit, indicating effective cost management relative to revenue growth.

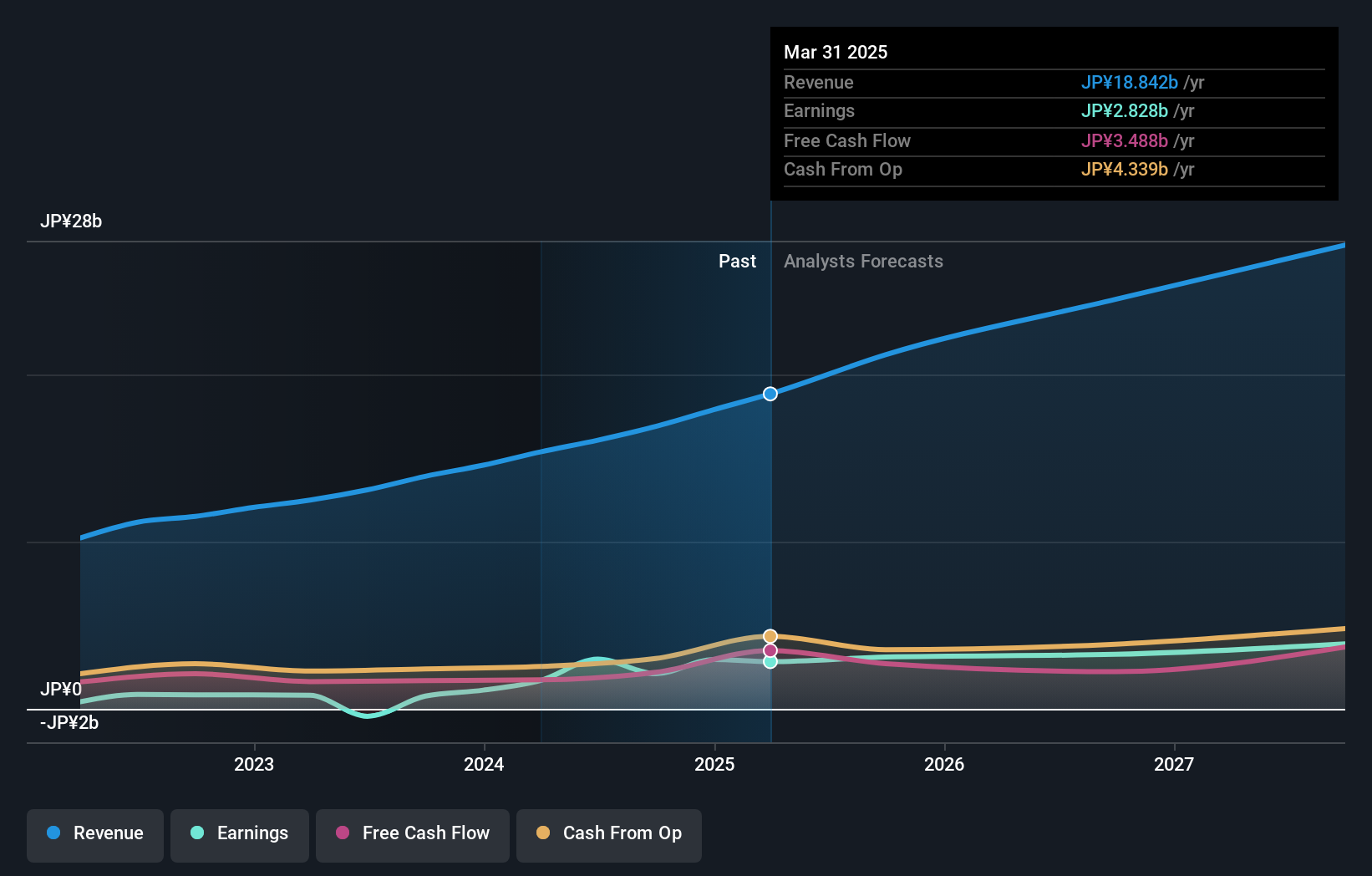

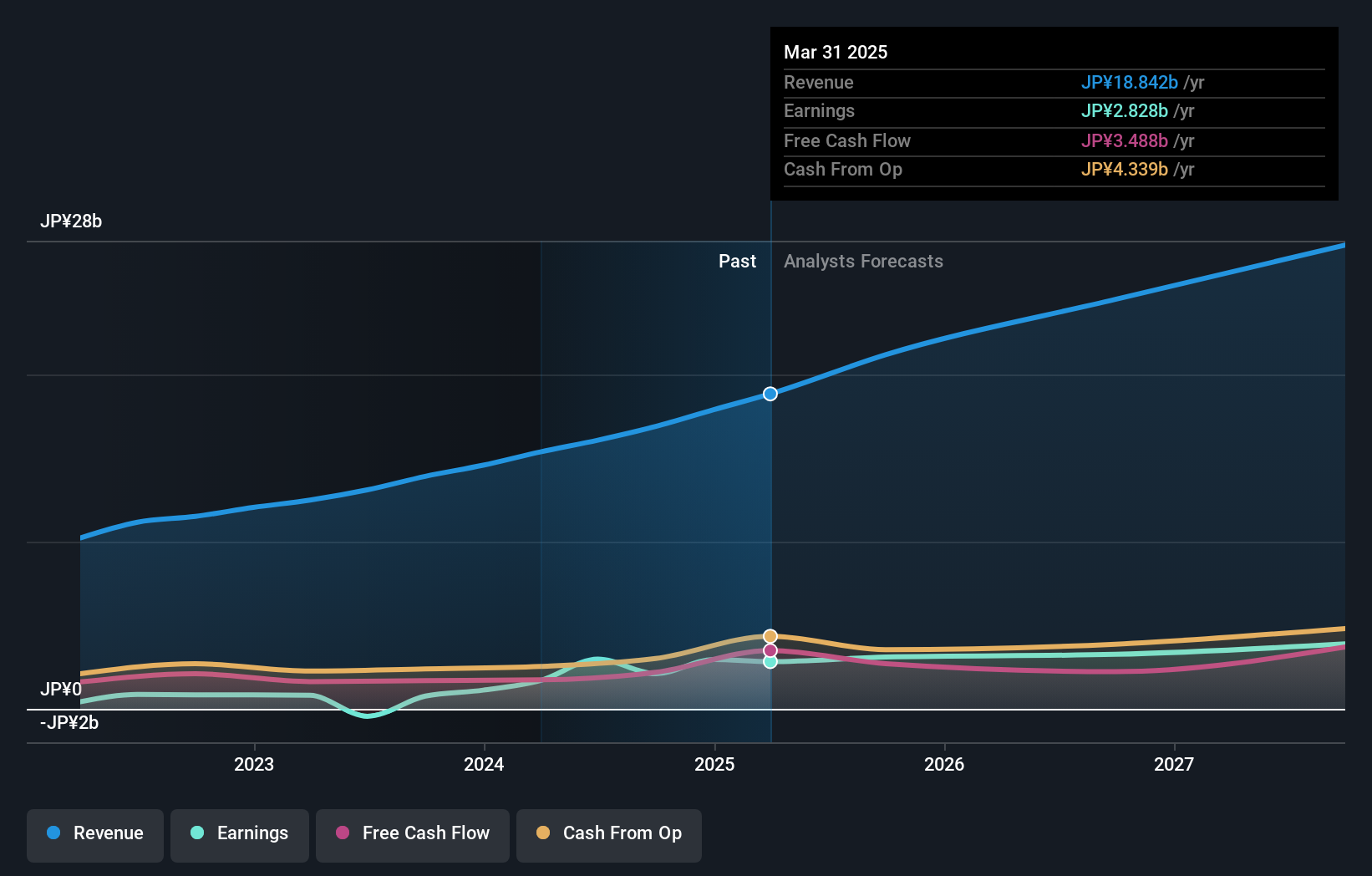

PKSHA Technology, a lesser-known Japanese entity, has shown remarkable financial performance with a 109.7% earnings growth surpassing the industry's 13.1%. With earnings forecasted to grow at 28.8% annually, its robust free cash flow and debt levels well managed—more cash than debt—signal strong fiscal health. Recent corporate guidance anticipates JPY 16.8 billion in net sales and JPY 2 billion profit for the year ending September 2024, reflecting confidence in sustained growth amidst market volatility.

- Take a closer look at PKSHA Technology's potential here in our health report.

Understand PKSHA Technology's track record by examining our Past report.

PKSHA Technology (TSE:3993)

Simply Wall St Value Rating: ★★★★★☆

Overview: PKSHA Technology Inc. specializes in creating algorithmic solutions in Japan, with a market capitalization of ¥116.32 billion.

Operations: This company generates its revenue primarily through the sale of technological solutions, with a consistent gross profit margin averaging around 50% in recent years. The cost of goods sold (COGS) has steadily increased, reflecting the growing scale of its operations, yet it has managed to sustain a notable size of gross profit, indicating effective cost management relative to revenue growth.

PKSHA Technology, a lesser-known Japanese entity, has shown remarkable financial performance with a 109.7% earnings growth surpassing the industry's 13.1%. With earnings forecasted to grow at 28.8% annually, its robust free cash flow and debt levels well managed—more cash than debt—signal strong fiscal health. Recent corporate guidance anticipates JPY 16.8 billion in net sales and JPY 2 billion profit for the year ending September 2024, reflecting confidence in sustained growth amidst market volatility.

- Take a closer look at PKSHA Technology's potential here in our health report.

Understand PKSHA Technology's track record by examining our Past report.

Mizuno (TSE:8022)

Simply Wall St Value Rating: ★★★★★★

Overview: Mizuno Corporation is a global manufacturer and seller of sports products, operating across regions including Japan, Asia, Europe, the Americas, and Oceania, with a market capitalization of ¥198.69 billion.

Operations: This company generates revenue primarily through the sale of goods, reflected in a gross profit margin of 39.59% as of the latest reporting period. Its cost structure is dominated by cost of goods sold (COGS), which accounted for approximately ¥138.77 billion of the total expenses.

Mizuno, a standout in Japan's leisure sector, has demonstrated robust performance with a 44.4% earnings growth over the past year, significantly outpacing the industry average of 14.7%. This growth trajectory is supported by a substantial reduction in debt-to-equity from 21.3% to 8.9%, enhancing financial stability. Trading at 24.2% below its estimated fair value, Mizuno offers potential upside amidst positive free cash flow and sufficient coverage for interest payments, positioning it as an attractive investment prospect within lesser-known Japanese equities.

- Navigate through the intricacies of Mizuno with our comprehensive health report here.

Gain insights into Mizuno's past trends and performance with our Past report.

Mizuno (TSE:8022)

Simply Wall St Value Rating: ★★★★★★

Overview: Mizuno Corporation is a global manufacturer and seller of sports products, operating across regions including Japan, Asia, Europe, the Americas, and Oceania, with a market capitalization of ¥198.69 billion.

Operations: This company generates revenue primarily through the sale of goods, reflected in a gross profit margin of 39.59% as of the latest reporting period. Its cost structure is dominated by cost of goods sold (COGS), which accounted for approximately ¥138.77 billion of the total expenses.

Mizuno, a standout in Japan's leisure sector, has demonstrated robust performance with a 44.4% earnings growth over the past year, significantly outpacing the industry average of 14.7%. This growth trajectory is supported by a substantial reduction in debt-to-equity from 21.3% to 8.9%, enhancing financial stability. Trading at 24.2% below its estimated fair value, Mizuno offers potential upside amidst positive free cash flow and sufficient coverage for interest payments, positioning it as an attractive investment prospect within lesser-known Japanese equities.

- Navigate through the intricacies of Mizuno with our comprehensive health report here.

Gain insights into Mizuno's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 757 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether PKSHA Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3993

PKSHA Technology

Engages in the development of algorithmic solutions in Japan.

Solid track record with excellent balance sheet.