As global markets navigate a complex landscape marked by fluctuating consumer sentiment and shifts in economic activity, Asia presents a unique opportunity for investors seeking potential growth in lesser-known small-cap stocks. In this dynamic environment, identifying promising companies often involves looking beyond headline-grabbing sectors to find businesses with robust fundamentals and the ability to adapt to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Asian Terminals | 26.58% | 10.87% | 15.82% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | NA | 17.03% | 23.40% | ★★★★★★ |

| Allmed Medical ProductsLtd | 13.13% | -2.37% | -30.93% | ★★★★★★ |

| Ningbo Henghe Precision IndustryLtd | 28.88% | 5.90% | 20.75% | ★★★★★★ |

| Center International GroupLtd | 13.20% | -0.33% | -19.78% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| Dura Tek | 1.52% | 68.54% | 50.63% | ★★★★★☆ |

| Hangzhou Zhengqiang | 19.76% | 7.83% | 16.32% | ★★★★★☆ |

| BIOBIJOULtd | 0.07% | 45.63% | 49.17% | ★★★★★☆ |

| Zhejiang Bofay Electric | 39.35% | -1.41% | -47.96% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Zhejiang Zhongcheng Packing Material (SZSE:002522)

Simply Wall St Value Rating: ★★★★★☆

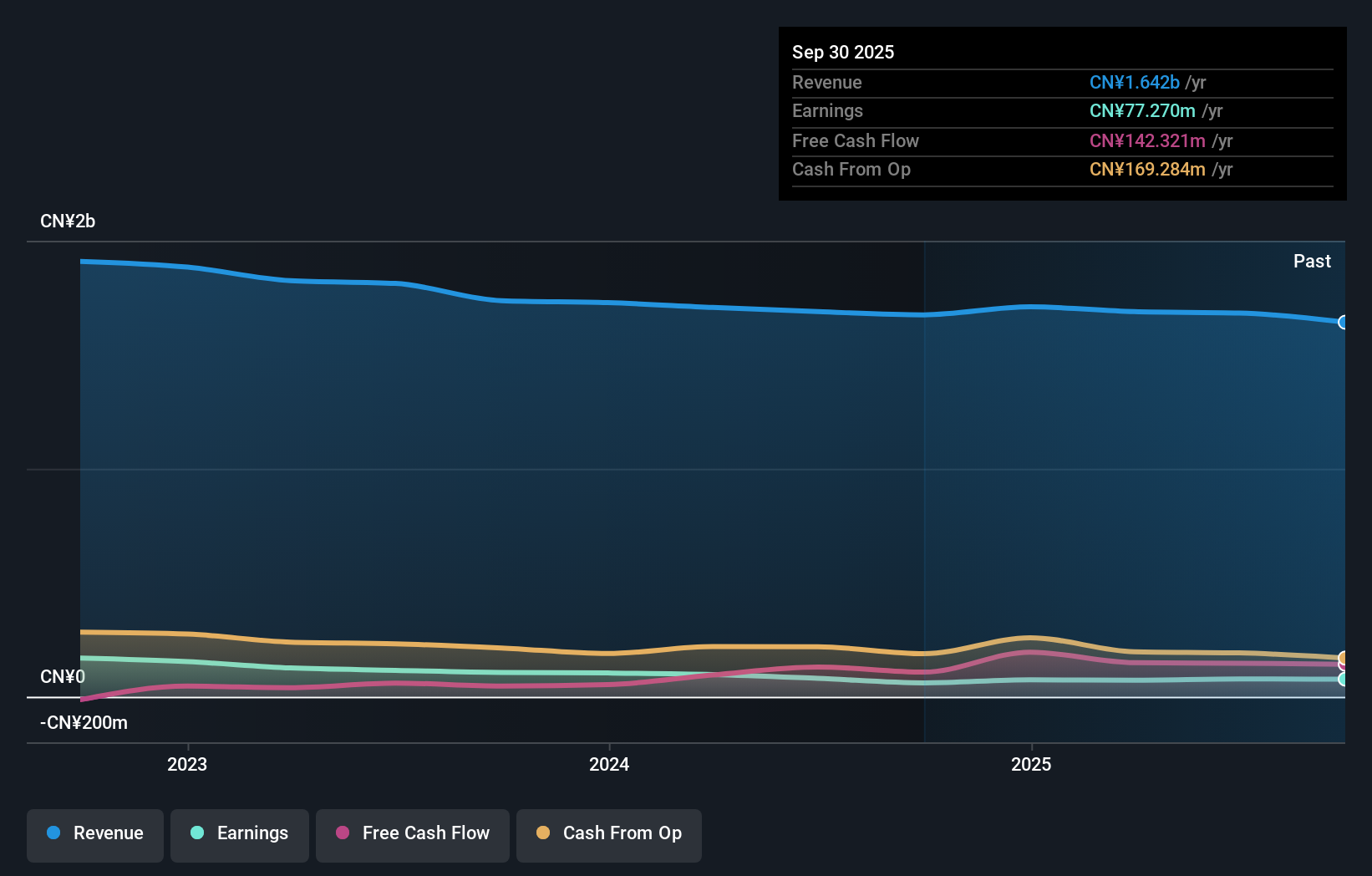

Overview: Zhejiang Zhongcheng Packing Material Co., Ltd. operates in the packaging industry and has a market capitalization of CN¥5.51 billion.

Operations: Zhejiang Zhongcheng Packing Material generates revenue primarily from its packaging products. The company's net profit margin stands at 5.2%, reflecting the efficiency of its operations in converting sales into actual profit.

Zhejiang Zhongcheng Packing Material, a small player in the industry, has shown resilience despite challenges. Its net debt to equity ratio stands at a satisfactory 7%, reflecting prudent financial management. Over the past year, earnings surged by 27.6%, outpacing the Chemicals industry's growth of 6.2%. However, a significant CN¥15M one-off loss impacted recent results. Sales for the nine months ending September 2025 were CN¥1.18 billion compared to last year's CN¥1.25 billion, while net income rose slightly to CN¥47.69 million from CN¥44.59 million previously, indicating steady profitability amidst fluctuating sales figures.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Value Rating: ★★★★★★

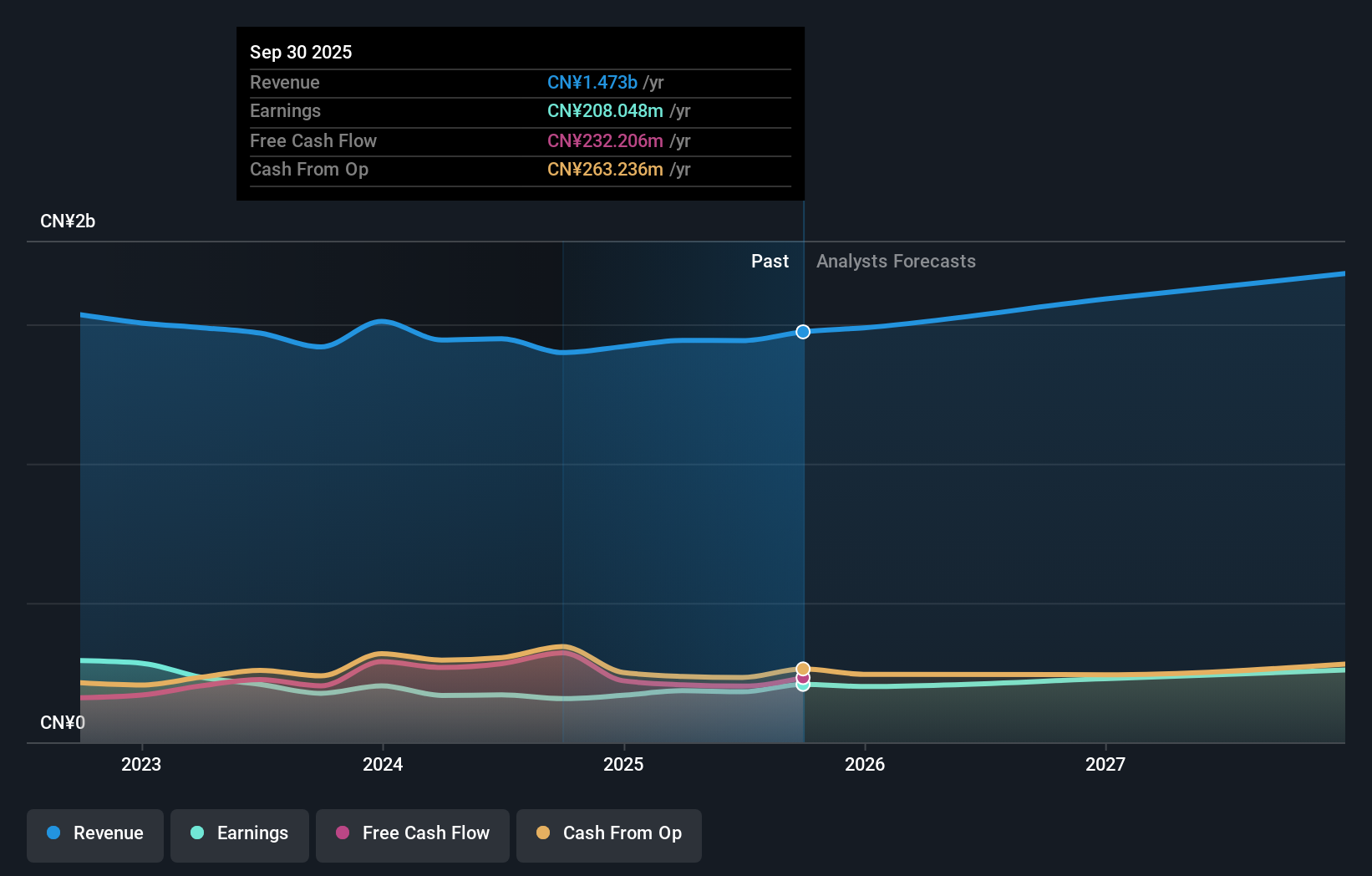

Overview: Beijing SDL Technology Co., Ltd. develops and sells environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥5.95 billion.

Operations: Beijing SDL Technology Co., Ltd. generates revenue primarily from the sale of environmental monitoring equipment and solutions. The company experiences fluctuations in its net profit margin, reflecting variations in cost management and operational efficiency over time.

Beijing SDL Technology, a nimble player in the industry, has shown impressive growth with earnings rising 33% over the past year, outpacing the electronic sector's 9%. The company's debt-to-equity ratio has notably decreased from 21.9% to just 0.4% over five years, indicating improved financial stability. Recent earnings reports highlight sales of CNY 888.29 million for nine months ending September 2025, up from CNY 835.35 million previously, while net income jumped to CNY 115.37 million from CNY 75.85 million last year. With a P/E ratio of 28.6x below China's market average of 45x, SDL appears attractively valued among its peers and industry standards.

Mizuno (TSE:8022)

Simply Wall St Value Rating: ★★★★★★

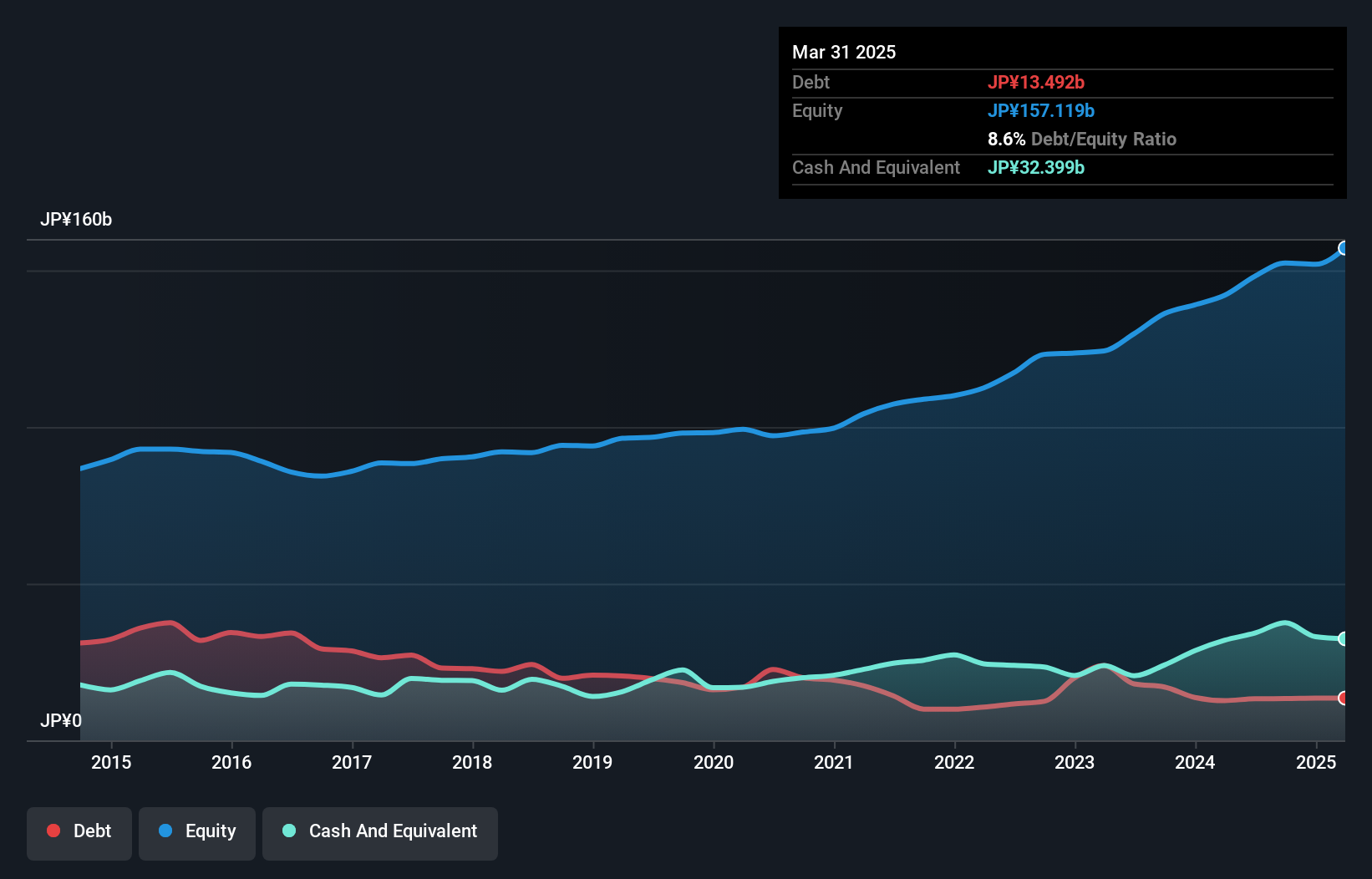

Overview: Mizuno Corporation is a global manufacturer and retailer of sports products, operating across Japan, Asia, Europe, the Americas, and Oceania with a market cap of ¥230.60 billion.

Operations: Mizuno generates revenue primarily from the sale of sports products across multiple regions including Japan, Asia, Europe, the Americas, and Oceania. The company's financial performance is influenced by its ability to manage production costs and operational expenses effectively.

Mizuno, a notable player in the leisure industry, has demonstrated resilience with earnings growth of 16.4% over the past year, outpacing the sector's -10.1%. The company is trading at an attractive 32.9% below its estimated fair value and boasts high-quality earnings. Over five years, Mizuno improved its financial health by reducing its debt-to-equity ratio from 20.3% to 8.3%, while maintaining positive free cash flow and sufficient interest coverage. Recent board decisions on treasury shares for employee incentives reflect strategic moves to enhance stockholder value and align interests with long-term growth objectives.

- Dive into the specifics of Mizuno here with our thorough health report.

Assess Mizuno's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 2425 Asian Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8022

Mizuno

Manufactures and sells sports products in Japan, the rest of Asia, Europe, the Americas, and Oceania.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives