Bandai Namco (TSE:7832): Valuation Check After Upgraded Earnings Outlook and Dividend Boost

Reviewed by Simply Wall St

BANDAI NAMCO Holdings (TSE:7832) caught investors’ attention after the company revised its full-year earnings guidance higher and revealed a second-quarter dividend that more than doubled compared to last year’s payout.

See our latest analysis for BANDAI NAMCO Holdings.

BANDAI NAMCO Holdings’ decision to boost its earnings outlook and lift the interim dividend naturally turned heads, but after a strong run earlier in the year, the share price has recently pulled back, with a 1-day share price return of -7.37% and a 30-day return of -9.67%. Despite the short-term volatility, the company’s one-year total shareholder return is an impressive 41.06%, and its five-year total return sits at 69.6%, suggesting long-term momentum is still very much intact, even as the latest news recalibrates near-term expectations.

If Bandai Namco’s latest moves have you thinking about what else could be on the rise, this is a great moment to explore fast growing stocks with high insider ownership

The question now is whether Bandai Namco’s recent pullback signals a window for investors to buy into future growth at a discount, or if the market has already factored in all the good news ahead.

Most Popular Narrative: 59.9% Overvalued

Bandai Namco’s current share price is running well above the most popular narrative’s estimated fair value, setting up a challenging outlook for value-focused investors eyeing its next move.

Bandai Namco is well-positioned to deliver 6 to 8% compound annual revenue growth over the next five years, supported by its diversified entertainment portfolio and strategic focus on intellectual property (IP) monetization. The company’s growth engine is fueled primarily by its Games segment, which benefits from a robust pipeline of AAA titles and digital distribution channels.

How does a narrative built on ambitious growth projections for multiple divisions still call this stock most overvalued? There is one crucial metric behind the bold valuation call. Want to know what Bandai Namco needs to achieve to hit that target? The numbers might surprise you.

Result: Fair Value of ¥2,797.59 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or waning interest in core franchises could undermine these ambitious growth expectations and reshape investors' outlook in the months ahead.

Find out about the key risks to this BANDAI NAMCO Holdings narrative.

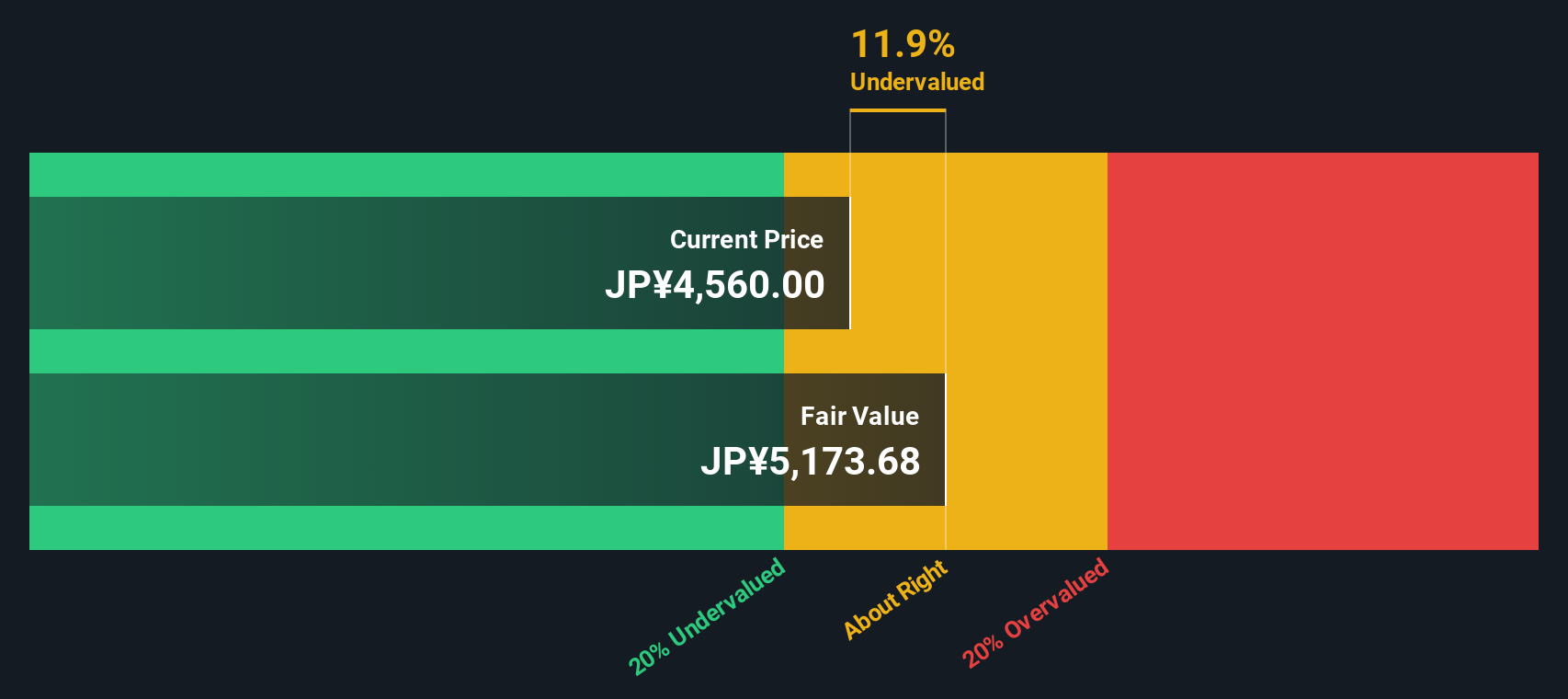

Another View: DCF Model Suggests Undervaluation

Looking through the lens of our DCF model, Bandai Namco appears to be trading about 16.7% below its estimated fair value of ¥5,368.18. This method offers a different perspective compared to the overvalued call based on growth narratives. Does the discounted cash flow approach reveal hidden value or overlook future risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BANDAI NAMCO Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BANDAI NAMCO Holdings Narrative

If you see the story differently or want to dig into the details yourself, you can put together your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BANDAI NAMCO Holdings.

Looking for More Investment Ideas?

Give yourself the edge: the best investors always keep their watchlist fresh. Use these proven ideas to target new opportunities before everyone else does.

- Tap into next-generation tech growth by checking out these 25 AI penny stocks. These are transforming industries with artificial intelligence solutions and scalable digital platforms.

- Seize untapped value by evaluating these 848 undervalued stocks based on cash flows, which have strong financials and might be flying under the radar right now.

- Secure dependable income streams by considering these 17 dividend stocks with yields > 3%. These deliver steady yields above 3% to boost your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BANDAI NAMCO Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7832

BANDAI NAMCO Holdings

Develops entertainment-related products and services worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives