- Japan

- /

- Professional Services

- /

- TSE:9746

TKC (TSE:9746) stock performs better than its underlying earnings growth over last five years

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. But TKC Corporation (TSE:9746) has fallen short of that second goal, with a share price rise of 47% over five years, which is below the market return. Looking at the last year alone, the stock is up 10%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for TKC

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

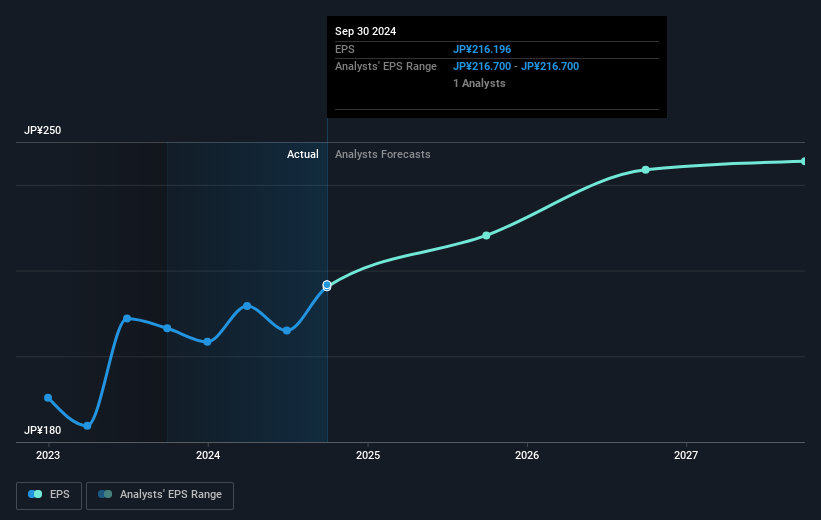

During five years of share price growth, TKC achieved compound earnings per share (EPS) growth of 11% per year. This EPS growth is higher than the 8% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on TKC's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of TKC, it has a TSR of 65% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

TKC's TSR for the year was broadly in line with the market average, at 13%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 11% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Before forming an opinion on TKC you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if TKC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9746

TKC

Operates as a specialized electronic data processing center for accounting firms and local governments in Japan.

Flawless balance sheet established dividend payer.