- Japan

- /

- Commercial Services

- /

- TSE:7846

Evaluating Pilot (TSE:7846): Has the Latest Buyback Unlocked Hidden Value?

Reviewed by Simply Wall St

Pilot (TSE:7846) has caught the market’s attention after announcing it has acquired over 1.2 million treasury shares as part of a buyback plan this quarter. More purchases are expected by December.

See our latest analysis for Pilot.

Pilot’s buyback news comes after a period of mixed momentum for the stock. While the 1-year total shareholder return is down 4.5%, longer-term investors have seen a strong 68% total return over five years. This highlights how much the company’s long game has rewarded patience. The recent buyback announcement has stirred new interest and suggests the company is working to strengthen its value proposition in a year that has otherwise been more subdued for short-term price action.

If the prospect of companies making bold moves for shareholders interests you, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets amid steady growth, investors are left to wonder if Pilot is quietly undervalued or if future upside is already reflected in the price.

Price-to-Earnings of 12.6x: Is it justified?

Pilot’s current price-to-earnings ratio stands at 12.6x, positioning the stock attractively in relation to its last close at ¥4,661 and well below the peer average.

The price-to-earnings (P/E) ratio represents how much investors are willing to pay per yen of earnings. For a company like Pilot, which has demonstrated both steady profit growth and resilience, the P/E ratio helps gauge if shares are priced in line with their underlying profitability.

Pilot is trading at a lower P/E than both the broader JP market and the Commercial Services industry, as well as the calculated “fair” ratio of 17.1x. This suggests that, relative to its sector and based on expected profits, the stock may be underappreciated and potentially positioned for a re-rating should earnings momentum persist.

Explore the SWS fair ratio for Pilot

Result: Price-to-Earnings of 12.6x (UNDERVALUED)

However, risks remain, including volatility in short-term returns and potential earnings disappointments. Both factors could dampen the positive outlook around Pilot’s valuation.

Find out about the key risks to this Pilot narrative.

Another View: What Does the SWS DCF Model Say?

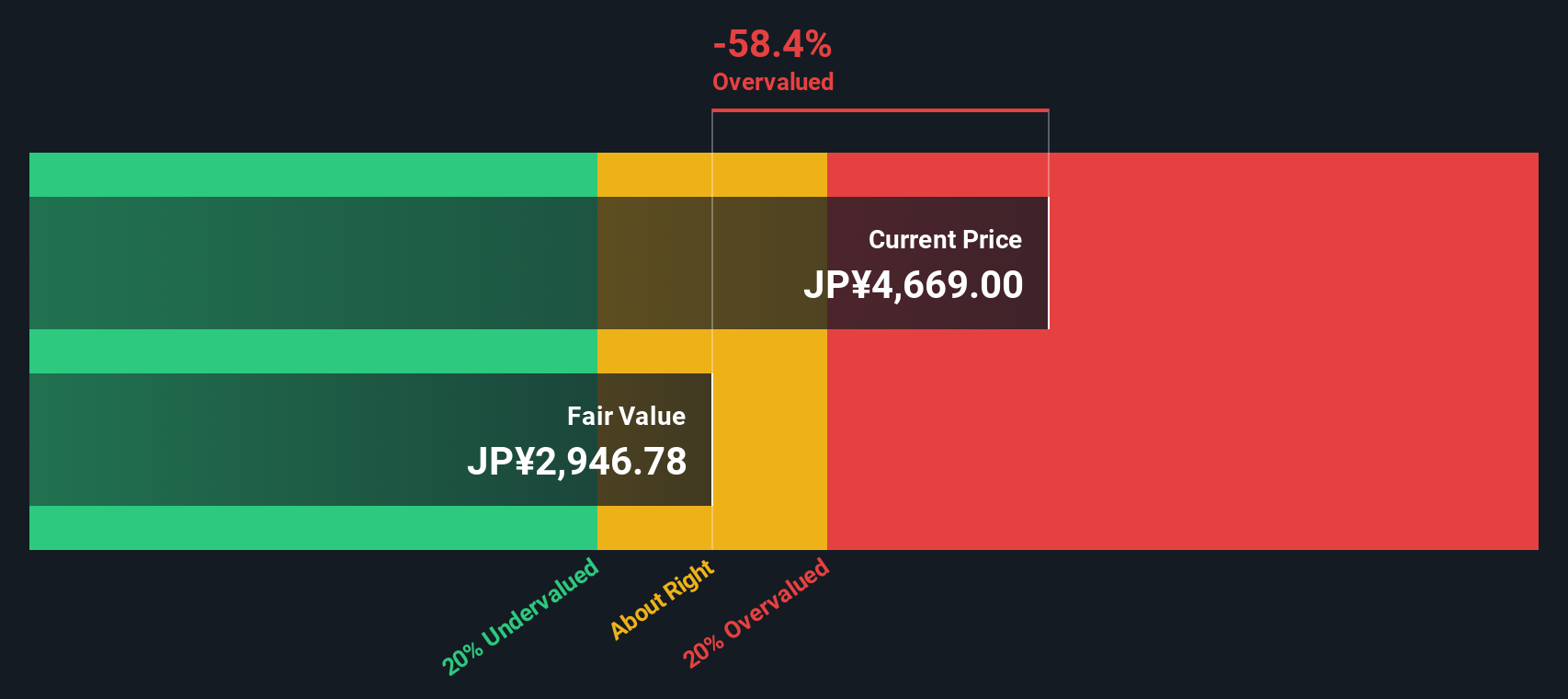

Looking at Pilot’s valuation through our DCF model gives a very different picture. The SWS DCF model estimates fair value at ¥2,946.78, which means the shares are currently trading well above this level. While multiples suggest undervaluation, the DCF view hints at the possibility of over-optimism. Is the true worth somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pilot for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pilot Narrative

If you have a different view or want to dig into the numbers on your own terms, you can craft your own perspective on Pilot in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Pilot.

Looking for more investment ideas?

Turn inspiration into action and seize opportunities others might miss by uncovering standout stocks beyond the headlines. Find your next advantage now with these handpicked screens:

- Target outsized income with market leaders offering impressive yields by using these 17 dividend stocks with yields > 3%.

- Fuel your portfolio’s growth with transformative breakthroughs in medicine by exploring these 32 healthcare AI stocks.

- Catch the best values before the crowd by seeking out these 860 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7846

Pilot

Engages in the manufacturing, purchase, and sale of writing instruments and other stationery goods in Japan, the United States, Europe, and Asia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives