- Japan

- /

- Professional Services

- /

- TSE:6028

TechnoPro Holdings (TSE:6028): A Closer Look at the Current Valuation and Investor Expectations

Reviewed by Simply Wall St

Most Popular Narrative: 24.8% Overvalued

The dominant narrative sees TechnoPro Holdings as priced above its fair value right now. Analyst projections point to significant long-term growth, but the current stock price reflects higher expectations than their consensus suggests.

"The focus on expanding solution business offerings, which have higher value and margin, is likely to contribute to overall revenue growth and enhance net margins over time. The recruitment of inexperienced engineers with a subsequent focus on their training provides potential for long-term growth through increased operational capacity and can stabilize SG&A ratios."

Curious about what’s fueling this lofty valuation? The narrative reveals the bold moves and ambitious expansion tactics that underpin analysts' projections. It also hints at growth strategies and future profit margins typically seen at market leaders. What's the roadmap guiding this high fair value? Dive deeper to discover the underlying assumptions that set these targets apart from the market’s expectations.

Result: Fair Value of ¥3,868 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising wage pressures and high turnover rates could narrow margins. These factors present real challenges to TechnoPro Holdings’ optimistic growth narrative.

Find out about the key risks to this TechnoPro Holdings narrative.Another View: A Different Method, A Different Story

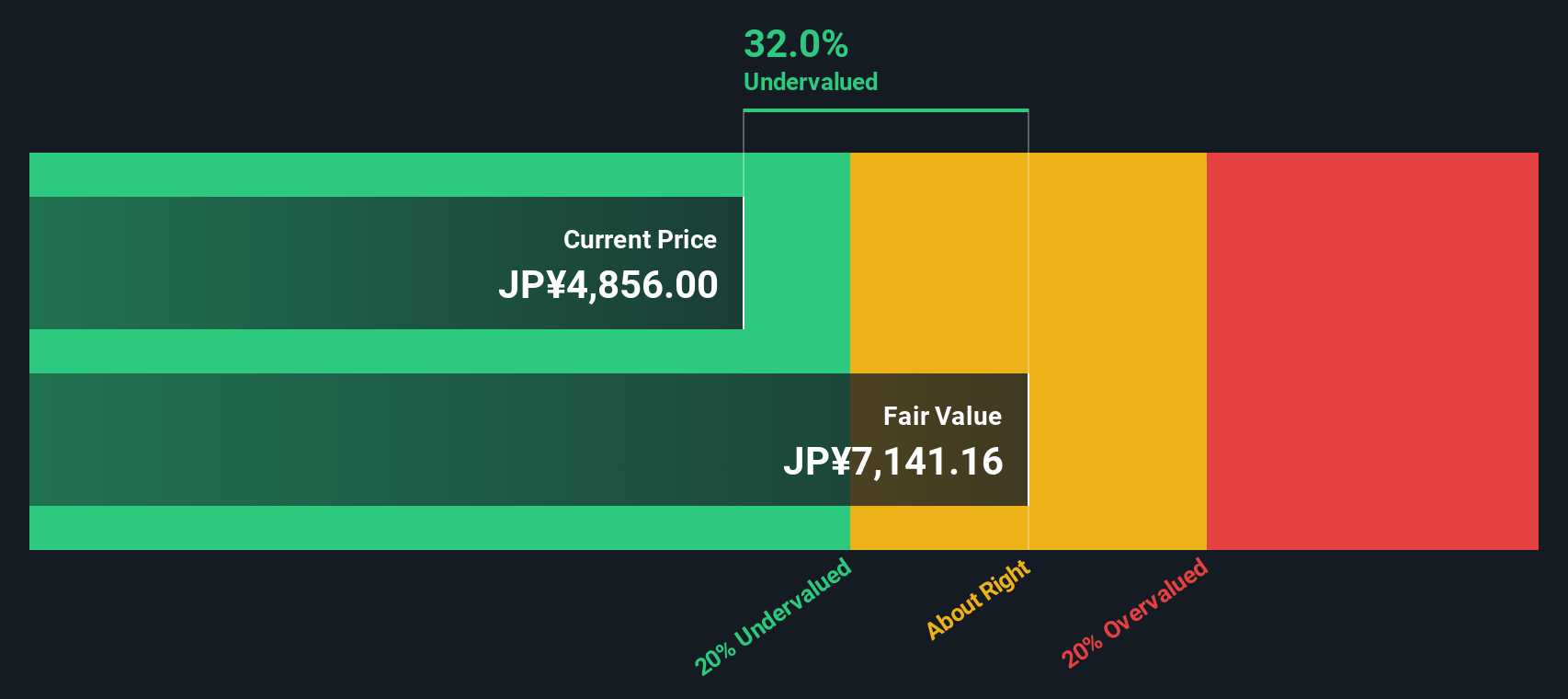

While the analyst narrative sees the stock as overvalued, our DCF model tells a contrasting story. Using this approach, TechnoPro Holdings appears undervalued compared to its long-term cash flow outlook. Which perspective makes more sense for you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TechnoPro Holdings Narrative

If you think there’s more to the numbers or want to follow your own process, you can put together a narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TechnoPro Holdings.

Looking for more investment ideas?

Make your next move confidently by tapping into top-rated strategies that investors are watching. If you only stick to one stock, you could miss these opportunities:

- Tap into the energy of cutting-edge biotechnology by starting with healthcare AI stocks. See which medical innovators are transforming patient care with artificial intelligence.

- Catch tomorrow’s market leaders before the crowd by exploring penny stocks with strong financials. This selection features small companies backed by strong fundamentals and notable growth potential.

- Secure potential bargains by using undervalued stocks based on cash flows to track down quality stocks trading below their true worth, as identified through deep cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnoPro Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6028

TechnoPro Holdings

Through its subsidiaries, operates as a temporary staffing and contract work company in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives