- Japan

- /

- Semiconductors

- /

- TSE:8035

DIP And 2 Other Japanese Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

Amidst the recent declines in Japan's stock markets, with the Nikkei 225 Index and TOPIX Index both experiencing notable drops, investors are keenly observing potential opportunities that may arise from current market uncertainties. Identifying undervalued stocks during such periods can be advantageous, as these stocks might offer value that is not yet recognized by the broader market, particularly when economic conditions create temporary price distortions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CURVES HOLDINGS (TSE:7085) | ¥803.00 | ¥1529.67 | 47.5% |

| Avant Group (TSE:3836) | ¥2122.00 | ¥3952.13 | 46.3% |

| Pilot (TSE:7846) | ¥4764.00 | ¥8938.01 | 46.7% |

| Forum Engineering (TSE:7088) | ¥874.00 | ¥1607.20 | 45.6% |

| Adventure (TSE:6030) | ¥3800.00 | ¥7310.01 | 48% |

| S-Pool (TSE:2471) | ¥355.00 | ¥688.70 | 48.5% |

| KeePer Technical Laboratory (TSE:6036) | ¥4105.00 | ¥7848.89 | 47.7% |

| BayCurrent Consulting (TSE:6532) | ¥4950.00 | ¥9318.36 | 46.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥4245.00 | ¥7972.52 | 46.8% |

| Mercari (TSE:4385) | ¥2090.00 | ¥4166.17 | 49.8% |

Let's dive into some prime choices out of the screener.

DIP (TSE:2379)

Overview: DIP Corporation, with a market cap of ¥139.54 billion, is a labor force solution company offering personnel recruiting services in Japan.

Operations: DIP Corporation generates revenue from its personnel recruiting services in Japan.

Estimated Discount To Fair Value: 40.2%

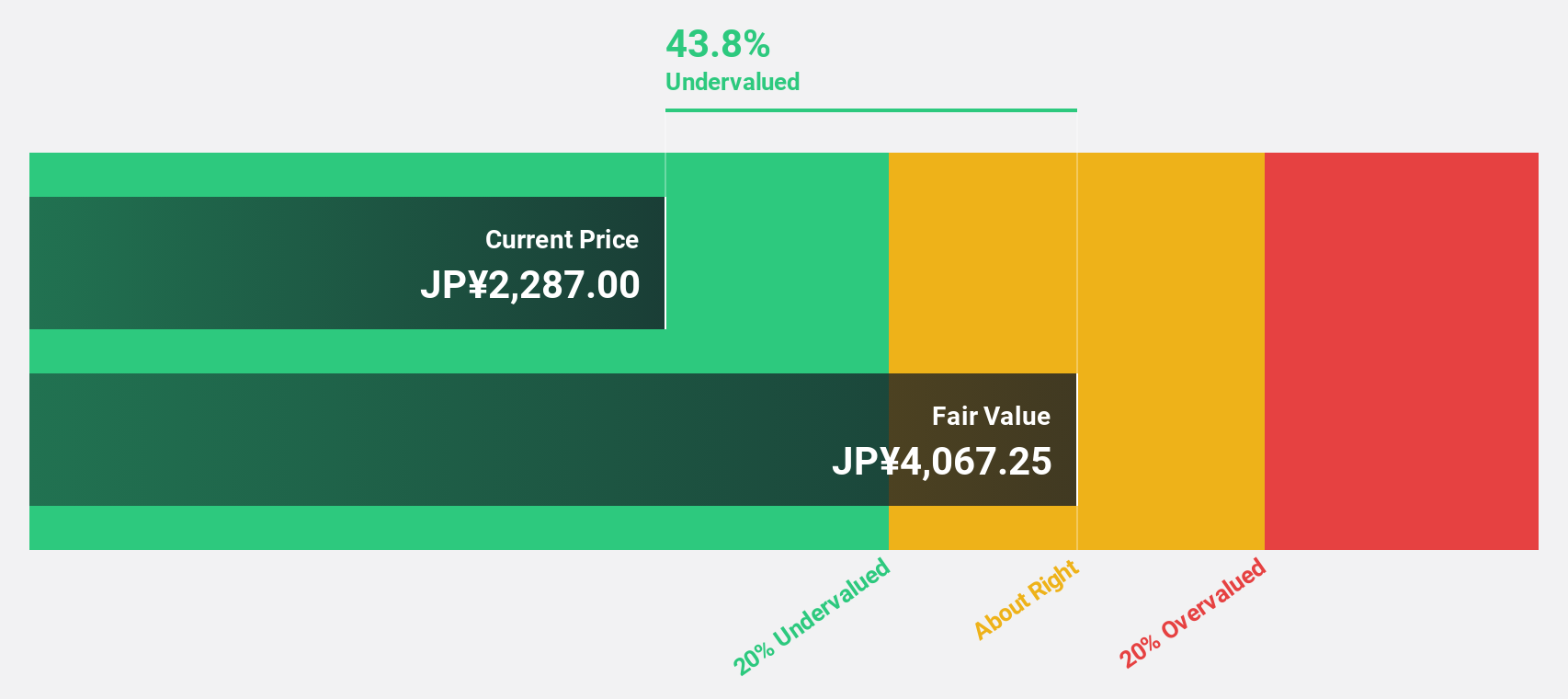

DIP is trading at ¥2667, significantly below its estimated fair value of ¥4456.18, indicating potential undervaluation based on cash flows. Earnings are projected to grow at 14.1% annually, outpacing the JP market's average growth rate. Recent developments include a dividend increase from ¥40 to ¥47 per share and strategic organizational changes to enhance AI-Agent services. The company also completed a share buyback worth approximately ¥5 billion, reflecting confidence in its valuation and future prospects.

- The analysis detailed in our DIP growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of DIP.

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan and has a market cap of ¥92.19 billion.

Operations: The company generates revenue primarily from its Beverage and Leaf Business segment, which amounts to ¥39.57 billion.

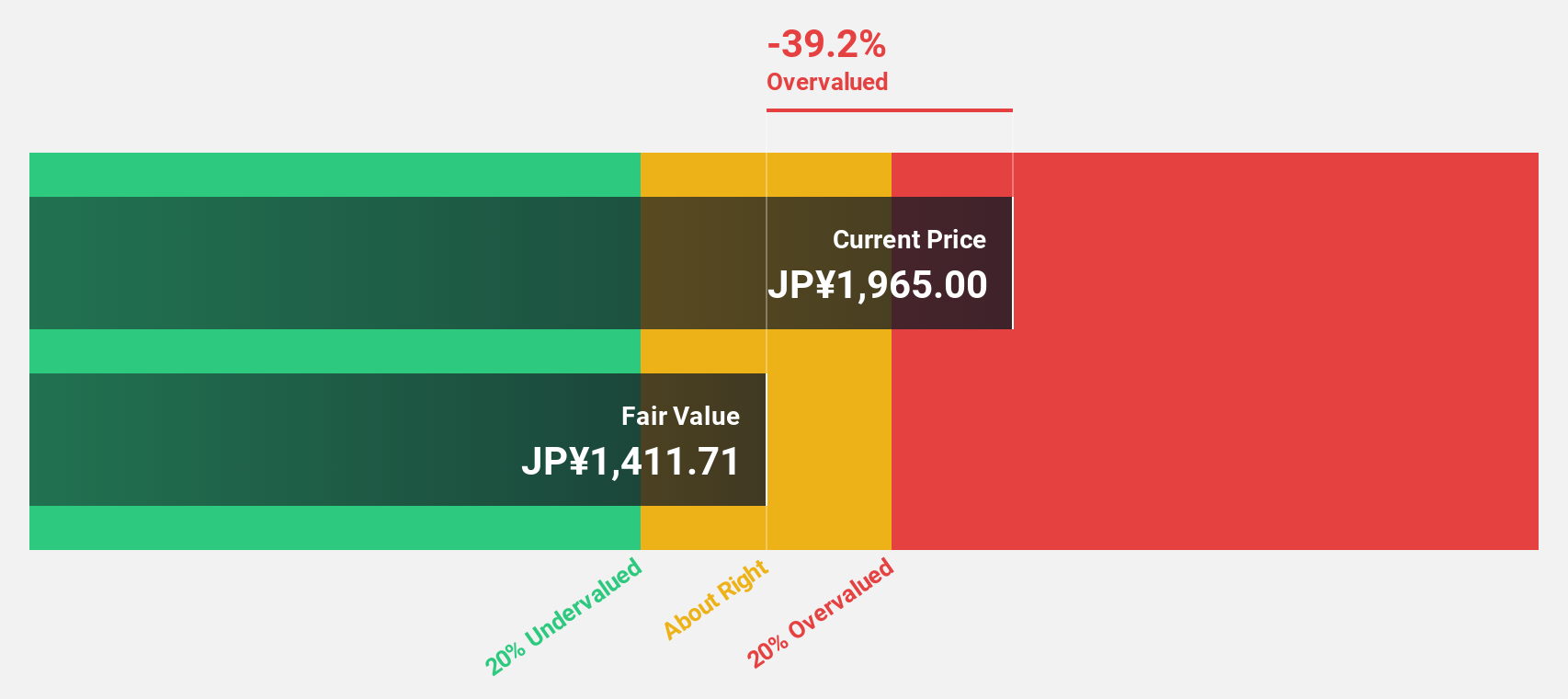

Estimated Discount To Fair Value: 32.4%

Lifedrink Company is trading at ¥1764, notably below its estimated fair value of ¥2608.82, highlighting potential undervaluation based on cash flows. Despite high debt levels and recent volatility, the company's earnings grew by 30.5% last year and are forecast to grow 12.11% annually, surpassing the JP market's growth rate of 8.7%. A recent 4:1 stock split in September may also influence investor perception and liquidity positively.

- Our growth report here indicates Lifedrink Company may be poised for an improving outlook.

- Click here to discover the nuances of Lifedrink Company with our detailed financial health report.

Tokyo Electron (TSE:8035)

Overview: Tokyo Electron Limited, along with its subsidiaries, is engaged in the development, manufacturing, and sales of semiconductor and flat panel display production equipment across various global markets, with a market cap of approximately ¥10.99 trillion.

Operations: The company's revenue is primarily derived from its Semiconductor Production Equipment segment, which generated approximately ¥1.99 trillion.

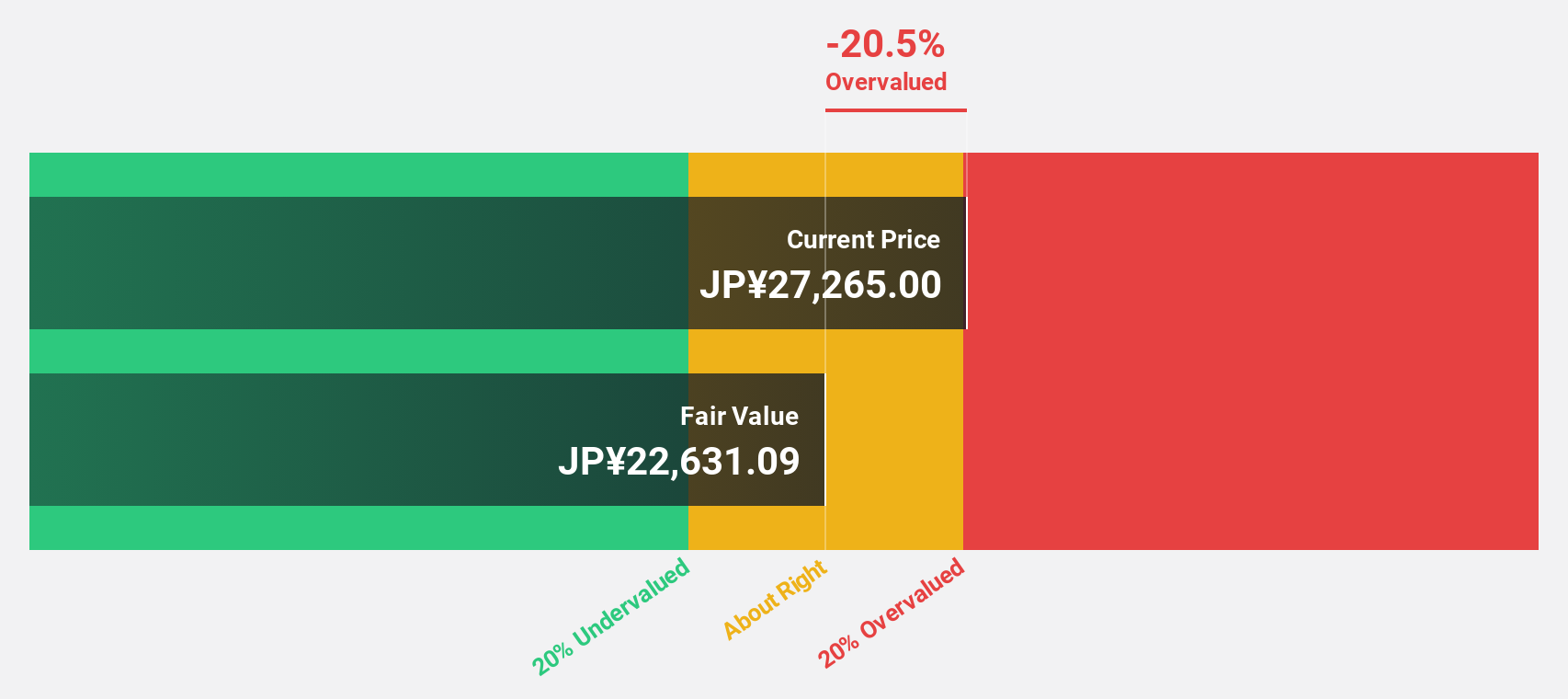

Estimated Discount To Fair Value: 10.8%

Tokyo Electron is trading at ¥23,860, below its estimated fair value of ¥26,754.60, indicating potential undervaluation. Recent earnings guidance revisions show increased net sales and operating income expectations for the fiscal year ending March 2025. While earnings are forecast to grow 15.2% annually—faster than the JP market's 8.7%—the stock remains volatile with an unstable dividend track record. Despite this volatility, revenue growth projections exceed the market average at 11.9% per year.

- According our earnings growth report, there's an indication that Tokyo Electron might be ready to expand.

- Unlock comprehensive insights into our analysis of Tokyo Electron stock in this financial health report.

Summing It All Up

- Get an in-depth perspective on all 86 Undervalued Japanese Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8035

Tokyo Electron

Develops, manufactures, and sells semiconductor and flat panel display (FPD) production equipment in Japan, Europe, North America, Taiwan, China, South Korea, Southeast Asia, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.