- Japan

- /

- Professional Services

- /

- TSE:2153

E J Holdings (TSE:2153) Margin Decline Challenges Value Narrative Despite Profit Growth

Reviewed by Simply Wall St

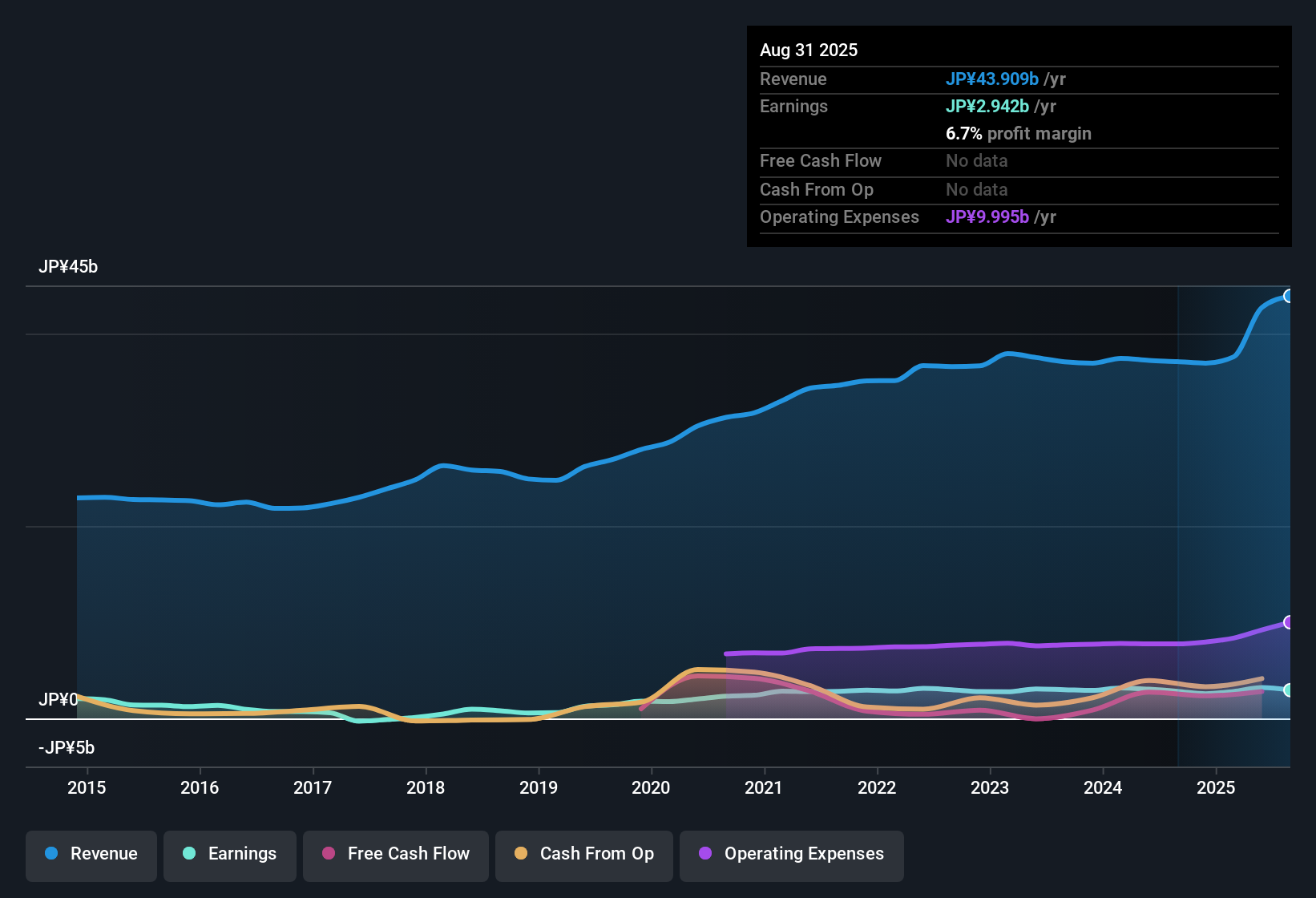

E J Holdings (TSE:2153) reported profit growth accelerating to 4.4% over the past year, building on a steady 2.4% annual earnings pace from the last five years. Net profit margins sit at 6.7%, down compared to last year's 7.6%, while shares currently trade at ¥1,688, well below the estimated fair value of ¥3,535.98. The combination of high-quality earnings and a price-to-earnings ratio under industry averages highlights solid value for investors, even as margin pressure and dividend risks draw attention.

See our full analysis for E J Holdings.The next section takes these earnings numbers and puts them head-to-head with the prevailing narratives from analysts and the community, spotlighting where the consensus holds up and where it might get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Outpaces Five-Year Average

- Profit growth accelerated to 4.4% over the latest year, moving faster than the company’s prior five-year annual pace of 2.4%, even as net profit margins slipped to 6.7% from last year’s 7.6%.

- The step up in annual profit expansion heavily supports the narrative that E J Holdings’ business remains resilient, especially as high-quality earnings are confirmed in the filing.

- Steady profit growth impresses relative to peers, hinting at solid strategic execution despite a moderate margin decrease.

- What is notable is that this improved pace emerges alongside lower net margins, suggesting that underlying business growth is making up for cost pressures.

Margin Pressure Persists Despite Quality Earnings

- Net profit margin slipped from 7.6% last year to 6.7% this period, flagging a dip in profitability even as profits rose on an absolute basis.

- The margin trend reveals more pressure than might be implied by the headline profit figure. It highlights that as costs edge higher or pricing tightens, ongoing earnings quality is at risk of being undercut by future margin erosion.

- Critics highlight that, without margin stabilization, sustaining both growth and returns for shareholders could become more challenging, especially if competitive or sector dynamics worsen.

- This tension is deeper than it first appears; bears point to the erosion as a reason to be wary, even with profit growth still positive.

Share Valuation Stands Out Versus Industry

- Shares currently trade at ¥1,688, not only below the estimated DCF fair value of ¥3,535.98 but also with a price-to-earnings (P/E) ratio of 10.3x, significantly below both the Japanese professional services industry average of 15.9x and peers at 21.5x.

- The valuation gap underscores a key discussion point for investors. The prevailing market view sees E J Holdings as undervalued on multiple fronts, yet persistent margin pressures may justify continued caution among more skeptical buyers.

- Analysts and investors will be watching to see if the current discount attracts buying interest or if operational risks keep a lid on rerating potential.

- With shares so far below fair value and sector multiples, the real question is whether fundamentals can improve enough to close that gap in the months ahead.

If you want the full story behind this valuation and what could drive the next move, check out the key arguments in the complete consensus narrative for E J Holdings. 📊 Read the full E J Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on E J Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite reporting profit growth, E J Holdings continues to face margin pressure and risks around sustaining both earnings quality and shareholder returns.

If you want reliable performance without those margin worries, compare with stable growth stocks screener that consistently deliver strong, stable earnings across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E J Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2153

E J Holdings

Through its subsidiaries, engages in the civil engineering consultant business in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives