How Investors May Respond To MISUMI Group (TSE:9962) Raising Full-Year Guidance After Fictiv Acquisition

Reviewed by Sasha Jovanovic

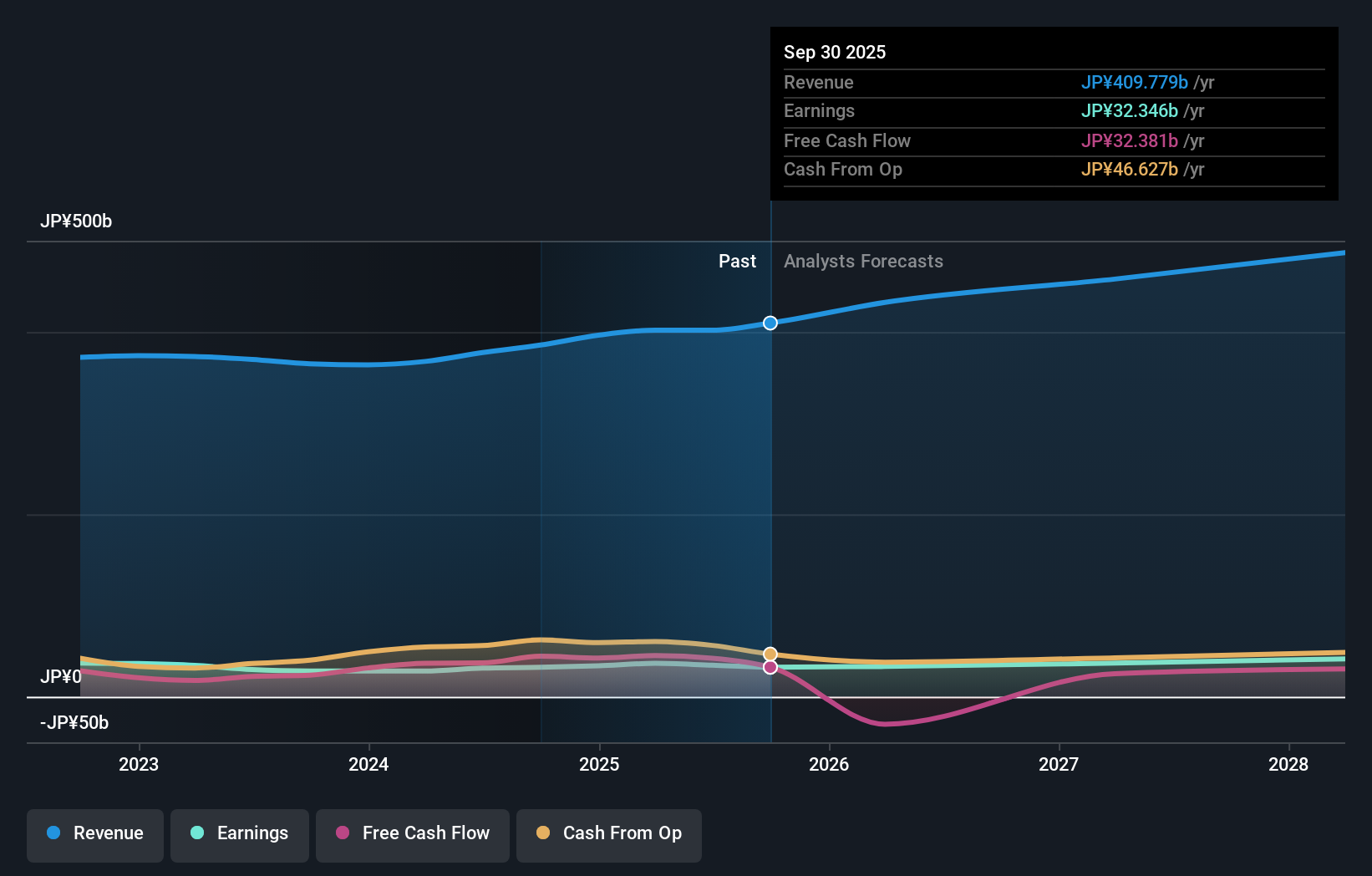

- On October 31, 2025, MISUMI Group Inc. announced an upward revision to its full-year earnings and year-end dividend guidance for the fiscal year ending March 2026, citing steady business progress and a positive contribution from its acquisition of Fictiv Inc.

- This announcement comes despite a challenging environment in the automotive sector and follows a slight decrease in the interim dividend compared to the previous year.

- We'll explore how the increased earnings guidance and Fictiv Inc.’s performance inform the MISUMI Group investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is MISUMI Group's Investment Narrative?

To stand behind MISUMI Group as a shareholder, you need conviction in its ability to keep expanding despite a less supportive backdrop, especially in the automotive sector and ongoing global uncertainties. The October 31 announcement, which revealed higher full-year earnings and a revised year-end dividend, points to a positive shift in short-term momentum, especially since much of this boost appears tied to the acquisition of Fictiv Inc. This move could deepen MISUMI’s digital integration and help diversify growth beyond its more challenged automotive segment. Prior analysis identified sluggish profit acceleration, underperformance versus both peers and the wider market, and an unstable dividend as key risks. While this latest guidance lift is a notable short-term catalyst that offsets some earlier concerns, it does not wipe away the risks of rapid sector changes or the potential for ongoing earnings volatility. Yet, dividend consistency remains a question for prudent investors.

MISUMI Group's shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MISUMI Group - why the stock might be worth just ¥2875!

Build Your Own MISUMI Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MISUMI Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MISUMI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MISUMI Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9962

MISUMI Group

Engages in the factory automation, die components, and VONA businesses in Japan, China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives