- Japan

- /

- Trade Distributors

- /

- TSE:9824

Undiscovered Gems in Japan Top Stocks to Watch This August 2024

Reviewed by Simply Wall St

Japan's stock markets have experienced significant volatility recently, driven by a rebounding yen and the Bank of Japan's hawkish turn. Despite these fluctuations, the Nikkei 225 Index and TOPIX Index managed to recoup much of their losses by week's end. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. Here are three undiscovered gems in Japan that are worth watching this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| Kondotec | 11.75% | 6.85% | 2.62% | ★★★★★☆ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Dear LifeLtd | 114.72% | 18.20% | 17.66% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Matsumoto Yushi-SeiyakuLtd (TSE:4365)

Simply Wall St Value Rating: ★★★★★★

Overview: Matsumoto Yushi-Seiyaku Co., Ltd. manufactures and markets fiber and textile chemicals, microcapsules, various surfactants, and high polymer-based products in Japan and Indonesia with a market cap of ¥53.56 billion.

Operations: The company's revenue streams primarily derive from the sale of fiber and textile chemicals, microcapsules, various surfactants, and high polymer-based products in Japan and Indonesia. The net profit margin for the latest fiscal year stands at 8.75%.

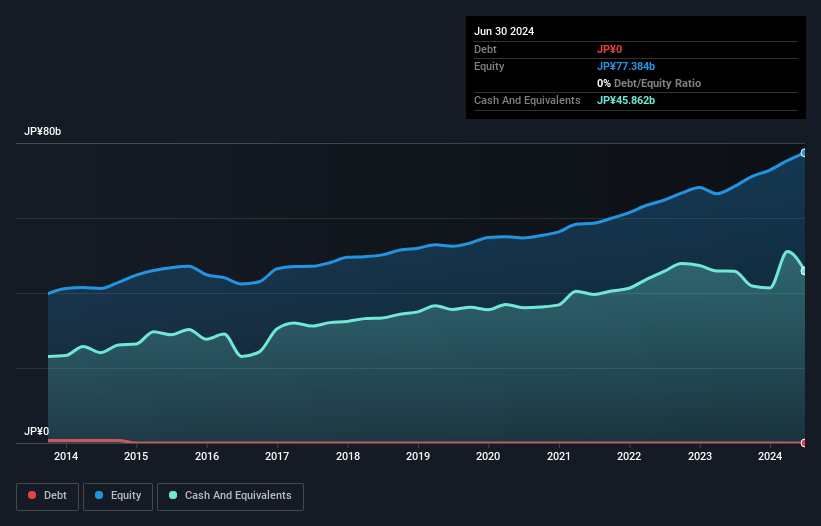

Matsumoto Yushi-Seiyaku Ltd. has shown impressive growth, with earnings up 16.1% over the past year, outpacing the Chemicals industry’s 9.9%. Trading at 66.8% below its estimated fair value, it represents a significant opportunity for investors. The company is debt-free and has been for five years, indicating strong financial health and stability. With high-quality earnings reported consistently, Matsumoto Yushi-Seiyaku stands out as a promising investment in Japan's market.

- Click to explore a detailed breakdown of our findings in Matsumoto Yushi-SeiyakuLtd's health report.

PIOLAX (TSE:5988)

Simply Wall St Value Rating: ★★★★★★

Overview: PIOLAX, Inc. designs, develops, produces, and sells various parts and products for automotive, medical, consumer, and security industries globally with a market cap of ¥81.33 billion.

Operations: PIOLAX generates revenue primarily from two segments: Automobile-Related products contributing ¥59.80 billion and Medical Equipment generating ¥4.75 billion. The company operates in Japan, the rest of Asia, the United States, Europe, and internationally.

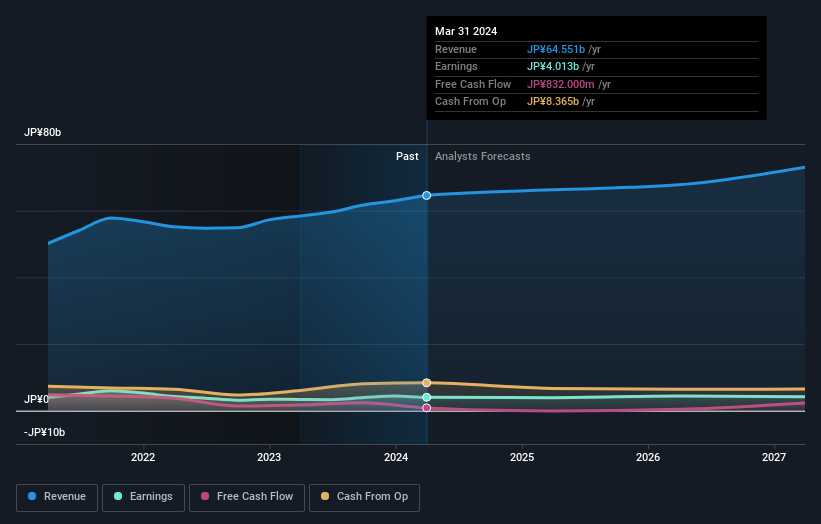

PIOLAX, a small player in Japan's auto components sector, has shown an 18.9% earnings growth over the past year, though this lags behind the industry's 29.6%. The company remains debt-free, eliminating concerns about interest coverage and highlighting financial prudence. Despite shareholders experiencing dilution in the past year, PIOLAX is forecasted to grow earnings by 2.99% annually and boasts high-quality earnings. Their free cash flow stands positive, reinforcing their stable financial footing amidst industry competition.

- Navigate through the intricacies of PIOLAX with our comprehensive health report here.

Understand PIOLAX's track record by examining our Past report.

Senshu ElectricLtd (TSE:9824)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senshu Electric Co., Ltd. trades in various cables, wires, and materials related to electrical construction work in Japan with a market cap of ¥85.78 billion.

Operations: Senshu Electric Co., Ltd. generates revenue primarily from the sale of cables, wires, and electrical construction materials. The company's net profit margin is 3.45%.

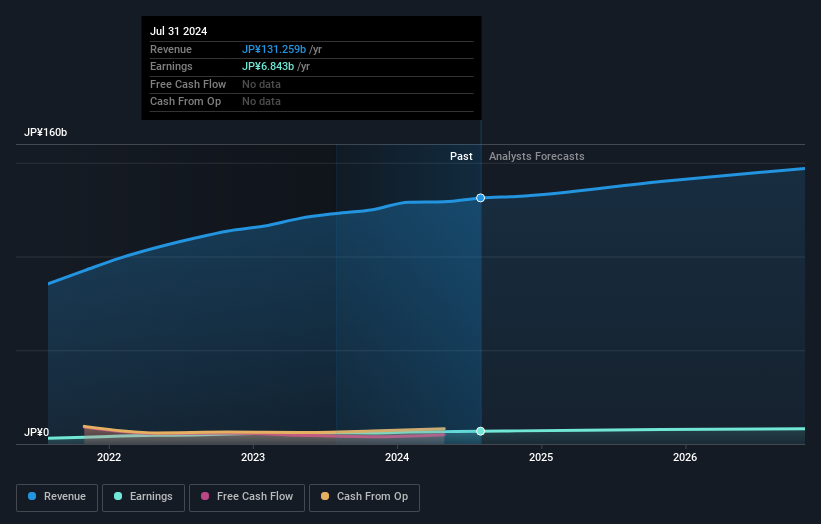

Senshu Electric Ltd., a small cap Japanese company, has shown impressive growth with earnings increasing by 13.5% over the past year, outpacing the Trade Distributors industry’s 6.5%. The firm’s debt to equity ratio rose from 0.3% to 1.5% in five years, indicating increased leverage but remains manageable as it holds more cash than total debt. Recently, Senshu repurchased 60,100 shares for ¥315 million and announced a dividend increase to ¥65 per share for Q2 of FY2024.

- Unlock comprehensive insights into our analysis of Senshu ElectricLtd stock in this health report.

Examine Senshu ElectricLtd's past performance report to understand how it has performed in the past.

Next Steps

- Unlock our comprehensive list of 736 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9824

Senshu ElectricLtd

Trades in various cables, wires, and materials related to electrical construction work in Japan.

Excellent balance sheet established dividend payer.