- Japan

- /

- Trade Distributors

- /

- TSE:8058

Assessing Mitsubishi’s Value After New Strategic Moves and a 40.5% Annual Gain

Reviewed by Bailey Pemberton

- Thinking about the true value behind Mitsubishi’s stock? You’re not alone, especially with all the chatter around its potential these days.

- While the past week saw Mitsubishi slip by 2.0%, the stock is still up an eye-catching 40.5% so far this year and has soared 420.6% over the past five years. This is fueling plenty of investor curiosity.

- Much of the interest lately has been sparked by reports of Mitsubishi’s new strategic ventures in renewable energy and overseas expansion. The coverage has put a spotlight on the company’s adaptability, as well as how recent deals could reshape its growth story and risk profile.

- Despite these developments, Mitsubishi currently scores just 1 out of 6 on our valuation checks, hinting at areas where the market may be getting ahead of itself. We will unpack those numbers and compare valuation approaches, but stick around for the end where we reveal a more insightful way to judge Mitsubishi’s true worth.

Mitsubishi scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mitsubishi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those projections back to today's value. This approach helps investors gauge what a business is truly worth, rather than relying solely on market sentiment or recent price changes.

Mitsubishi's current Free Cash Flow (FCF) stands at approximately ¥728.9 billion. Analysts offer detailed forecasts only through 2030, indicating a projected FCF of ¥712.0 billion by then. For the years after analyst coverage, projections are extrapolated based on trends by Simply Wall St. Over the next ten years, these future cash flows decline gradually, eventually reaching roughly ¥416.5 billion in 2035 as estimated by the model.

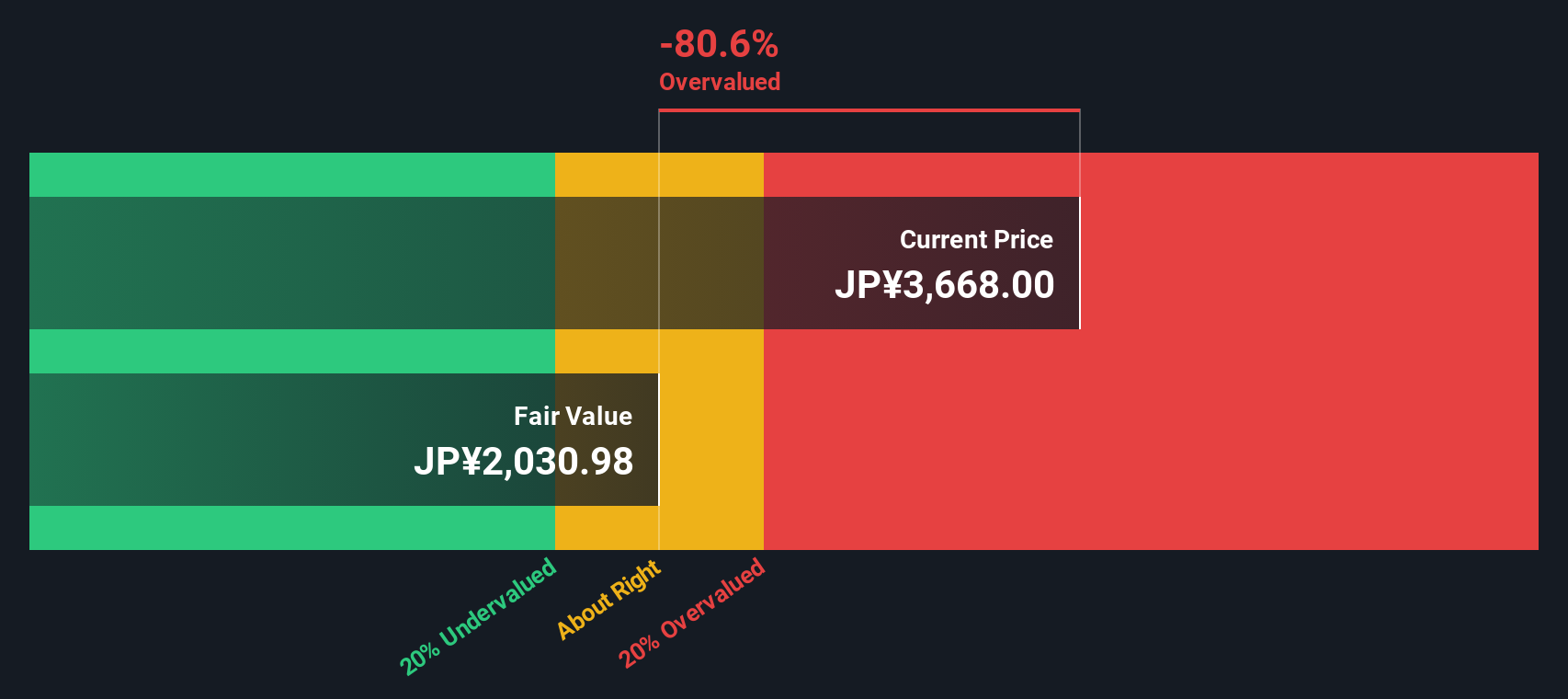

After calculating these cash flows with the 2 Stage Free Cash Flow to Equity model, the DCF analysis delivers an intrinsic value of ¥2,030 per share for Mitsubishi. However, compared to Mitsubishi's current market price, this implies the stock is trading at a 79.2% premium, which signals significant overvaluation based on these long-term cash flow forecasts.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mitsubishi may be overvalued by 79.2%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Mitsubishi Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as a fundamental yardstick for valuing profitable companies. For investors, it offers a straightforward way to measure how much they are paying for each unit of earnings, making it particularly useful for stable, established businesses like Mitsubishi that consistently generate profits.

Growth prospects and perceived risks play a big part in determining what a "normal" or "fair" PE ratio should be. Rapidly growing companies typically command higher PE ratios, reflecting optimism in future profit expansion, while firms facing greater uncertainty or slower growth warrant lower multiples.

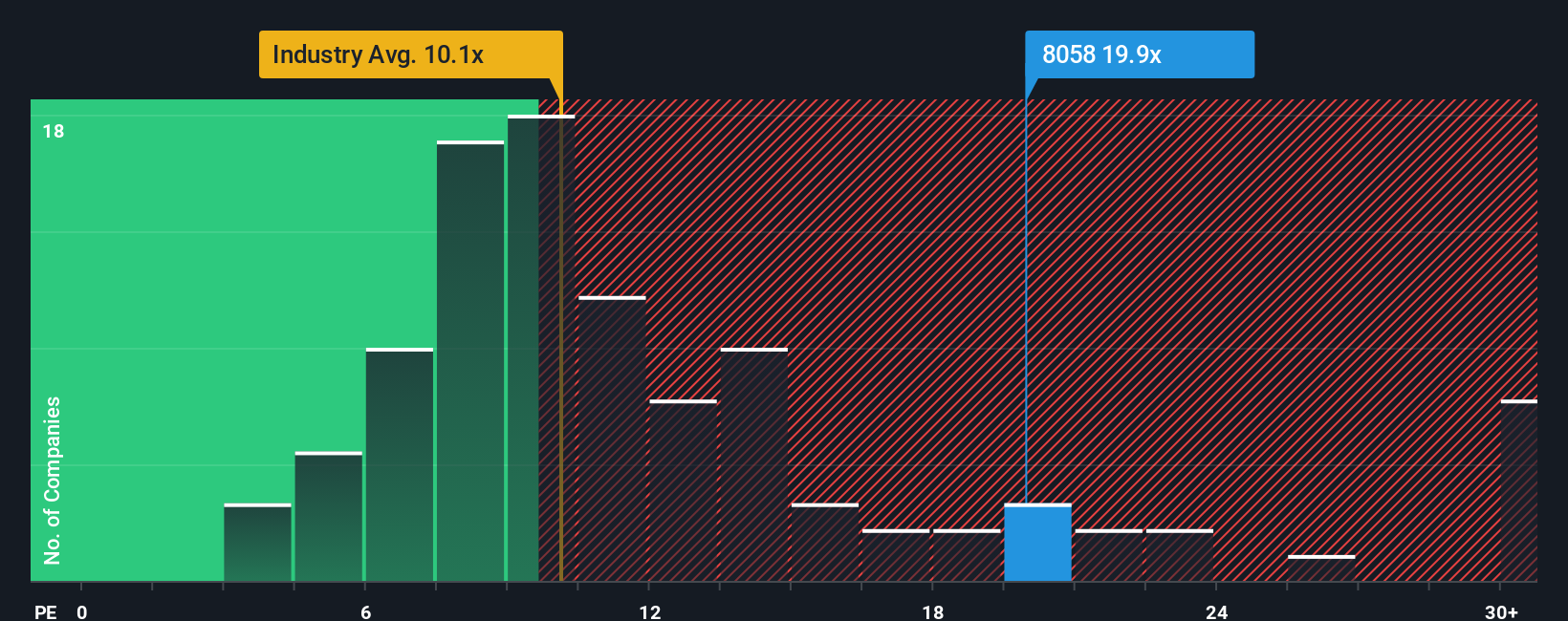

Currently, Mitsubishi trades at a PE ratio of 19.8x. For context, this sits well above the Trade Distributors industry average of 10.1x and its peer group’s 11.9x. However, simple comparisons can miss some important subtleties. Simply Wall St has introduced the concept of the “Fair Ratio.”

The Fair Ratio, calculated at 27.4x for Mitsubishi, is designed to encapsulate more than just sector trends or what peers are doing. It factors in a company’s specific earnings growth expectations, risk profile, profit margins, industry nuances, and even market capitalization. This data-driven approach gives a clearer, more bespoke benchmark for valuation.

Comparing Mitsubishi’s actual PE ratio of 19.8x with its Fair Ratio of 27.4x, the stock currently appears undervalued on this metric. There is a significant gap between what investors are paying today and what the company may deserve based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsubishi Narrative

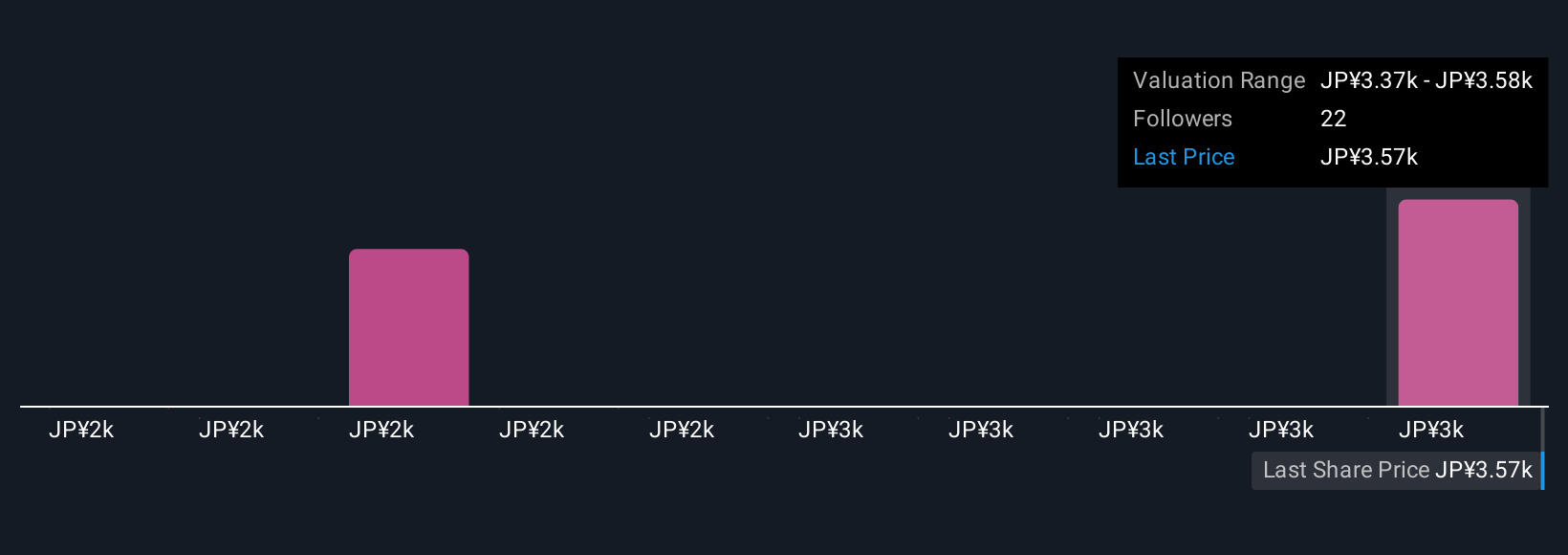

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. This is a smarter, more dynamic tool for investors. A Narrative is simply your personal story about a company, connecting what you believe about its future (like revenue growth, profit margins, or risks) to specific financial forecasts and a calculated fair value. Rather than just crunching numbers, Narratives let you document your reasoning, explaining why you think Mitsubishi should be valued a certain way. This approach makes investing more transparent and thoughtful. Available right now for millions of users on Simply Wall St’s Community page, Narratives are easy to create and automatically stay up to date when company news or earnings are released.

Narratives empower you to decide when to buy, hold, or sell Mitsubishi stock by continually comparing your evolving Fair Value to the current share price. For example, one investor might build a bullish Narrative based on rapid success in digital transformation and set a Fair Value target of ¥3,700. Meanwhile, a cautious investor focusing on risks from volatile commodities or sluggish legacy assets might assign a much lower value, such as ¥2,500. With Narratives, each investor gets a personalized, living valuation anchored in both clear logic and real-time data.

Do you think there's more to the story for Mitsubishi? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8058

Mitsubishi

Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives